Key success factors for Mold-Tek

A. Innovation in packaging solutions

Innovation in product development has been a key success factor for Mold-Tek. Coming out with innovative value-added products at regular intervals has helped the company with new customer acquisitions and increase its share of business with the existing customers. Some examples of Mold-Tek’s product innovations are:

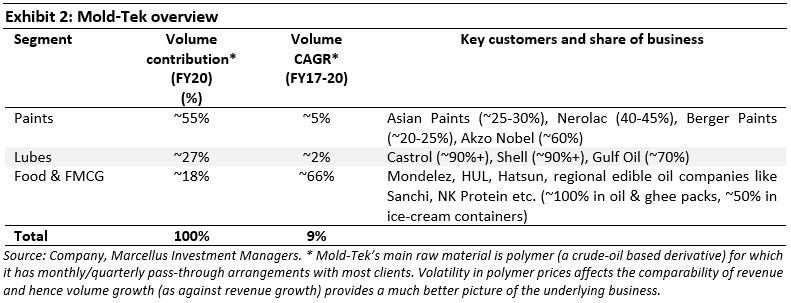

- Plastic pails for paint industry: In the early 1990s Mold-Tek pioneered the concept of plastic pails for paints industry. Over the years, plastic pails have replaced tin containers in most cases except for solvent based paints which continue to be sold in tin containers since solvents react with plastic.

- Plastic containers with pull-up spout for lubes industry: After its success in paints, in the late 1990s Mold-Tek introduced plastic containers for lubes industry with value added features like ‘pull-up spout’ and tamper & leak free features. Mold-Tek was also granted a patent for the innovation related to pull-up spout with tamper proof seal. Over the years, plastic containers have replaced tin containers in lubes and has helped Mold-Tek garner a lion’s share (>70%) with major lube companies.

- In-Mold Labelling (IML): IML is the latest decoration technique in the Indian packaging industry though it is already well-penetrated in Europe & US markets over the last two decades. Mold-Tek has been a pioneer of this technology in India. The key advantages of IML over other techniques are: (a) Superior aesthetics and high durability, (b) Better hygiene due to minimal human contact – a major factor for Food & FMCG companies, (c) Elimination of labelling step and associated labour and space requirements. Due to these factors, IML is ideal for Food & FMCG industry.

Over the last few years, Mold-Tek has come up with various products like ice-cream containers, square shaped edible oil packs, ghee packs, cups, etc. which have found acceptance with major companies. Couple of examples worth highlighting here are:

- Mold-Tek designed and developed the containers for Mondelez’s Lickables product becoming its exclusive supplier in India; and

- Mold-Tek designed and developed square-shaped packs with tamper proof features which is witnessing increased adoption with regional edible oil & dairy companies due to its tamper proof features (since adulteration & counterfeits is a major concern for these companies) and push from FSSAI (India’s food standards regulator) for restricting reuse of tin containers to improve the hygiene standards.

Apart from above, the Company has indicated in recent results calls that there are multiple products under development such as QR code enabled IML containers (enabling tracking within supply chain), plastic containers for fertilizers & pesticide industry, tamper proof plastic containers for home delivery companies like Swiggy/Zomato etc.

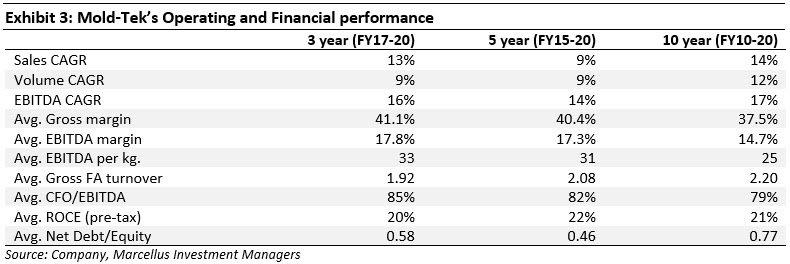

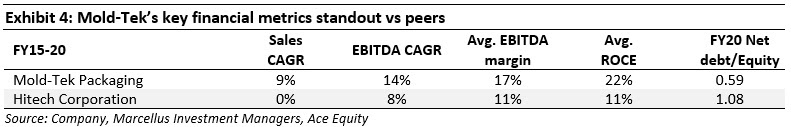

B. Backward Integration

A major source of competitive advantage for Mold-Tek is its backward integration. Mold-Tek is possibly the only Indian packaging company to develop in-house moulds, robots, and labels whereas competitors mainly rely on imports. This capability gives Mold-Tek a significant cost advantage. For instance, Mold-Tek has developed close to sixty in-house robots at 60% cheaper cost vs the market price. Further, in-house mould making capabilities also help with faster product development and market introductions. These capabilities are of special importance in IML which requires a high degree of reliance on automation including robots. Whilst peers are still struggling to adopt IML technology, Mold-Tek is making incremental advancements in IML (QR coded, Square packs, Tamper proof packs, etc.) further widening its gap with peers.

Mold-Tek’s backward integration capabilities is a result of the technical background of promoters, Mr. Lakshmana Rao, and Mr. A Subramanyam. Mr. Rao is civil engineer and MBA from IIM Bangalore and Mr. Subramanyam is mechanical engineer from Karnataka Regional Engineering College, Surathkal (now known as National Institute of Technology Karnataka or NITK Surathkal) and has completed a course on injection moulding and mould making from Central Institute of Plastics Engineering and Technology, Chennai. Mr. Subramanyam (Deputy MD) oversees the overall mould, robot and manufacturing activities of the Company.

C. Deep-rooted customer relationships

Mold-Tek has a proven track record of quality and reliability of supply which has helped it become one of preferred suppliers for leading companies in Paints, Lubes and Food & FMCG industries. Mold-Tek is amongst the few companies which has got a ‘green channel clearance’ from Asian Paints i.e., pails supplied by Mold-Tek go straight to the filling line without quality checks. Further, being the pioneers in IML is helping Mold-Tek get embedded in supply-chain ecosystem of major companies like HUL at an early stage of IML adoption in Food & FMCG. As adoption of IML increases, Mold-Tek stands to benefit.