Great lenders (banks as well as NBFCs), which are Consistent Compounders, benefit significantly in the aftermath of a financial crisis. This is because: (a) when the competition struggles to raise funds during & after a crisis, great lenders have access to adequate liquidity; and (b) as competition’s ability to lend reduces, great lenders can pick and choose quality borrowers, leading to better net interest margins (NIMs), higher loan book growth, lower NPAs and hence better RoEs. However, it is also worth bearing in mind that as the crisis intensifies, great lenders might witness some short-term moderation in loan book growth (which then leads to a temporary rise in NPA ratios) as it is always prudent to maintain discipline while selecting borrowers during a deteriorating macro environment. In this month’s newsletter we highlight the journey of great lenders through the 1997 and 2008 financial crisis, and why we continue holding HDFC Bank, Bajaj Finance and Kotak Mahindra Bank in our portfolio during the ongoing financial crisis.

“These bubbles and crises seem to be deep-rooted in human nature and inherent to the capitalist system. By one count there have been sixty different crises since the early seventeenth century—the first documented bank panic can, however, be dated to A.D. 33 when the Emperor Tiberius had to inject one million gold pieces of public money into the Roman financial system to keep it from collapsing… Watching central bankers and finance officials grappling with the current situation—trying one thing after another to restore confidence, throwing everything they can at the problem, coping daily with unexpected and startling shifts in market sentiment—reinforces the lesson that there is no magic bullet or simple formula for dealing with financial panics” – Liaquat Ahamed in ‘Lords of Finance: The Bankers Who Broke the World’ (2009)

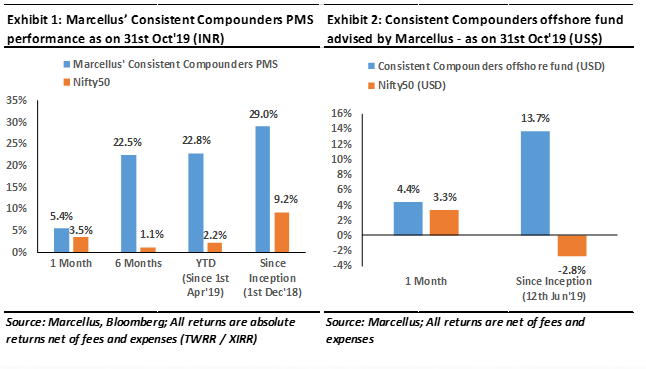

Performance update – as on 31st October 2019

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of five analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Three financial stocks – HDFC Bank, Bajaj Finance and Kotak Mahindra Bank – together form a significant allocation in our Consistent Compounders Portfolio (CCP). Over the past year, as a host of banks and NBFCs faced their own set of troubles, we continue to stay invested in these three lenders in our clients’ portfolios. This newsletter summarizes the rationale for our conviction.

Lessons from historical financial crises

What is certainly clear is that again and again, countries, banks, individuals, and firms take on excessive debt in good times without enough awareness of the risks that will follow when the inevitable recession hits. This time may seem different, but all too often a deeper look shows it is not… More money has been lost because of four words than at the point of a gun. Those words are ‘This time is different. – Carmen Reinhart and and Kenneth Rogoff, ‘This Time Is Different: Eight Centuries of Financial Folly’ (2009)

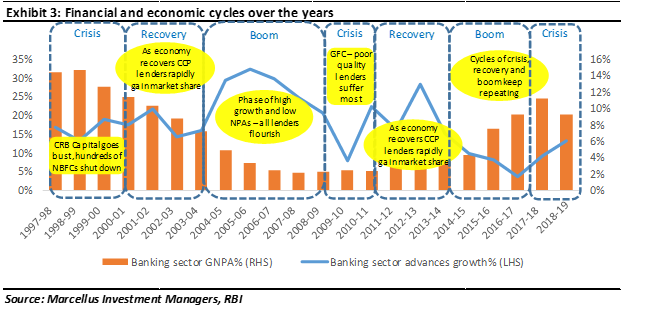

As highlighted in Exhibit 3 above, a few years of high loan book growth, low NPAs and economic boom are inevitably followed by low credit growth, high NPAs and recessionary fears. Good quality banks and NBFCs manoeuvre through these economic and financial cycles with razor-sharp focus on capital allocation, execution and underwriting and they do not get swayed by the emotions of greed and fear. Having said that, it is worth bearing in mind how loan book growth, NIMs (Net Interest Margins), NPAs (Non-Performing Assets) and P/E multiples of good quality lenders move during and after a crisis.

- Loan book growth: Even for good banks and NBFCs, loan book growth tends to moderate during the crisis, although it remains much higher than the loan book growth reported by their peers. This moderation in growth is because of the heightened caution exercised by lenders as the external environment incrementally deteriorates. However, since the liability side of the balance sheet (funding) is comfortable through the crisis for these good lenders, the loan book growth rates accelerate after the crisis has bottomed out. This is due to market share gains in an environment where the liability side of the balance sheet is severely constrained for their peers.

- NIMs (Net Interest Margins): If cost of funds rises during a liquidity crisis, NIMs for the good quality lenders can compress a bit during the crisis. However, once the crisis is over, the pricing power of the good quality lenders leads to an increase in their NIMs because competition is less aggressive in the aftermath of a crisis, given their weaker ability to raise funds.

- NPAs ratio (Non-Performing Assets as a % of total assets): Although asset quality might deteriorate a bit during the crisis, the improved ability of great lenders to cherry-pick quality borrowers in the aftermath of the crisis (because of reduced competition) leads to a substantial improvement in the asset quality of good quality lenders in the years following a financial crisis. Moreover, this ratio reflects an optical increase to a certain extent during the crisis, because the loan book growth rates (i.e. the denominator) fall below historical averages while NPAs (the numerator) in absolute amounts might keep rising at the historical loan book growth rate. Similarly, during the years following the crisis, the ratio tends to show an optical decline as the loan book growth accelerates.

- P/E multiple: P/E multiple of a high quality lender typically moves in the same direction as that of the broader market / financial services sector – which tends to be downward direction during a financial crisis. However, such a movement in the P/E multiple doesn’t matter much for good quality banks and NBFCs because:

- In the case of great lenders, earnings growth more than offsets P/E multiple compression within 12-24 months.

- P/E multiple compression reverses for the great banks and NBFCs because of the benefits highlighted around loan book growth, NIMs and NPAs in the three bullets above.

Given the current environment of gloom and doom for the lending stocks, in the next section we analyse how great lenders emerged as winners from such crises in the past – HDFC Ltd. from the NBFC crisis of the late 1990s and HDFC Bank from the global financial crisis of 2008-09.

HDFC Ltd. during the NBFC crisis of the late 1990s and early 2000s

The Indian NBFC crisis in the 1990s was marred by fraudulent behaviour of large NBFCs, changing regulations, and eventually a shakeout in the NBFC sector. In 1997-98, CRB Capital, a financial Services conglomerate with a net worth of over Rs. 400 Cr and an asset base of Rs. 1,000 Cr (this was as big as ~15% of HDFC Limited’s loan book size then), which was even granted a provisional banking licence, duped millions of small investors of their investments in its mutual fund and in its fixed deposits.

Even though CRB had a AAA credit rating (just like IL&FS did before the ongoing crisis started), the auditors never pointed out any problems and CRB had 133 subsidiaries before the crisis. As the crisis deepened, the Government infused Rs. 2,550 Cr into three public sector banks, IFCI had to be bailed out with a Rs. 1,000 Cr package, NPAs of IDBI increased to 18% and Global Trust Bank’s networth turned negative (it had to be eventually merged with the Oriental Bank of Commerce). Subsequently, as the RBI tightened NBFC regulations, the number of NBFCs dropped to 7,855 in March, 1999 from 55,995 in March, 1995 i.e. over 80% of the NBFCs were shut down.

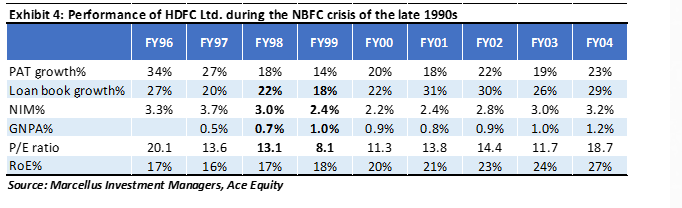

Exhibit 4 below shows how HDFC Ltd. reported an increase in GNPAs (Gross NPAs) by ~50% i.e. from 0.7% in FY98 to 1% in FY99. Growth in PAT and loan book moderated and the P/E ratio compressed by ~40% in FY99. However, after the crisis, HDFC Ltd’s loan book growth accelerated from 18% in FY99 to 31% in FY01 and 30% in FY02, and its PAT growth went back to over 20% CAGR after the crisis, from as low as 14% during the crisis. As a result, despite a 40% cut in its P/E multiple in FY99, over the five year period from March 1998 to March 2003, HDFC Ltd. delivered a share price CAGR of +16%, while the Sensex delivered a -5% CAGR (negative) during the same period.

HDFC Bank during the 2008-09 global financial crisis

During the 2008-09 crisis, Indian NBFCs had a massive ALM mismatch (asset-liability-management) – over 50% of the NBFCs had borrowings which matured within one year while average asset duration was 3 years. Disbursements for several NBFCs were down by 50-70% due to lack of funds. In September 2008, NBFCs’ borrowings from mutual funds had increased to 45% of total borrowings vs. 30% in March 2006. ICICI Bank, the largest private sector bank at that time, saw large delinquencies on its retail book – GNPAs for ICICI Bank rose 100bps from 3.3% in FY08 to 4.3% in FY09. Immediately after the Lehman crisis subsided, as part of its attempt to deal with inflation, the RBI changed the policy rate a record 13 times between Apr’10 and Oct’11, increasing it from 3.25% to 8.50% during the period.

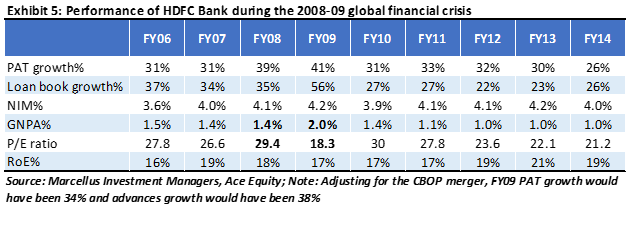

In an uncertain and volatile environment with the lending system afflicted by rising NPAs, HDFC Bank continued to cautiously grow its retail loan book. HDFC Bank suffered the same fate as HDFC Ltd. in the previous crisis: its NPAs as a % of loan book increased by ~50% and P/E ratio compressed by ~40% in FY09 (see Exhibit 5 below). Then, in the years following the crisis, HDFC Bank was able to rapidly gain market share and its asset quality became better than the pre-crisis years. As competition reduced, yields increased and HDFC Bank was able to offset the asset quality risk with better pricing. PAT growth was sustained at ~30% CAGR both before as well as after the crisis. As a result, despite a 40% cut in its P/E multiple in FY09, over the five year period of Mar’08 to Mar’13, HDFC Bank delivered a share price CAGR of +26%, while the Sensex delivered a +4% CAGR during the same period.

What differentiates the lending stocks which we hold in our clients’ portfolios, from their competitors?

“With little differentiation in finished products (loans and services) and no aspirational value attached to these products, low raw material cost (as measured by the cost of funds) and superior execution are the only two key competitive advantages for a top-quality retail bank. Moreover, a hugely leveraged balance sheet (10x leverage is normal for banks) means that below-par credit selection usually has a disproportionately large adverse impact on the bank’s profitability.” – ‘The Unusual Billionaires’ by Saurabh Mukherjea (2016) – see chapter 7 on HDFC Bank.

Apart from having their own individual strengths, the commonalities that differentiate HDFC Bank, Kotak Mahindra Bank and Bajaj Finance from their competitors are:

- Good corporate governance;

- Focus on consistent and sustainable long-term growth across market cycles;

- Prudent credit underwriting; and

- Management teams with an innate sense of capital allocation.

Highlighted below is a summary of our stock-specific views on each of these three lenders.

HDFC Bank

HDFC Bank’s strength lies in its consistent execution and a focus on long term profitable growth. Over the years, HDFC Bank has developed such stringent systems and processes that business continuity, irrespective of employee turnover, is no longer a challenge. For instance, a newly appointed HDFC Bank collection manager who had previously worked with another lender confessed to us that “at HDFC Bank I have to sit in front of the system all day long and keep feeding it data, there is no need for any human intervention or offline coordination. However, the number of hours that HDFC Bank makes its employees work is much more than any other lender.” This is reflected in HDFC Bank’s consistent growth and NPA metrics. Its loan book has grown by more than 15% in each of the previous 11 years with a 24% CAGR over FY09-19. Its PAT has grown at a CAGR of 26% during the same period. HDFC Bank’s average net NPAs over FY09-19 have been 0.31%, substantially lower than that of its peers.

Over the years, HDFC Bank has focused on procuring low cost funds (cost of funds at 4.8% is one of the lowest in the industry), high quality assets (as seen in the NPA numbers above) and impeccable execution. HDFC Bank’s consistently high RoE (average of 19% over FY09-19) is a testament to its robust business model and capital allocation skills. The strength of the ‘HDFC’ brand, the ability to execute relentlessly despite its gigantic size and its vast omni channel distribution network will enable HDFC Bank to keep growing consistently in the coming years.

Bajaj Finance

Bajaj Finance (BAF) is the sole NBFC in our portfolio. Amongst Indian NBFCs, BAF appears to be unique in its ability to balance profitable growth and risk by combining technology and high-quality execution. BAF’s loan book has grown at a CAGR of 47% over FY09-19 (more than 15% loan book growth in each of the last 11 years). PAT has grown at a CAGR of 61% during the same period (FY09-19). Along with the stellar loan book growth, BAF has been able to maintain steady asset quality with average net NPAs of 1.03% during FY09-19 (average net NPA ratio has been 0.40% during FY11-19).

In the recent past, as much as 70% of BAF’s incremental loans have been given to its existing customers. In a relatively short period of time, BAF has emerged as the only sizeable diversified NBFC in India – it offers consumer durable loans, housing finance, auto loans, gold loans, loan-against-property as well as credit cards. This has ensured that it has a diverse set of growth drivers in its portfolio which help it reduce cyclicality in growth and asset quality. BAF has a stable liability profile with deposits now forming 16% of the liability mix, up from 1% in FY14. Thanks to disciplined asset liability management and the implicit backing BAF receives from its parent’s mighty balance sheet (Rs 16,368 crores of net cash in Bajaj Auto’s balance sheet), helps BAF keep funding costs in check during a crisis. As a result, BAF was one of the few NBFCs which had access to adequate liquidity post the recent IL&FS crisis. Over FY12-19, on average only ~8% of Bajaj’s liabilities were raised in the form of short-term borrowings (CPs).

BAF has been proactive in making timely investments in technology and automation, which over a period of time, will help reduce operating and delivery costs. Given its multiple levers of growth, adequate access to liquidity and a long run-way of growth available to it from the financial sector, BAF is poised to rapidly gain market share over the next few years.

Kotak Bank

Kotak has demonstrated highly consistent and healthy historical track record – a pre-requisite for inclusion in our Consistent Compounders portfolio. Kotak’s loan book has grown at a CAGR of 27% over FY09 – FY19. Consolidated earnings growth CAGR during the same period (FY09-19) was at 27%. Kotak’s loan book grew by greater than 15% YoY in 9 out of the last 11 years. Even more interestingly, Kotak’s net NPA ratio has been at 0.87% during FY09-FY19 (one of the lowest in the industry). Over the last five years, while other banks have struggled with asset quality issues in their corporate loan book, Kotak’s corporate loan book has grown at more than 20% CAGR in a challenging environment. Kotak’s key strengths include: (a) CASA (current account savings account) contributes to 53% of its total funds (up from 30% in FY13) – this is the stickiest source of funding which is related to trust built with its retail customers, and most importantly it helps in understanding the customers better; (b) prudence in managing risk, which is reflected in its NPA numbers; (c) anticipating market cycles well ahead of peers; and (d) capital allocation discipline.

In an industry which is so closely linked to the macro environment, Kotak’s ability to maneuver through market cycles with exceptional capital allocation sets it apart from competition. The management has been successful in creating a conservative credit culture and has ingrained the ethos of entrepreneurship, innovation and customer centricity in its employees. A strong retail franchise, exceptional management and healthy capitalization (Tier1 capital of 17.6%), place Kotak Mahindra Bank in a sweet spot to capitalize on growth opportunities and gain market share especially as other banks and NBFCs struggle with poor asset quality and difficulties in raising low cost funds.

Investment implications

History may not repeat itself, but it does rhyme. We believe that the ongoing financial crisis will turn out to be a big positive for the three lenders in our Consistent Compounders Portfolio. As was also witnessed recently, HDFC Bank, Kotak Bank and Bajaj Finance emerged largely unscathed from the IL&FS debacle – the only impact they suffered was a short-term de-rating of multiples while business continued as usual for these companies. Our portfolio action in this circumstance is to stay away from poor quality lenders and to keep focusing on high quality players which have stability on both the liability as well as asset side of their balance sheet. As highlighted in our March, 2019 newsletter it is futile to time the market and therefore instead of worrying about timing our entry and exit into these well managed lenders, we are spending most of our time and energy on further deepening our understanding of these great lenders.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Copyright © 2019 Marcellus Investment Managers Pvt Ltd, All rights reserved.

This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient if not the addressee should not use this message if erroneously received, and access and use of this e-mail in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. Any opinions or advice contained in this email are subject to the terms and conditions expressed in a duly executed contract or written agreement between Marcellus Investment Managers Private Limited and the intended recipient. No liability whatsoever is assumed by the sender as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus Investment Managers Private Limited may be unable to exercise control or ensure or guarantee the integrity of the text of the email message and the text is not warranted as to its completeness and accuracy.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.