|

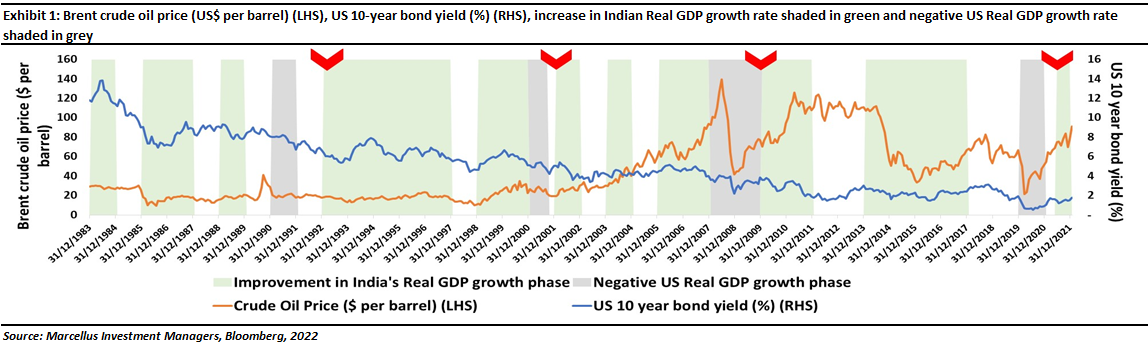

As the red chevrons in Exhibit 1 show, each grey bar (which denote US recessions) is followed by a green bar (which denotes accelerating GDP growth in India). Typically, it takes anywhere between 3-12 months after a recessionary period in the US for the growth phase in India to kickstart. In other words, within a year of a recession in the US, India’s GDP growth begins to accelerate. Sustained periods of strong economic growth in India after a recession in the US have been observed in 1993-97, 2002-2008, 2009-11, and – most recently – the economic growth phase that began in 2021.

Myth #1: Rising interest rates are bad for stock market

It is but natural that when GDP growth accelerates, central bankers start hiking interest rates to take some of the steam out of the economy and thereby dissipate inflationary pressures with the aim of helping the economic growth phase last longer. The data from United States and from India clearly shows that interest rate hikes during growth phases help sustain bull markets.

The S&P500 in the US has averaged a 9% per annum return in the 12 rate rising cycles since World War II. The US benchmark index has risen in 11 of these 12 rate hiking cycles. In fact, we have had two sustained bouts of rate hikes from the Fed in this century which underscore this point. The Fed hiked interest rates 17 times from 2004 to 2006. The S&P500 rose by 46% during that period. Even more recently, the Fed hiked rates 9 times, from Dec 2015 to Dec 2020 (from 0.25% to 2.5%). The index rose nearly 50% in the first two years of this rate hiking cycle.

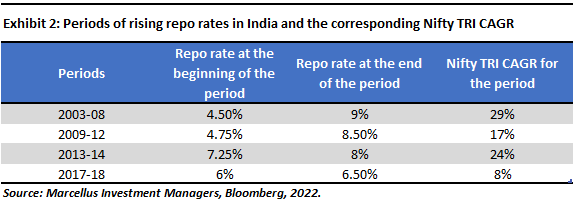

We looked at Reserve Bank of India’s (RBI) repurchase (or repo) rates in India from 2001 to date and identified four periods of rising rates – 2003-08, 2009-12, 2013-14, 2017-18. Interestingly, in none of these periods, not even when the repo rate was as high as 9%, did the Nifty Total Return Index (TRI) fall; in fact, its return on an annualized basis was very healthy, as shown in Exhibit 2.

Myth #2: High inflation is bad for high quality stocks

Typically, when economic growth is strong, inflationary pressures build up (which is why, as mentioned above, central bankers hike rates gradually to defuse these inflationary pressures). However, at such times, pseudo-economists peddle the notion that “high inflation is bad for high quality stocks”. Such a contention is neither supported by data from the real world, nor by theory.

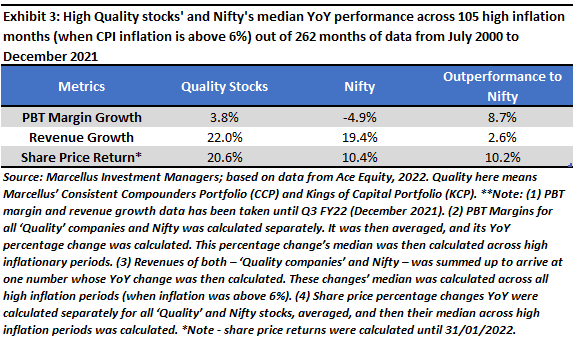

Contrary to the popular notion of high-quality stocks taking a beating during periods of elevated inflation, history shows that such companies have outperformed the broader market even more strongly (when CPI inflation exceeds 6%) on revenue growth, profit margins and shareholder returns.

As can be seen in Exhibit 3, on all three parameters – PBT margin growth, revenue growth, and share price return – high quality stocks (i.e., stocks which are part of Marcellus’ Consistent Compounders and Kings of Capital portfolios) significantly outperform the Nifty. Why does this happen? Let’s take two recent examples to illustrate the broader point that high quality franchises have both greater pricing power (to pass on input price hikes to their customers) and greater ability to manage input cost pressures (by squeezing suppliers and by reducing the working capital cycle).

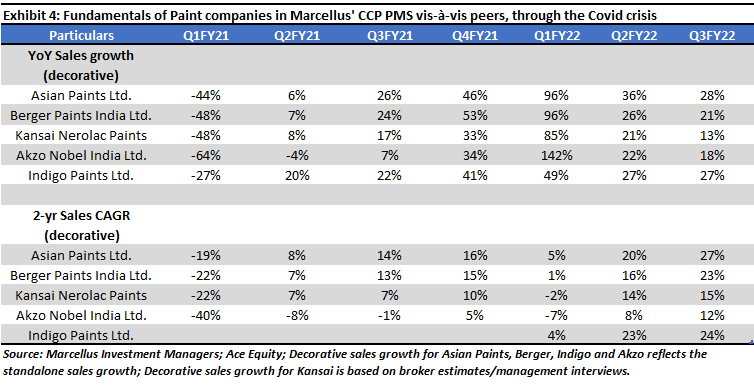

Example 1: Asian Paints – As shown in the table below, as India gradually climbed out of the Covid-19 hole over the last four quarters, Asian Paints has consistently grown sales and volumes faster than any of its rivals. This is a familiar situation for Asian Paints – over the past 20 years, it has emerged from every exigency – be it the 2008 financial crisis, 2016 demonetization, 2017 GST or 2021 Covid – stronger than its competitors. The firm’s ability to manage both supply-side and demand-side shocks is unrivalled in the paints industry.

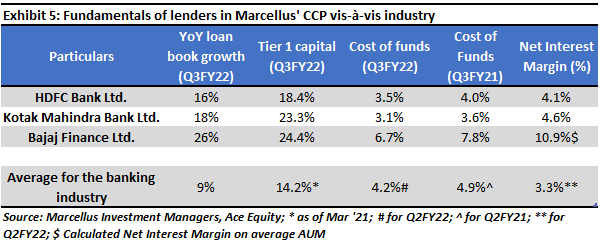

Example 2: HDFC Bank, Kotak Bank and Bajaj Finance – over the past three quarters these three lenders have grown their loan book 2-3x faster than the broader banking sector. Their faster growth has been aided not just by the drop in their cost of funds (which has allowed them to offer lower cost loans to their customers) but also by their superior reach and superior balance sheet i.e., stronger Tier1.

Implication for investors

Economic recoveries are associated with high quality companies continuing to outgun their rivals on revenues, profits and shareholder value compounding. Such recoveries also tend to be accompanied by higher rates of inflation, gradually rising interest rates and rising stock markets. Our advice to you would be to not let the pseudo-economists rob you of the benefits of the incipient economic recovery in India.

Note: All the stocks mentioned in this note are part of Marcellus Investment Managers’ portfolios. The authors of the note and their families hold these stocks via these investments in Marcellus Investment Managers’ portfolios.

Nandita Rajhansa and Saurabh Mukherjea are part of the Investments team in Marcellus Investment Managers.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.