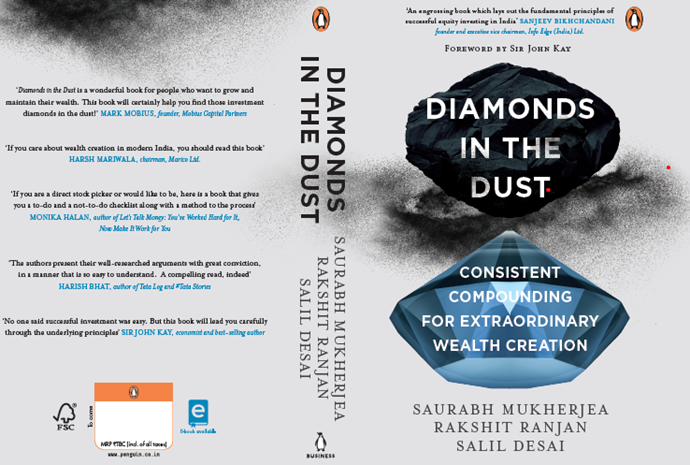

You will get good ROI from our latest book

There is a lot of excitement these days about investing in the Indian stock market. However, the vast majority of the newbies commencing their investing journeys would benefit from understanding just how polarised a stock market India is. Although, there are over 6,000 companies listed in India, just 10 companies now account for 90% of the corporate profits generated in the Indian economy and just 16 companies account for 80% of the wealth generated by the Nifty50 over the past decade. On the other hand, not only have 50% of the index constituents from ten years ago faded into obscurity, a mere 15% of the stocks listed in the BSE500 a decade ago have delivered returns above the cost of capital (i.e. 15%). As a result, generating consistent returns from the Indian stock market is much harder than investors – even professional investors – understand it to be. Our new book lays out a method which investors can use to swing the odds of making money firmly in their favour.

In this book, we elaborate on the key elements necessary for crushing risk to generate steady and healthy returns from equities in India. Our approach is to buy clean, well-managed Indian companies selling essential products behind very high barriers to entry. We call this approach to investing Consistent Compounding, and have seen, both in theory and in practice, that it works. This approach has three key elements—Credible Accounting, Competitive Advantage and Capital Allocation. They are the foundational pillars of Marcellus’s investment philosophy, which will help investors generate healthy returns without taking extra risk.

The first pillar, Credible Accounting, uses a set of forensic accounting ratios and techniques to identify companies with the least accounting risk and the highest reliability of reported financial statements. We use case studies of three prominent companies who have each stolen billions of dollars of shareholders’ and lenders’ money to explain how investors can use annual report analysis to identify corporate frauds before the rest of the market latches on to them [and before the stock price collapses]. We also provide a forensic accounting checklist that investors can use to shield themselves from such companies.

Competitive Advantage is the search for companies that possess strong and durable pricing power, enabling them to be leaders in their markets and consistently earn returns higher than their cost of capital. This mitigates their revenue and profit risk. We not only use detailed case studies of how great franchises have been built in India over the past two decades, we also refute common myths about competitive advantages – for example, the strange notion that ‘brand’ is a competitive advantage.

The third pillar, Capital Allocation, is about finding companies that make the best use of their excess returns (the difference between return on capital and cost of capital, akin to free cash flow) in order to grow their business as well as to deepen their competitive advantages. Knowing what stocks to buy using the three pillars is what we call the Consistent Compounding approach. We provide a checklist that investors can use to gauge the quality of company’s moats and its capital allocation.

To motivate those who believe that all of the above is hard work, we have our guru Sir John Kay’s Foreword which acts as a tonic for investors whose heart is willing but the head is unwilling to do the necessary reading. Sir John says, “In this book, you will learn first of all that successful investors look to fundamental value. Real businesses with real capabilities. As I write this, I am bombarded with invitations to buy meme stocks, baseball cards, cryptocurrencies and non-fungible tokens. But the tendency for price to revert to fundamental value is a basic law of investment….As Warren Buffett puts it, if you aren’t willing to hold it for ten years, do not hold it even for ten minutes. Long run stock returns are asymmetric – a small number of stocks accounts for a high proportion of overall market returns. Appreciation of the underlying economics of the business gives you the best – indeed the only – chance of holding these outstanding stocks.

No one said successful investment was easy. But this book will lead you carefully through the underlying principles. You will learn how to see through deceptive accounting. You will not learn how to time the market, but you will learn that even if you were able to do it – by some prescience no one else has yet achieved, the returns from market timing are far less than the returns from effective stock picking. You will learn the nature of competitive advantage, and how to identify sources of competitive advantage that are appropriable and sustainable. To invest well, you must understand these things – or entrust your funds to someone who does – like Marcellus. I hope this book will encourage many people to take control of their own wealth management.”

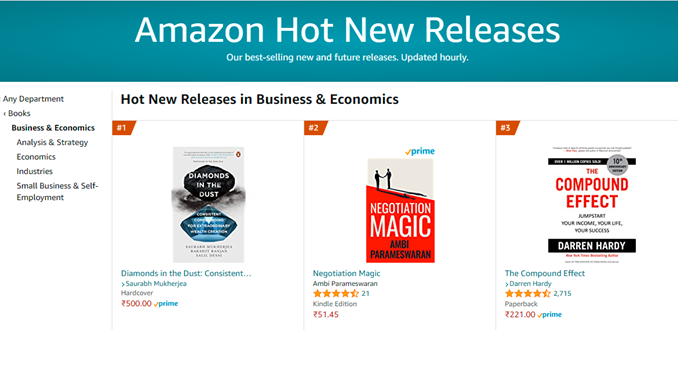

“Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth” debuted in the Indian market last week and went straight to #1 on Amazon’s New Releases (Business & Economics) list. To buy the book: click here