Whilst there are various investment philosophies aimed at swapping disrupted incumbents with new disruptors, such investments entail taking speculative risks around the future dominance of the new disruptor. At Marcellus, we believe that dominance cannot be sustained without disruption, and disruption is not worth investing into if it doesn’t generate substantial free cash flows for the disruptor. Hence, our CCP philosophy invests in companies which are deeply moated dominant incumbents which can use their core business to either disrupt themselves and transform their core (thereby making it less replicable) or disrupt incumbents in an adjacent business.

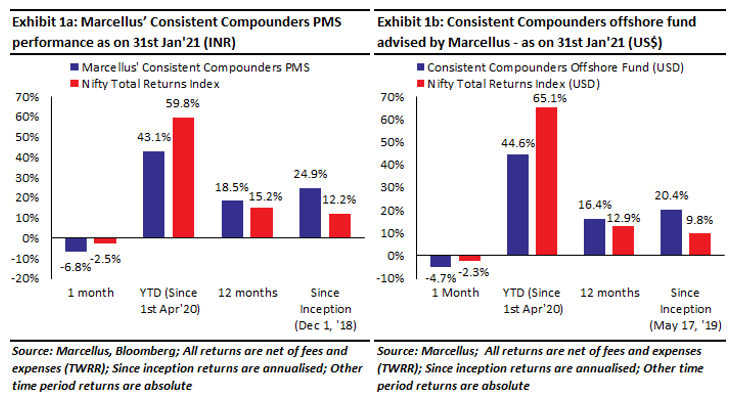

Performance update – as on 31st January 2021

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of eleven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below. Whilst there has been a 6.8% decline in the NAV of CCP PMS over the past one month, our portfolio companies continue to deliver healthy fundamental results. For the quarter ending December 2020, Asian Paints, Dr Lal Pathlabs, Pidilite and HDFC Bank posted YoY PAT growth of 62%, 75%, 30% and 18% respectively. These growth rates were backed by healthy volume growth (33% YoY for Asian Paints, 22% YoY for Pidilite and 16% YoY for Dr. Lal Pathlabs), reflective of healthy market share gains from both organized as well as unorganized competitors. Moreover, our channel checks continue to point to a positive operating environment for our investee companies. Hence, as has been the case since inception, we continue managing our portfolios with minimal churn and a focus on the long-term competitive advantages of our portfolio companies.

One of the most frequently asked questions we face in our interaction with equity investors is – “In an increasingly disruptive world, Marcellus’ CCP philosophy expects long holding periods of stocks in their portfolio. Also, the philosophy seeks an established historical track record of dominance and strong cash generation for all companies under coverage. Does that mean Marcellus’ CCP philosophy is assuming that these stocks will never get disrupted, and that the philosophy will avoid participation in ‘disruption’ as a theme?”

In this newsletter, we seek to answer this question.

Two distinct investment approaches to benefit from disruption

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.” – Charles Darwin

The frequency with which disruptions are transforming industries, has been consistently rising over the past 10-20 years. Innovative technologies / digitisation / automation / machine learning / artificial intelligence – all these themes have been a significant source of disruption over the last decade. There are several other areas of disruption which could take place over the next decade. For instance, the rate at which costs of solar & wind power is falling, has made many existing fossil fuel plants unviable. Similarly, a rapid fall in automotive battery costs is likely to accelerate the transition from IC engines (internal combustion) to EVs (electric vehicles) over the next decade. Formalisation of various industries, financial inclusion, transformation of payment mechanisms used by customers, adoption of telecom as a medium to access products and services – and many more such transformations are underway, particularly in India.

There exist multiple philosophies of investing in the stock market around such themes, many of which can be successful if executed well. An investment portfolio which consists of dominant companies in their respective industries, can consider the impact of ‘disruption’ on the portfolio in two distinct ways –

- Swap between disrupted incumbent dominance and the new disruptor: This is exciting. An investor can look to sell the company which might have been a dominant incumbent so far (and hence was part of such an investor’s portfolio), but which could get disrupted in future. Instead, the investor can look to buy a new company which has to date not been dominant, but can act as a disruptor to become dominant in future. This approach will lead to a lot of ‘action’ & excitement in terms of buying and selling stocks in the portfolio.

- Buy and hold incumbent dominant firms which will also be the disruptors (rather than getting disrupted) in future: This is very boring. Buy a portfolio of companies which are not only dominant in their respective industries currently, but which will continue to disrupt themselves and their competitors in future, so that their dominance is sustained through massive transformations in their external and internal environment. This approach will not lead to much churn in the portfolio!

Marcellus’ Consistent Compounders PMS attempts to significantly benefit from the theme of ‘disruption’ using the second of the two approaches highlighted above. Here are some pros and cons of these two approaches.

Swap between disrupted incumbent dominance and the new disruptor

‘Nothing lasts forever’ – this phrase can be applied to several companies and industries in the past. Polaroid, Xerox and Kodak and various other such examples dominance disrupted are well known. Firms like Netflix could eat into the growth prospects of brick & mortar cinema halls in India. In India’s telecom sector, the dominance of Bharti Airtel, Vodafone and Idea has already been successfully challenged by disruptors like Reliance Jio.

Recently we came across an article in Forbes, published by a professional investment research firm focused on understanding and profiting from disruption – click here for the article. This article highlights that since year 2000, half of all Fortune 500 companies have either gone bankrupt or been acquired. They ceased to exist in less than two decades! The flip-side of such disruption is the list of new disruptors which have emerged over the same time period. The same Forbes article states that today’s truly disruptive companies are building their fortunes faster than ever before.

Given these trends, if executed well, the swap in an investor’s portfolio between disrupted dominance and the new disruptor is likely to help the investor get richer faster than ever before!

However, at Marcellus, we believe our skillsets are not deep enough to overcome certain risks associated with the hunt for a new disruptor who has – so far – never existed as a dominant company in the past. As we see it, there are two significant risks associated with this style of investing:

- Uncertainty around the shape, size and pace of how the opportunity will play out at a macro level. Whilst renewable sources of energy are likely to take market share from fossil fuels, what if the wind Power opportunity is decimated by solar power or nuclear power? And hence, which company will be a winner amongst the various types of renewable sources of power? In another example, even if the evolution of EV disrupts IC engines in transportation, will the acceptance of fleet operators (like Ola and Uber) and auto-EV (self-driven) be 10-times greater than what it was under IC? If yes, then can the prevalence of fleet operators reduce the total opportunity size as the number of individually owned cars reduces dramatically? Hence, what if the winner OEM from this transformation into EVs doesn’t get to grow sales volumes well enough due to significantly higher utilisation of each vehicle for transportation?

- Will the disruptor be a highly cash generative and deeply moated business? Whilst transition to EV engines will be a disruptive theme in an industry dominated by IC engines, what will be the drivers of competitive advantages for winners amongst all EV players. Will it be something related to the engine, or access to a battery charging/replacement infrastructure, or will it be the brand/design/after sales service of the OEM, etc? Similarly, what will be the sources of competitive advantage amongst all solar power producers?

A great business doesn’t just possess strong competitive advantages at a point in time, but it also has sustainable competitive advantages – which are derived from disciplined capital allocation, deepening of moats, superiority around softer aspects of the business (such as succession planning, training, recruitment, etc.) in order to help the business model evolve and make it irreplicable over time. Moreover, during the initial stages of evolution of such disruptive opportunities, most disruptors are willing to burn cash and be amongst the last men standing. So, when will the winning disruptor start generating free cash flows which will then provide a fundamental long term support to the value of he company?

Successful handling of these and other such uncertainties in an investment portfolio might include: a) buying a long list of companies from which a few could turn out to be prospective winners (and others might not even survive); or b) targeting short term (1-2 years) share price rallies as the disruption becomes more widely accepted, even if eventually the underlying business fails to generate significant free cash flows. These attempts, we believe, elevate the speculative risks involved in building such an investment portfolio, which can be avoided under Marcellus’ Consistent Compounders philosophy, as highlighted below.

Buy and hold incumbent dominant firms which will also be the disruptors (rather than getting disrupted) in future

Taking cues from history, what type of firms belong to this category? An expected winner in a disruptive transformation which is also an existing, dominant, deeply moated company with a strong core business in a related area. Such a firm can leverage on its core business to either disrupt itself and transform its core, thereby making it less replicable; or disrupt incumbents in an adjacent business. A strong core incumbent business for such a firm also helps protect the downside if success doesn’t come easily under future disruption. For instance, Pidilite started as a white glue company. Instead of waiting for other home-building materials companies to come and challenge its dominance, Pidilite expanded its products across masonry applications (e.g. M-Seal, Roff), construction chemicals (e.g. water-proofing via Dr. Fixit), in addition to expanding its dominance across the whole adhesives industry (most recent example being its acquisition of Araldite).

When technology/AI/ML/data analytics are considered as disruptive themes, instead of searching for new companies which can win in these industries, investment in firms like Bajaj Finance and Asian Paints is more rewarding and less speculative. These firms use such new technologies better than their existing competitors and better than possible new entrants (e.g. fintech companies vs Bajaj Finance) to strengthen dominance in their respective industries.

Another example of radical transformation is that of a sector like diagnostic testing which is being transformed through home collections (with a Swiggy / Ola / Uber type of tech-oriented offering). A sector like decorative paints is becoming more labour and service oriented (rather than paint product oriented) since labour costs have increased at a rate substantially higher than product prices over the past two decades. Playing such disruptions through firms like Dr. Lal Pathlabs and Asian Paints offers a favourable risk-reward balance to investors as these companies lead the disruption of their industries under the new regime, thereby increasing the longevity of their competitive advantages.

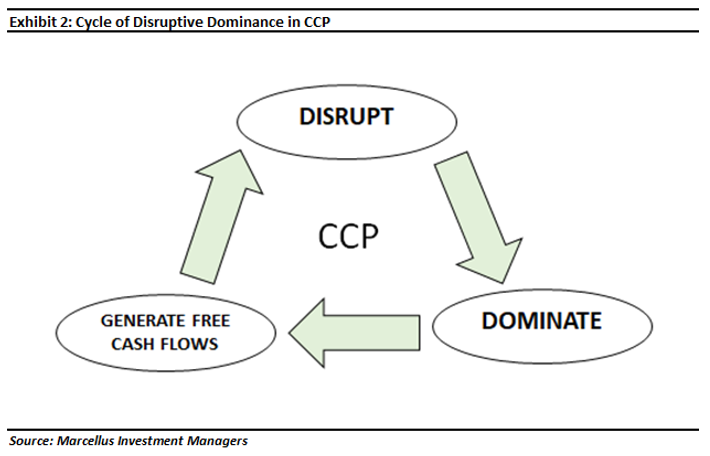

What are the key characteristics of such disruptive incumbent dominant firms? CCP companies follow the cycle shown in the exhibit below. They disrupt, dominate, generate strong free cash flows and then reinvest this cash flow back into areas where they further disrupt, dominate and generate more free cash flows. In effect, such firms generate strong returns on capital employed (ROCE) and can invest this surplus capital towards innovation. They keep their ears close to the ground and hence can assess the potential for disruption. They control the entire value chain of the industry and hence can execute the disruption across manufacturing, supply chain, and customer interface. We have discussed more on these aspects of CCP businesses in our 1st May 2020 newsletter (Enduring Greatness in a Disrupted World).

How does Marcellus remain convinced about the ability of its CCP portfolio companies to successfully play the role of a cash generative disruptor in future? Marcellus’ research team applies our lethargy test framework (discussed in detail in our 1st Aug 2020 newsletter) to all coverage companies at least twice a year. This framework measures how alive, awake and adaptive are the business models of our portfolio companies to evolutionary and disruptive changes.

The lethargy test framework also tracks the capital allocation discipline behind such initiatives as we seek to assess whether our investee firms are avoiding expending too much capital in unsuccessful areas, whilst also investing aggressively in more successful areas of disruption. For instance, Dr. Lal Pathlabs’ tech investments and supply chain investments around home collection infrastructure is an attempt to radically disrupt the diagnostics testing industry in future. Similarly, Asian Paints’ foray into services – architect offerings (Beautiful Homes), sanitisation (San Assure and Safe Painting Service), and total home décor offerings – are attempts at radical disruption of the future of the home décor industry in India. Even if only some of these initiatives taken by our portfolio companies become highly successful disruptions, it provides longevity to the franchise by protecting against challenges that might have been triggered by competitors, and accelerates earnings growth rates. Just to highlight some initial outcomes of these disruptions – a) Asian Paints grew volumes YoY since July 2020 and delivered 33% volume growth in 3QFY21 largely supported by their disruptive services offerings; and b) Dr. Lal Pathlabs reported a 40% increase in home collection testing compared to pre-Covid levels, and the firm has aggressively invested behind the home collection infrastructure to disrupt the future of their industry.

Investment implications: A long term investor’s search for disruption is incomplete without dominance and sustainable free cash flows

Analysing potential for disruptions caused by existing deeply moated companies reduces speculation around the softer aspects of the management team (focus, capital allocation discipline, scalability through decentralised execution, etc), investor’s entry and exit points in the share price of the disruptor and increases the probability of successful disruption by leveraging on dominance already created in adjacent categories. Such an approach towards capitalising on disruption through CCP companies lacks the excitement of portfolio churn and the excitement of hunting down ‘unicorns’. However, such an approach is less risky and hence in our view offers a better risk-reward outcome to investors.

To summarise, dominance cannot be sustained without disruption but disruption is not worth investing into, if it doesn’t generate substantial free cash flows. Marcellus’ CCP philosophy benefits from the investing in dominant disruptors with strong free cashflows.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.