An Alternative Recipe For Investing In India Comes From California

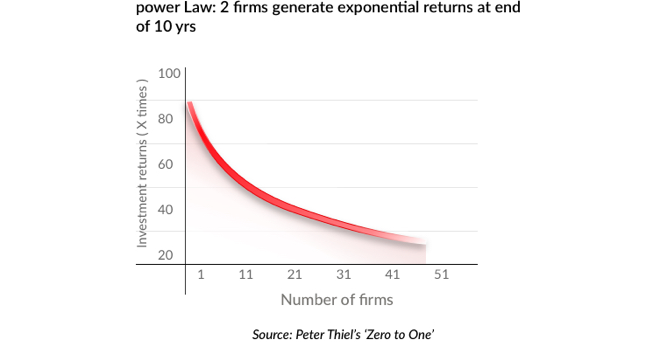

Rob Kirby, in a note written in 1984 (in the Journal of Portfolio Management), narrated an incident involving his client’s husband. The gentleman had purchased stocks recommended by Kirby in denominations of US$5000 each but, unlike Kirby, did not sell anything from the portfolio. This process (of buying when Kirby bought but not selling thereafter) led to enormous wealth creation over a period of about ten years. The wealth creation was mainly on account of one position transforming to a holding worth nearly $1m in Xerox. Impressed the power of this approach – of buying great companies and then letting them for ten years – Kirby coined the term “Coffee Can Portfolio”.  Nearly 40 years later, Peter Thiel hit upon the same insight but this time in the context of the VC investing – great VC portfolios are defined by a couple of blazing winners at the end of ten years. Thiel calls this the “Power Law”.

Nearly 40 years later, Peter Thiel hit upon the same insight but this time in the context of the VC investing – great VC portfolios are defined by a couple of blazing winners at the end of ten years. Thiel calls this the “Power Law”.

Marcellus’ Investing Philosophy

At Marcellus, our Purpose is to make wealth creation simple and accessible by being trustworthy and transparent capital allocators. Our philosophy at Marcellus has evolved from the ideas of Kirby and Thiel, which we have refined further. Our investing approach has 3 pillars:

- Clean Accounts: Our quantitative frameworks which use a combination of forensic accounting and capital allocation assessment define our investible universe.

- Capital Allocation: We look for companies with superior track record of capital allocation. We love companies that generate free cash flows and reinvest them in the business to fuel further growth

- Competitive Advantage: Our experienced investment team through in-depth primary research constructs a portfolio of companies with deep competitive moats

We then hold these companies for long periods of time with little or no churn, which allows us to capture the benefits of long-term compounding and deliver superior returns.