Marcellus’ Consistent Compounders Portfolio consists of companies which have already delivered consistently healthy growth in their fundamentals over the past decade or longer, and where we expect the firms to deliver consistent compounding over the next decade as well. However, given the long and consistent historical track record of these companies, some investors are concerned around saturation of the growth runway for these firms given their large size vs global players in similar categories and given their already dominant market shares. Our portfolio companies overcome these potential challenges by: a) orienting their product portfolio towards a high volume of small ticket day-to-day essentials in a country which offers a long run-way for growth in middle class household consumption; and b) executing business expansion through institutionalised systems and processes, minimising product price hikes, and successfully expanding their product portfolio over time in adjacent product categories.

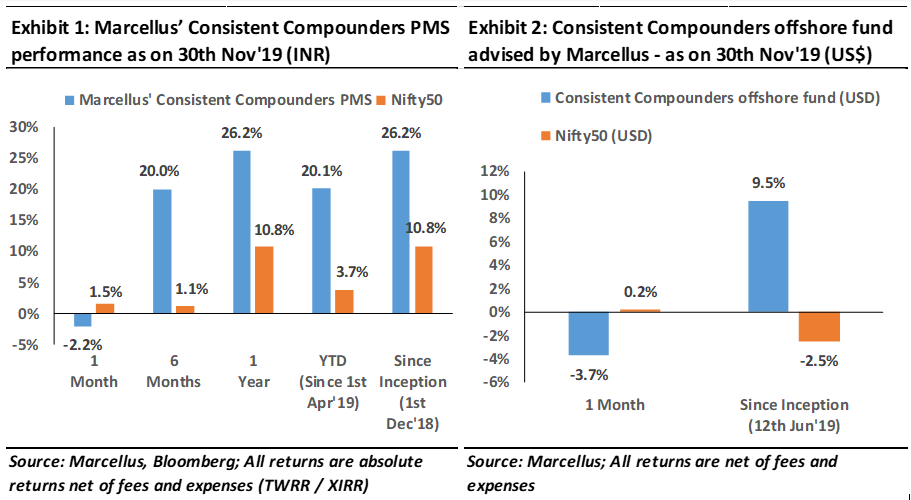

Performance update – as on 30th November 2019

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of five analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Common apprehensions around size of consistent compounders

One of the first steps we take in our research process while trying to identify a ‘Consistent Compounder’ is a 10-years or longer historical track record of consistent and healthy fundamentals. In fact, many firms in our holding portfolio and in our coverage universe have delivered more than 20 years of consistency of healthy fundamentals. Such long and consistent track record of healthy fundamentals clearly means that by now most of our portfolio companies have become large in size (in terms of revenues, volumes, market share, etc).

Moreover, given the low intended churn in our portfolio, our average holding period of a stock in the portfolio is likely to be at least 8-10 years. This means that at the very least, we don’t expect our portfolio companies to face saturation in terms of the growth run-way available to them.

However, some of the common apprehensions that an investor might come across while investing in Consistent Compounders are:

- Relaxo Footwears manufactured and sold 18 crores (180 mn) pairs of footwears in FY19 in India. Compared to this number, India’s population of Rs 125 crores is only 7-times bigger – two thirds of which lives in rural areas. In comparison, Adidas (including Reebok) sold 40 crores (400 mn) pairs across the world in CY18! With Relaxo’s volumes sold being half that of Adidas globally and half of urban India’s population count, isn’t it too large already to deliver consistent growth over the next decade?

- HDFC Bank’s loan book size is around Rs 9.5 lakh crores currently (Rs 9.5 tn). JP Morgan Chase, one of America’s largest banks is only 7 times bigger than HDFC Bank in terms of loan book size. If HDFC Bank keeps compounding at 20-25% CAGR, it will become as big as JP Morgan Chase in a decade! Given the slow pace of financial inclusion in India, and the low per capita household income compared to the US, how can HDFC Bank become as large as US’s largest retail bank after only 10 years?

- Bajaj Finance’s customer franchise has increased from 35 lakh (3,500 K) customers 10 years ago, to 4 crore (40 mn) customers today. At this pace, Bajaj Finance’s customer franchise will increase to 40 crores (400 mn) by 2029. With only 25 crore households in India today, achieving a customer base of 40 crores might mean that there is a Bajaj Finance customer in every household of the country after a decade.

Another way of looking at the growth runway

Let’s consider the following points about the three companies mentioned above – Relaxo, HDFC Bank and Bajaj Finance:

- Relaxo:

India’s footwear industry is approx. Rs 40,000 crores in size. Relaxo’s revenues only Rs 2,300 crores (approx.) i.e. less than 6% of the market. 70% of the footwear industry is unorganized and the industry is likely to undergo a consistent shift from unorganized to organized footwear as GST compliance increases, aspirational consumption rises and customers look for better quality branded products. Products with a price point of Rs 2,000 or higher contribute to less than 15% of the overall market. Relaxo is the largest organized player in the economy segment of the industry because its inhouse manufacturing enables it to provide superior quality products at affordable price points (average revenue per unit sold for Relaxo stood at Rs 125 in FY19), backed by an aspirational brand recall (Sparx, Relaxo, Flite, Bahamas etc) and an efficient distribution network. Moreover, Relaxo has demonstrated its ability to: a) expand its product portfolio across sub-segments of the industry – from economy flip-flops 20 years ago to a sports shoes, sandals, women’s footwear, etc today; and b) premiumise its product portfolio over time – e.g. from white-and-blue economy flip flops (hawai chappals) to the Bahamas range of premium flip flops today. Hence, provided Relaxo continues to sustain and enhance its competitive advantages, it should not be difficult for the firm to increase its market share from 6% currently to 12% or higher over the next 10 years. Mathematically, doubling of market share over a decade contributes 7% to revenue CAGR. Alongside, if the overall footwear industry continues to grow at 10% CAGR or higher over the next decade, the runway for growth doesn’t appear to be a constraint for Relaxo

.

- HDFC Bank and Bajaj Finance: Credit (loans) in the Indian banking industry has grown at 13% CAGR over the past decade, broadly in line with India’s nominal GDP growth rate. HDFC Bank currently has 7% market share in this industry and Bajaj Finance has approximately 1 % market share. As highlighted in our newsletter last month (click here), HDFC Bank and Bajaj Finance are amongst the best placed lenders in terms of their access to low cost funds (liabilities side of the balance sheet) and their ability to grow their loan book ahead of their competitors, particularly in the aftermath of the ongoing financial crisis. Both these banks have also demonstrated their ability to use technology as an enabler to manage high quality of large volumes in small ticket size loans as the external environment evolves whilst also widening the basket of products being offered to their customers. Hence, if the broader credit industry continues to grow at a rate higher than 10% CAGR over the next decade, and within that if firms like HDFC Bank and Bajaj Finance double (to 12%) and treble (to 3%) their market share respectively, the current size of these lenders won’t be an impediment to growth.

What prevents consistent compounders from saturating in their growth potential?

The context given in this newsletter so far suggests that companies which have become 100 times (or more) bigger in size over the past two decades are not necessarily approaching saturation in their growth rates. This happens because of the following factors:

- Demographic dividend: A young and large population combined with economic growth supported by rising middle class household consumption provides a long runway for growth to most sectors in India. To draw a parallel – it is true that America’s largest bank JP Morgan Chase is only 7x bigger than HDFC Bank, and only thrice as big as State Bank of India in terms of its loan book size. However, it is also true that China has four state owned banks – ICBC, China Construction Bank Corp, Agriculture Bank of China, and Bank of China – each of these is twice as big as JP Morgan.

- Ability to successfully expand into adjacencies over time: Page Industries started its business in India with only mens innerwear 25 years ago – a category which is ~Rs 10,000 crores in category size currently. However, today under the same brand Jockey, Page has successfully expanded into women’s innerwear, leisurewear (outerwear), and kidswear – a total category size of over Rs 40,000 crores currently. In footwear, 20-25 years ago, Relaxo Footwears used to sell predominantly rubber hawai chappals (white flip flops with blue straps) under the brand of Relaxo. Today, the firm has diversified into sports shoes (Sparx), floaters (Sparx), premium flip flops (Flite, Bahamas) etc. While Bajaj Finance was focused predominantly on consumer durable loans 8-10 years ago, today consumer durable loans contribute to no more than 10% of its overall loan book with the balance being diversified across home loans, business loans, personal loans etc. This ability to keep widening the basket of products whilst also sustaining the firm’s competitive advantages helps avoid market share related stagnation within a single product category.

- Institutionalised systems and processes help play the small-ticket, high-volume game: A combination of large population in India and significant under-penetration of economy products in some of the most basic categories of day-to-day essentials creates a huge opportunity for a firm to scale up volumes in product categories of low ticket sizes. However, scaling up a pan-India business in such small ticket categories becomes difficult given the heterogeneity of consumer tastes and preferences across geographies, religions, socio-economic stratas; poor transportation and logistics infrastructure; demand centers which are remotely located from each other; and several local unorganized competitors as incumbents. One of the most common solutions to these challenges implemented by consistent compounders has been a strong focus on institutionalizing: a) IT investments in distribution and sales; b) professional empowerment of high quality talent; and c) strategic decision-making through an empowered and independent board of directors.

- A focus on product affordability via minimum price hikes: With price elasticity of demand being particularly high in low-ticket size product categories of day-to-day essentials, most Consistent Compounders minimise product price hikes while focusing on operating efficiencies to protect their profitability over time. This, combined with various other competitive advantages of these firms, ensures that there is limited room for a competitor to significantly disrupt the consistent compounder by way of ‘price wars’ by undercutting product prices. For instance, over the last couple of decades, Asian Paints has hiked product prices on a like for like basis by around 2.5% CAGR. Similarly, over the past 3-4 years, Dr. Lal Pathlabs has not hiked prices for its diagnostics tests at all.

Investment implications

Most stocks in our Consistent Compounders portfolio exhibit the characteristics mentioned above while executing their business expansion. Provided, we continue to have conviction on the ability of our portfolio companies to sustain their competitive advantages, the risk of the growth runway becoming saturated appears to us to be low. Our analysis shows that the growth runway available to most of our portfolio companies – from category growth or market share gains or ability to expand the basket of product portfolio – remains long.

Regards

Team Marcellus

If you want to read our other published material, please visit http://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Copyright © 2019 Marcellus Investment Managers Pvt Ltd, All rights reserved.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.