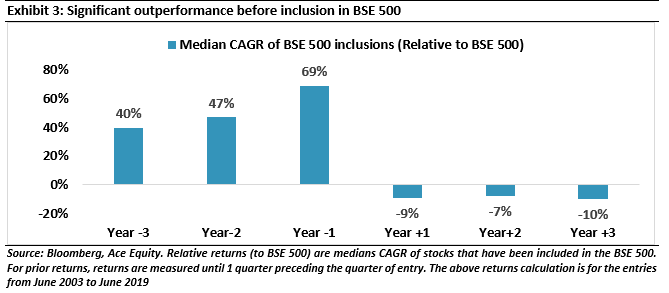

Given that each year 60 companies enter the BSE500, we can see that there are certain economic drivers which are helping well run small firms explode into prominence. From an investors’ viewpoint, in the three years run-up to entering the BSE500, new entrants outperform the index at a CAGR of as much as 40%, indicating significant return opportunity before these stocks are discovered by institutional investors. However, at the same time, high promoter-dependency, smaller size and relatively shorter operating history necessitate much higher degree of research rigour, diligence and investment horizon/patience from the investors. At Marcellus, the key objective of our small cap fund “Little Champs” is to own a portfolio of about 15 sector leading franchises with stellar track record of capital allocation, clean accounts and high growth potential. While we intend to fill our portfolio with winners, we want to be particularly sure of staying away from dubious names.

The case for small-cap investing

More and more Small caps gaining prominence and an entry in BSE500

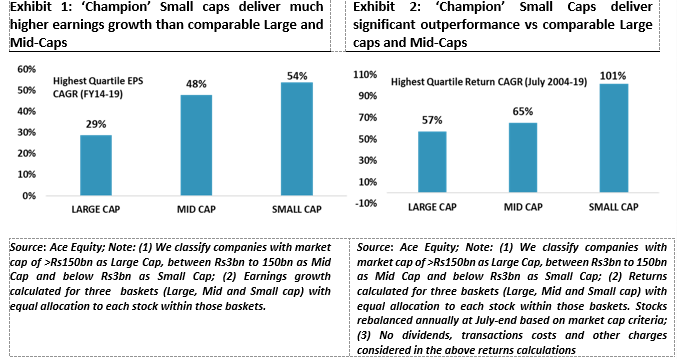

The best performing stocks on earnings growth as well as stocks price returns in the recent years have been names relatively unknown a decade back. For instance, of the 10% best performing stocks over FY09-19, ~80% are stocks which ranked below 500th on market capitalisation as at March 2009-end. This is also evident in the significant churn in BSE500 (on an average BSE500 churned almost 12% p.a. over the last ten years) as these high performing small caps replace the incumbent laggards. Given that each year ~60 new names are entering the BSE500, such a trend clearly points to underlying economic drivers which are helping well run small firms explode into prominence.

The three common stories across these successful firms which have grown from near obscurity to prominence over the last decade have been:

- Businesses that were earlier local in nature, became regional and finally gained national presence. The success template here has been to build a pan-India brand, a national distribution network and thereby chipping away share from the unorganised local plays or grow the addressable market pie. Improved integration within the economy be it communication (including internet), mode of travel (road, air) etc. have helped break-down barriers which hitherto helped informal businesses flourish. The likes of Kajaria Ceramics and La Opala have been able to take their products national and build a pan-India franchise.

- Businesses that were successful in replicating the leadership in one category across multiple categories. This has been driven by profitably deploying the cashflows from the core businesses into adjacencies i.e. a new product segment. Companies like Supreme Industries and Astral Poly have shown how to leverage the cash flows, product understanding as also the distribution/customer relationships of the core business to build profitable adjacencies.

- Businesses that were able to successfully capture a significant part of the global pie. These not only include export-oriented companies but also players able to substitute high level of imports into India. The underlying drivers for success here have not only been leveraging the low-cost Indian manufacturing advantage, but also coming up with innovative products or processes that induces customers to shift from existing vendors. Successful examples here include Vinati Organics, AIA Engineering and Garware Technical Fibres each of whom have gone to dominate the global market for their products niches.

Disproportionate benefits in owning these companies before their ‘discovery’

From an investors’ viewpoint, more relevant than the churn in BSE500 is the returns that these entrants into the BSE500 produce as they fly into the index. As shown in the chart above, in the three years run-up to entering the BSE500, entrants outperform the index at a CAGR of as much as 40%!!!

This return performance is not only a function of the superior earnings growth delivered by these firms in the run-up, but also a result of their valuations getting re-rerated. When these stocks are small and still inventing the wheels of their business, they are largely unnoticed by the large investors’ and research analysts’ communities. This results in them trading at significant discounts to their larger counterparts. However, once they reach a particular size (say market capitalization above US$0.5 billion), they come under the ambit of more and more research analysts’ coverage and institutional investors’ ownership and thus move up the valuation band.

But beware of the pitfalls

It goes without saying that not every small firm will be successful and the winners will be those who have: (a) the work ethic to grow the organisation larger such as instilling process oriented culture, devolution of power & responsibilities to build scale etc; (b) the capital allocation skills to rationally and patiently invest in building long term competitive advantages; and (c) the skill and the drive to run efficient manufacturing operations such as keeping the working capital cycles tight.

There is only a narrow set of small cap companies that have been able to pass these tests and eventually generate significant shareholders’ wealth. On the other hand, there are more examples of small cap stocks that not only failed but also ended up destroying significant investor wealth. Hence, while the reward is enormous for picking the right small cap stocks, the associated risks and rigour required are manifold compared to that in the large cap and even mid cap space for that matter.

In particular, the risks/hardships of investing in a small cap are due to the following factors:

- Inordinate bet on the promoter’s acumen and integrity: There is relatively high dependence on promoter(s) as generally the level of institutionalisation is relatively low in the company given the stage of evolution. Hence the business acumen and integrity of the promoter(s) would play a defining role in the success/failure of these smaller companies.

- Incorrect capital allocation can be disastrous: Besides the success in the core business, allocation of the cash thus generated plays a vital role in the value creation or destruction for such companies. More than the failure in the core business, inefficient deployment of capital either due to a wrong business judgement or promoter’s hubris or sub-par corporate governance (loans to related parties) have led numerous small cap firms to fall apart. Needless to say, given their smaller sizes, capital allocation gone awry can wreak havoc in small companies.

- Low analysts’ coverage necessitates deeper diligence: We highlighted earlier that low level of analysts’ coverage creates a ‘valuation gap’ in small cap stocks and thus creates a non-linear share price return for successful small-caps. At the same time, lack of analysts’ scrutiny necessitates the onus of deep diligence and research on the investors.

- Higher thresholds of patience and investment horizon: Compared to the mature business, smaller companies, no matter how strong they are, tend to be affected more by business/macro cycles due to their smaller size and also low stock liquidity. Hence, during weak cycles (just like we have been experiencing for a year and half now), small-caps’ earnings as well as returns drawdowns see larger impacts compared to larger caps. Also, due to smaller size, any capex or other business decisions tend to impact earnings more in the near term (depreciation, interest costs, low utilisation) before the fruits are realised over the medium-longer term. Hence, patience and longer-term investment horizon are necessary virtues for small-cap investing.

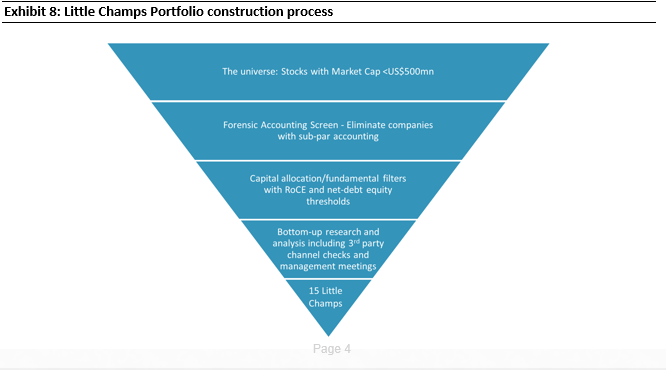

Marcellus Little Champs PMS – how do we intend to navigate the world of small caps?

At Marcellus, the key objective for the “Little Champs” fund is to own a portfolio of about 15 sector leading franchises with a stellar track record of capital allocation, clean accounts and corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be particularly sure of staying away from dubious names where we are not convinced about the cleanliness of the accounts or the integrity of the promoters (even though business potential may sound promising) as fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30%) to reap the benefits of compounding as well as minimise the impact of trading costs.

We use the following process to build the Little Champs portfolio:

- Using our in-house frameworks to shortlist high quality names:

We have developed the following rigorous screening frameworks to help shorten the large universe of ~1,200 small cap companies into a researchable universe of 40-50 companies

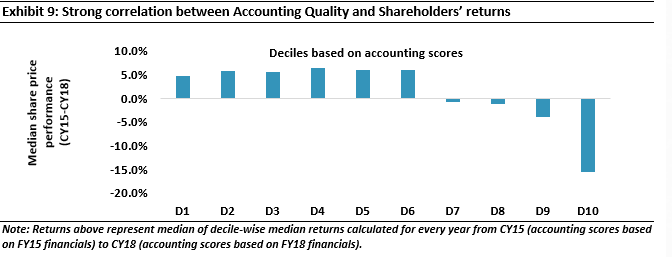

a. Our forensic accounting framework draws upon Howard Schilt’s legendary text on forensic accounting, “Financial Shenanigans”. Using a set of forensic ratios, we rank the companies on accounting quality. This helps us stay away from companies with dubious financials. Our experience and analysis have shown that shareholders’ returns are strongly linked to accounting quality.

b. Our competitive advantage/capital allocation framework uses financial parameters like revenue growth, improvement in margin, working capital & fixed assets turnover with certain thresholds on RoCE and net debt to rank the companies. Essentially, this framework helps us to identify companies which demonstrate ability to grow efficiently, generate cash and redeploy them to further grow – in essence, a self-sustaining cash machine.

b. Our competitive advantage/capital allocation framework uses financial parameters like revenue growth, improvement in margin, working capital & fixed assets turnover with certain thresholds on RoCE and net debt to rank the companies. Essentially, this framework helps us to identify companies which demonstrate ability to grow efficiently, generate cash and redeploy them to further grow – in essence, a self-sustaining cash machine.

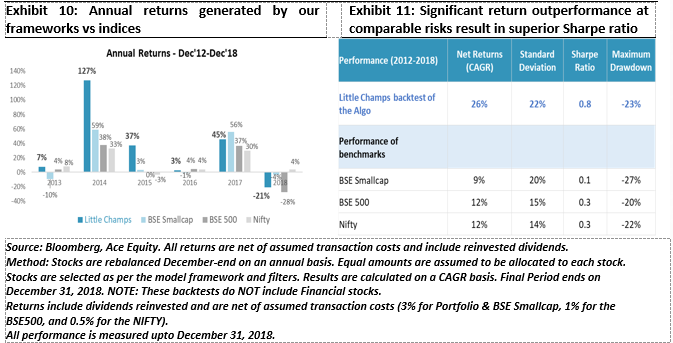

We have backtested the above frameworks for several years and the results have shown that the portfolio generated by the Algo has not only expectedly outperformed the BSE Sensex (the benchmark) during periods of market downturn but also generally outperformed or matched the benchmark performance during market upturns. Given, the rule of compounding, if you fall less and rise equally, you reach higher – the framework has generated significant outperformance over December 2012-December 2018.

- In-depth research and diligence:

The stocks shortlisted by our screening frameworks are taken up for deep dive research and diligence. Besides analysis of the published financials and other secondary data, we aim to build insights into the companies through interacting with a host of primary data network sources. Here, we draw upon our following strengths:

- Forensic accounting skills – We have a deep pool of accounting talent in the team which have cumulatively done more than 1,000 bespoke accounting projects over the last ten years for institutional investors.

- Access to primary data and insights – The team has built a pan-India network of primary data sources which include dealers, distributors, promoters, ex-employees, customers, vendors etc.

In this stage we bring down the 40-50 names shortlisted by our frameworks to around 15-20 names that we end up investing in.

- Continuous monitoring and evaluation:

The portfolio names will be subject to continuous monitoring (keeping a tab on results, continuing to meet customers, competitors and suppliers of these companies whilst maintaining regular contact with management) of major developments. We do not intend to put much weightage to short-term impacts like weak quarterly earnings owning to macro/business cycles. However, we would not desist from reacting in case of any structural changes in the company like key management changes (where we think the new management is not of the same pedigree as the earlier one), any capital allocation decisions that seems out of order or any corporate governance steps that does not seem to be in the best interests of the minority shareholders.

Performance update of the Live Fund

Our fund went live on August 28, 2019. The performance so far is shown in the below table.

Regards

Team Marcellus

If you want to read our other published material, please visit http://marcellus.in/resources/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.