The superficial approach of choosing winners from the recently announced tax rate cuts, is to look for companies paying the highest rate of tax and then expect a 10-15% increase in their profits. Instead, the real winners will be determined by the ability of a company to either: (a)reinvest the incremental cash flows back into the business and generate a high return on capital on this incremental capital deployed; and/or (b) increase operating expenditure via advert spends, price cuts, channel incentives, IT initiatives, HR spends, or R&D spends. Hence, firms with high ROCE and high rate of reinvestment of cash flows will be able to create a ‘snowball’ effect on their future earnings, which is yet to be factored into their share prices. Marcellus’ Consistent Compounders are the perfect fit examples of such firms. “…there has been a lot of fuzzy and often partisan commentary about who really pays corporate taxes –

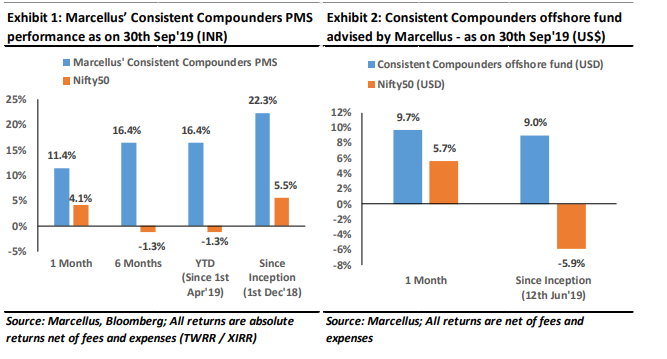

businesses or their customers…. What really happens? When the corporate rate is cut, do Berkshire, The Washington Post, Cap Cities, etc., themselves soak up the benefits, or do these companies pass the benefits along to their customers in the form of lower prices? This is an important question for investors…” – Warren Buffett in Berkshire Hathaway’s 1986 Letter to shareholders Performance update – as on 30th September 2019 .We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of five analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Tax rate cuts – the incorrect conclusion: higher the existing tax rates, higher the future benefits

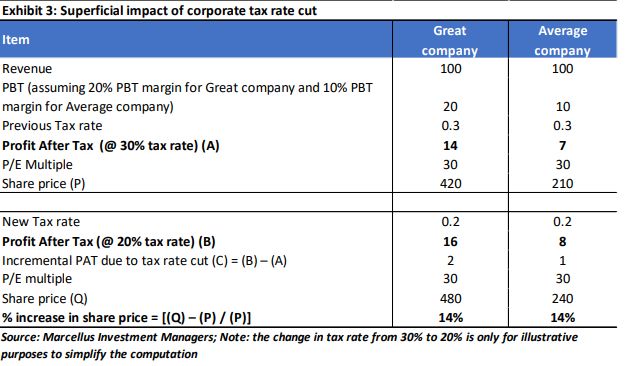

On 20th September 2019, India’s Finance Minister announced a reduction in corporate tax rates from 30% to 22%. The knee jerk reaction to such an announcement is to find companies which incur the highest rate of tax currently and compute the increase in their profits following this announcement. Then, assuming the fair value P/E multiple of such companies remains unchanged, any increase in profits should warrant a commensurate increase in the share price of the company. As summarized in the exhibit below, using this approach, two companies with the same tax rate, but different profit margins and ROCEs, are expected to see the same appreciation in their fair values and hence share prices.

Note that the table shown above concludes that profits of the ‘Great company’ will be twice as much as the profits of the ‘Average company’, both before as well as after the cut in corporate tax rates. We shall return to this point further on in this note.

This part of the benefit from 20th September’s announcement by the Finance Minister has already been factored into share prices over the past 10 days. However, this conclusion is superficial and incompletebecause it does not consider, the ability of a company to retain (or not retain), and then reinvest, any benefitsfrom the incremental profits retained following a cut in corporate tax payout.

On this subject, Warren Buffett stated in Berkshire Hathaway’s 1986 Letter to Shareholders (Click here) –“…there has been a lot of fuzzy and often partisan commentary about who really pays corporate taxes -businesses or their customers…. What really happens? When the corporate rate is cut, do Berkshire, The Washington Post, Cap Cities, etc., themselves soak up the benefits, or do these companies pass the benefitsalong to their customers in the form of lower prices? This is an important question for investors and managers, as well as for policymakers….

Our conclusion is that… in the price-competitive industry, whose companies typically operate with very weak business franchises. In such industries, the free market “regulates” after-tax profits in a delayed and irregular, but generally effective, manner. The marketplace, in effect, performs much the same function in dealing with the price-competitive industry as the Public Utilities Commission does in dealing with electric utilities. In these industries, therefore, tax changes eventually affect prices more than profits.

In the case of unregulated businesses blessed with strong franchises, the corporation and its shareholders are then the major beneficiaries of tax cuts. These companies benefit from a tax cut much as the electric company would if it lacked a regulator to force down prices. Many of our businesses, both those we own in whole and in part, possess such franchises. Consequently, reductions in their taxes largely end up in our pockets rather than the pockets of our customers. While this may be impolitic to state, it is impossible to deny.”

Tax rate cuts – the real impact: High ROCE + High Reinvestment rate will determine the winner

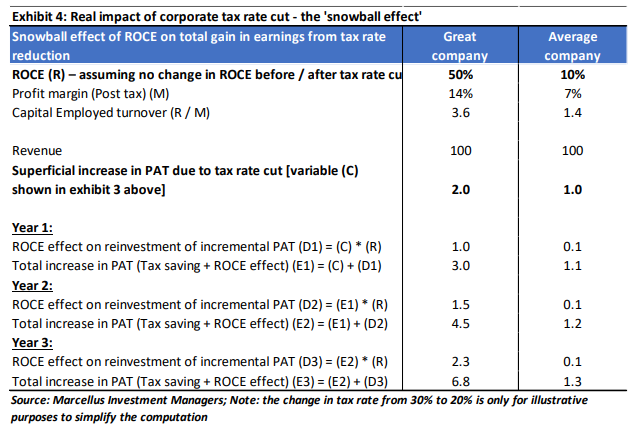

Extending the comparative analysis between a ‘Great company’ and an ‘Average company’ from exhibit 3

above, let us assume the following:

- A Great company can deliver 50% ROCE (14% PAT margin and 3.6x capital employed turnover) with

100% capital reinvestment rate - An Average company can deliver 10% ROCE (7% PAT margin and 1.4x capital employed turnover) with

100% capital reinvestment rate

As highlighted in exhibit 4 below, the Great company will plough back the incremental profits generated from reduced tax rates, thereby creating a strong snowball effect as time progresses. Due to this ‘snowball effect’,

the ratio of incremental profits for the Great company and those for the Average company, will not remain

constant at 2x (which was apparent in the superficial analysis of Exhibit 3 above). Instead, it will widen

exponentially over time into the long-term future. This ‘snowball effect’ accelerates the earnings growth rate

of the Great company into the long term.

It is also worth noting here that a firm like HUL, which has ~100% ROCE, is unlikely to create this ‘snowball effect’ (versus a firm like Asian Paints with 40% ROCE or Pidilite with 37% ROCE) because HUL has less than 20% rate of reinvestment of cash-flows (vs 51% for Asian Paints and 68% for Pidilite) i.e. HUL has not demonstrated its ability to redeploy a large part of its operating cash flows back onto the balance sheet and then sustain its high ROCE.

In addition to the ‘snowball effect’ of reinvesting incremental profits back onto the balance sheet, some great

companies might also decide to utilise the incremental profits via increase in costs like advertisement spends,

R&D spends, IT initiatives, HR initiatives, price cuts, etc. Such actions will also benefit a ‘Great company’ more than an ‘Average company’ because of two reasons: (a) as highlighted in Exhibit 3 above, the quantum of incremental profits of a Great company are higher than those of an Average company, giving it the extra firepower to spend in these areas; (b) some of the moats of a Great company might have been built around R&D / IT / HR / brand-recall, etc – which might not be true for the Average company. At this point, it might be tempting to believe that a firm like HUL will be able to benefit from its higher profit margin, brand and distribution strength etc compared to its competitors. However, for such firms, these gains might be temporary because the next price war from a competitor like Patanjali / Nirma / Colgate / P&G will force HUL to cut its product price and hence sacrifice the incremental profits earned from the cut in corporate tax rates.

To conclude, the biggest beneficiaries of the cut in corporate tax rates are companies with a combination of high ROCE + high reinvestment rate + high tax rate. Firms which will NOT benefit much from the tax rate cut are those which either do not have avenues for capital reinvestment, or which have low pricing power (and hence will have to sacrifice the gains from the tax cut), or which have low ROCE, or those that are not cash generative. In short, the vast majority of the Indian stockmarket will not benefit from the recent cut in corporate tax rates! Those gains shall, rightfully, go to their consumers as Warren Buffett points in the quote cited earlier on in this note.

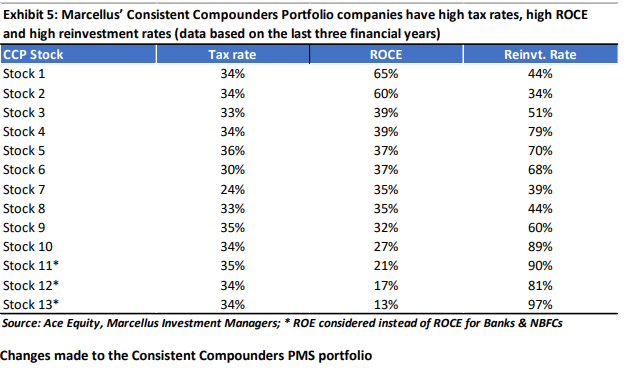

Consistent Compounders benefit disproportionately from the cut in corporate tax rates

As highlighted in exhibit 5 below, the 13 stocks in our Consistent Compounders Portfolio (CCP) will not only benefit from high existing tax rates (an effect which has been factored into their share price in September already), but also from accelerated earnings growth given their high ROCEs and capital reinvestment rates (a snowball effect which has not yet been factored into their share price).

Changes made to the Consistent Compounders PMS portfolio

In September, we added one stock to the portfolios of our clients (no stock was exited though) – Abbott India Ltd. Abbott India has delivered an excellent historical financial performance track record with industry-beating revenues, EBITDA and net earnings CAGR of 18%, 23% and 22% respectively over the last 10 years. Abbott India has consistently generated high ROCEs, averaging 39% (pre-tax) and ROICs (averaging 94% pre-tax) over the last 10 years. The firm benefits from a strong focus on India by its MNC parent firm Abbott Laboratories, which is reflected in terms of new product introductions, rigorous oversight on product/manufacturing quality and support in the implementation of global best practices across all key functions. All top ten revenue contributing brands of Abbott India rank either as #1 or #2 in their respective application areas – for instance Thyronorm (treating Thyroid), Duphaston (infertility/miscarriages), Vertin (Vertigo), etc.

Abbott India has an opportunity to grow faster than Indian pharma industry on the back of: (i) presence in under-penetrated therapy areas like thyroid, gynaecology, vaccines, etc; (ii) market share gains in core products as well as introduction of new products for treating adjacencies within the broader therapy areas. Abbott India is exceptionally strong in product efficacy, sales and marketing. The company’s earnings have historically demonstrated strong resilience to price control measures – for instance, reduction in Thyronorm prices in FY14 led to an increase its market shares/volumes and the ensuing operating leverage helped mitigate the adverse impact on margins. There exists an opportunity for margin expansion on the back of rising share of own brand contribution (currently Abbott India generates ~30-35% revenues from distribution of Novo-Nordisk Insulins where the distribution margin is low). Miles White, the Chairman and CEO of Abbott Laboratories has had a strong track record of capital allocation which – as explained in this note – is particularly important for a high cash generative firm like Abbott India which currently holds Rs 17 billion of surplus cash on its balance sheet.

Regards

Team Marcellus

If you want to read our other published material, please visit http://marcellus.in/resources/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Copyright © 2018 Marcellus Investment Managers Pvt Ltd, All rights reserved.

This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient if not the addressee should not use this message if erroneously received, and access and use of this e-mail in any manner by anyone other than the addressee is unauthorised. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. Any opinions or advice contained in this email are subject to the terms and conditions expressed in a duly executed contract or written agreement between Marcellus Investment Managers Private Limited and the intended recipient. No liability whatsoever is assumed by the sender as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus Investment Managers Private Limited may be unable to exercise control or ensure or guarantee the integrity of the text of the email message and the text is not warranted as to its completeness and accuracy.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.