‘Niche’ focused players have been the biggest wealth creators in India over the past decade thanks to superlative earnings growth and high return on capital. Given this background, it makes sense to identity & invest in such companies, more so when such companies are relatively ‘unknown’ in the stockmarket. We find German Management Guru Hermann Simon’s ground-breaking book “Hidden-Champions of the 21st Century” particularly useful in identifying the traits associated with successful niche MSMEs. The lessons from Simon’s Hidden Champions form an important part of our checklist for assessment of stocks in our Little Champs portfolio. Simon’s work is particularly relevant with regards to the sustainability of the competitive advantages (quality of leadership, customer-orientation, work culture), management capability/continuity and capital allocation (focus, self-financing, soft diversification).

Successful niche focussed MSMEs have been the biggest wealth creators of the past decade

In our maiden newsletter on Little Champs published in October 2019, we had highlighted that over the longer term “Champion Small Caps’ significantly outperform their Large Cap counterparts on both earnings growth as well as shareholder returns. Indeed, of the 20 best performing stocks (excluding Financials) over the last decade (October 2009-19), 18 stocks were those with market cap <Rs300cr as at October 2009. The remaining 2 names out of the above 20 i.e. Page Industries and Eicher Motors, too, had market cap of <Rs800cr and <Rs1,500cr respectively in October 2009.

What’s more intriguing than small caps dominating the best performers’ list is the nature of these small cap companies – mostly focussed on the small niches within a much larger market. These players have been able to build market dominance in their niches, command pricing power, expand the niches and resultantly generate high earnings growth and healthy returns on capital. The financial performance of these smaller companies has been clearly better than: (a) most mass market companies; and (b) diversified large corporations. Some of these smaller companies are highlighted in the exhibit below.

Exhibit 1: Small-mid niche focused players have been the biggest wealth creators of the past decade driven by their superior earnings growth and return on capital

Some of the above names such as Eicher Motors and Page Industries have now become multi-billion dollar market cap companies as their niches have drawn in a large number of customers from the mass market thanks Royal Enfield’s and Jockey’s aspirational appeal to mass-market brand consumers.

Key pillars of successful niche MSMEs: learning from Hermann Simon

We also discussed in our October 2019 newsletter that a significant portion of a successful small cap company’s share price return comes from its valuation re-rating as the stockmarket recognise its fair value over time. Given the enormous wealth generated by successful niche MSMEs, it makes sense to identify and invest in such companies and more so when these companies are relatively ‘unknown’ in the stockmarket.

We have found German Management Guru Hermann Simon’s ground-breaking book “Hidden-Champions of the 21st Century” (1996) particularly useful in identifying the traits associated with successful niche MSMEs. Simon’s book focuses on small companies (revenue below US$4bn) which are market leaders (number 1, 2 or 3 in the global market or number 1 on its continent) and yet very few people know about them (low level of public awareness). He calls them ‘Hidden Champions”. Based on his extensive analysis of thousands of Hidden Champions across the globe, Simon has identified certain common characteristics which he believes has made these companies successful and helped them sustain their success for decades.

Hermann Simon identifies the following key traits of hidden champions from his analysis of several companies over a long period – brief excerpts from the book are reproduced below:

- Growth and market leadership

“Typical hidden champions follow the mantra – grow or die.”

- Hidden champions pursue ambitious goals particularly with regards to growth and market leadership. These goals are formulated very early on in the company’s life and communicated unequivocally across the organisation. Interestingly, the goals are long term in nature extending sometimes over generations rather than quarters.

- Growth is often achieved through successful innovations and expansion into new markets.

- Market leadership is driven not by aggressive pricing but through superior performance, innovation, quality and reputation.

- Market and focus

“The dependence on their market makes hidden champions ferocious defenders and great innovators”

- Hidden Champions typically define their market narrowly. For example, La Opala for instance has deliberately focused on the niche Opalware crockery market rather than much large crockery market in India in general.

- Once they have selected a market, the Hidden Champions show a strong and lasting commitment to it.

- Focus on the core business enables hidden champions to track their market closely and defend their positions to evolving customer needs and technological developments.

- Innovation

“Innovation is one of the key pillars on which the market leadership of the hidden champions is base.”

- Innovation applies to not only to technology and products but more so to business processes.

- Further, process innovations are not just restricted to cost reduction but also applied in regard to quality, faster development cycles and thus help in in delivering higher value to the customers.

- Top management generally plays a key role in driving innovation. This involvement is not only in the initial and early phases of a Hidden Champion’s life but throughout the lifecycle of the company. For example, in almost every single company highlighted in the table on the first page of this note, the promoter continues to play a central role in driving innovation and R&D.

- Customer orientation

“Hidden Champions and their customers often develop relationships similar to a symbiosis.”

- Hidden Champions may be little known to the general public, but they are well-known in their industry and enjoy a strong reputation amongst their customers.

- The customers’ demands are aimed at performance (quality, reliability, timely delivery) rather than low prices. The products and services supplied by Hidden Champions offer not only top quality but also increasingly comprehensive solutions which are hard for others to deliver (and thus become significant barriers to entry).

- Top management values continuous direct customer contact and practices this on regular basis. This is possible due to their manageable size, decentralised organisational structure and regular customer contact by top managers.

- Financing and organisational structure

“Most hidden champions flourish with very little organisation”

- Hidden Champions typically generate healthy profits & free cash flows and a high return on capital employed. To that effect, self-financing remains the most important source of financing for the Hidden Champions creating a virtuous financial circle. You will note that very few of the companies mentioned in the table on the cover page have relied upon debt to finance their growth.

- Hidden Champions typically exhibit decentralised customer-oriented organisational structure (empowered frontliners) with a very lean top management.

- Hidden Champions strongly outsource non-core competencies. This is less for cost reasons than to derive higher quality from specialised suppliers.

- Work culture

“Hidden Champions have more work than heads and high-performance culture”

- Hidden champions see employee loyalty, training, motivation, and flexibility as their key competitive strengths.

- The work culture of hidden champions is not subject to the political correctness of the time but characterised by aspects such as long-term loyalty, intolerance of laziness and strict selection. For example, a significant barrier to entry erected by Page Industries is its labour force. Whilst Page’s competitors struggle to retain workers for more than 9 months, a typical Page employee stays with the firm for 9 years. That in turn allows Page to generate labour productivity which are many multiples of what its competitors can generate.

- Multi-functional assignments and transfer between functions are more widespread at Hidden Champions than in large corporations. This flexibility results in better performance at lower costs.

- Hidden champions ensure that they have more work than people. This condition minimises unproductive activity and proves to be an extremely effective productivity driver.

- Organisational leadership

“The leaders are the ultimate source of the success of the hidden champions. They are characterized by unity of person and purpose, single-mindedness, fearlessness, stamina, and inspiration to others”.

- The leaders of Hidden Champions are fearless. As entrepreneurs, their personal fortunes are often inseparably tied to the success of their companies: if their companies fail, they stand to lose everything. Clearly, they possess the courage, the fearlessness, to take risks.

- The leadership continuity of Hidden Champions is much stronger than that for large corporations, with leaders staying at the helm for 20 years or more. This is also why “single mindedness” is far more pronounced among the leaders of Hidden Champions.

- Hidden Champion leaders often spend their entire lives, or at least decades, with a single company. Thus, the plans and goals implemented by the leaders of Hidden Champions are often shaped by extremely long-term strategic thinking. In this context you might want to read our blog on leaders who play the “infinite game” [https://marcellus.in/blogs/the-greatest-exponent-of-the-infinite-game-verghese-kurien/].

Can niche focus restrict longer term growth?

A question arises that would focus on a narrow market together with a high market share may act as limiting factor for long term growth. Hidden champions, as per Simon’s findings, have often overcome this challenge through the following routes:

- Globalisation (can also apply to expansion into new states in the Indian context): Globalisation not only makes even the narrow markets large, it further contributes to growth in profits through economies of scale. The foundation for the success of this strategy is that customers in the same industry tend to have similar needs across countries. Hence, it is better to expand regionally in a narrowly defined market than to enter different markets in the same region. Hidden Champions prefer their own subsidiaries for global business than entering a tie-up or alliance with a foreign partner. For example, Symphony has preferred to acquire air cooler manufacturers as far afield as USA and Australia rather than entering tie-ups.

- Soft diversification: Particularly over the last two decades, diversification has been increasingly been employed by Hidden Champions to keep the flame of growth glowing. Besides the growth objective, better exploitation of existing competencies and know-how are another important motive for diversification. But wouldn’t diversification raise the risk that the Hidden Champion’s focus may be lost? To overcome this risk, Hidden Champions employ ‘soft diversification’ where new units stay close to the traditional business, both in terms of technology and market. Further, new business units are organised and managed like hidden Champions.

Using the hidden champions construct in Marcellus Little Champs investment process

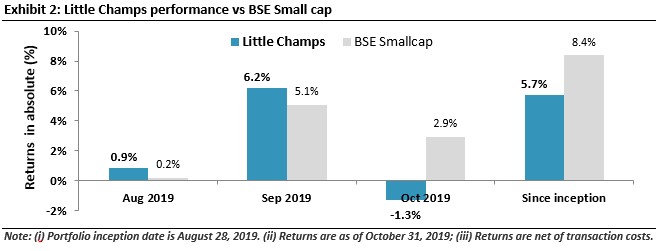

At Marcellus, the key objective for our small cap “Little Champs” fund is to own a portfolio of about 15 sector leading Indian franchises with a stellar track record of capital allocation, clean accounts and corporate governance and at the same time high growth potential.

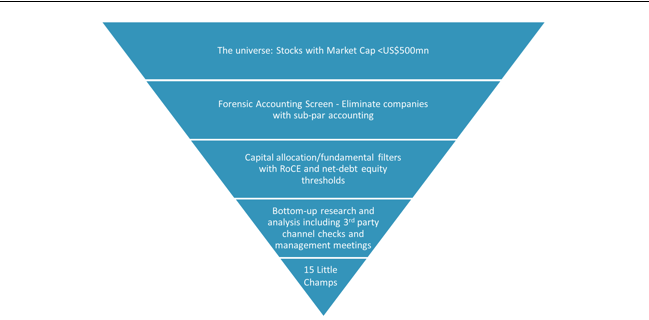

We use the following process to build the Little Champs portfolio:

Little Champs Portfolio construction process

Our forensic accounting and capital allocation/fundamental filters help us eliminate the dubious and weak franchises. Subsequent to this elimination process, we are left with 40-50 small cap stocks for further diligence. Due to the filters used, this shortlist invariably contains companies who are typically leaders with high RoCEs.

Our diligence is then focussed towards finding the sources of the competitive advantages of these companies, past track record of dealing with technological or competitive disruptions and capital allocation decisions. Here, the lessons from Hidden Champions explained in preceding sections form an important part of our checklist for such qualitative assessment of stocks. This is particularly with regards to sources and sustainability of the competitive advantages (quality of market leadership, innovation, customer-orientation, work culture), management capability/continuity (organisational leadership, work culture) and capital allocation (focus, self-financing, soft diversification).

Regards

Team Marcellus

If you want to read our other published material, please visit http://marcellus.in/resources/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.