| Antifragility is a much talked about virtue these days. However, what are the sources of antifragility? Why are some companies antifragile whereas their competitors aren’t? Is antifragility an innate trait or can it be cultivated? We answer these questions in this note

“Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.”

― Nassim Nicholas Taleb in ‘Antifragile: Things That Gain from Disorder’ (2012)

In his must-read book Antifragile, author Nassim Nicholas Taleb talks about the concept of “Antifragility” which refers to the ability of benefitting from uncertainty and shocks. In the context of investing, antifragility could be interpreted as ability of companies to not only withstand the uncertain and unpredictable events (like the Covid-19 outbreak) but to benefit from them and come out stronger rather than weaker. Not many companies qualify to be called antifragile and for those which qualify, their antifragility is an outcome of policies and operational management instituted by those companies. So what are these policies which mark out the antifragile companies?

“Wind extinguishes a candle and energizes fire.” ― Nassim Nicholas Taleb in ‘Antifragile: Things That Gain from Disorder’ (2012)

1) Antifragility of a system depends on fragility of its constituents – Any business operation has many components and both external and internal constituents and this multi layered nature of business means that any organisation cannot become antifragile unless its constituents become strong and able to withstand uncertainty. During the Covid-19 crisis, the hospitality sector aggregators with multi-billion-dollar valuations reneged on their contracts to their hotel partners leaving the most vulnerable components of their business weaker. As a result, the franchises of the hospitality sector aggregators are now at greater risk of disruption by any competitor backed by deep-pocketed investor.

In stark contrast, in the not so glamourous paints industry, the leading manufacturers – Asian Paints and Berger Paints – provided cash support in May 2020 to their dealers and their painter partners who were at increased risk due to loss of income (in the wake of the lockdown from March-May). The financial support provided ran into hundreds of crores and seems to have been provided unconditionally. Unsurprisingly, as soon as the economy was unlocked, the leading paints companies’ revenues grew at double digits as these companies benefited from the gratitude of the dealer and painter community. Asian Paints looks likely to have entered the lockdown with market share around 55% and exited the lockdown with market share at least at 60% and probably higher.

“You cannot say with any reliability that a certain remote event or shock is more likely than another, but you can state with a lot more confidence that an object or a structure is more fragile than another should a certain event happen.” ― Nassim Nicholas Taleb in ‘Antifragile: Things That Gain from Disorder’ (2012)

2) Having surplus capacity for meeting any unforeseen event is a pre-requisite for antifragility – One cannot predict how the economy or its constituents would behave or when any geo-political trouble would crop up anywhere in the world which would put the global financial systems at risk. However, as an investor, one can reasonable assess the ability of companies to withstand the uncertainty should it arise. This assessment can be best illustrated by taking examples from the Indian Financial Services industry. As soon as the Covid-19 outbreak and resultant lockdown unfolded, investors knew that the financial system would witness significantly higher delinquencies. Although all the lenders were facing the challenge, well capitalised banks and NBFCs (HDFC Bank, Kotak Mahindra Bank, Bajaj Finance, etc) were at lesser risk compared to their not-so well capitalised peers because of: (a) greater prudence in lending in the years prior to the Covid crisis; and (b) deeper capital cushions than their competitors. Whilst having a capital cushion might have dampened their ROEs, in a shock-prone country like India, it provides them with the dry powder required to increase market share when their competitors are at their weakest.

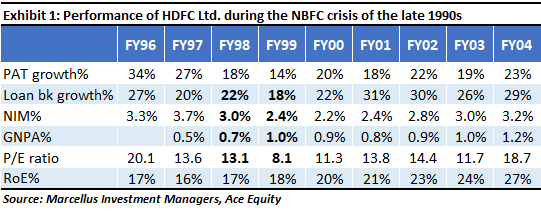

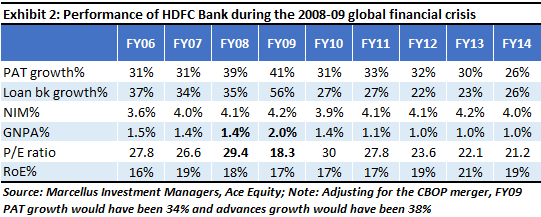

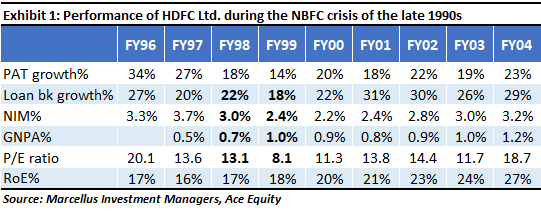

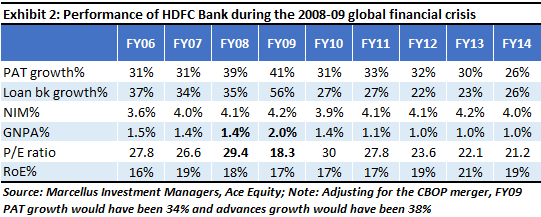

You can see an illustration of this from the table below which shows how HDFC came out of the late 1990s NBFC crisis as the king of the housing finance industry even as 80% of the NBFC industry went bankrupt between 1997-2000 (Exhibit 1). HDFC Bank did something similar in the context of car finance and credit cards in the wake of the Lehman crisis in 2008 (Exhibit 2). Note the similarity in the two examples: both lenders exited the crisis with higher ROEs than they went in. That is anti-fragility exemplified

“Antifragility is the combination of aggressiveness plus paranoia”― Nassim Nicholas Taleb in ‘Antifragile: Things That Gain from Disorder’ (2012)

3) Continuous improvement of operations & financials – The most fundamental aspect of business continuity and growth – continuous improvement – tends to be overlooked by many businesses. It involves comprehensive approach and continuous work on improving products, innovating, logistics, client servicing, vendor management, cost optimisation, financial reserve creation etc. As companies work on innovation and improvement, they end up with some failures but benefit from the learning derived in the process and that learning helps them improve. As highlighted in our Consistent Compounders newsletter for July 2020, it takes sustained disciplined effort by companies to maintain their competitive advantages whilst growing their businesses. Conducting a “Lethargy Test” helps us differentiate between companies which are likely to continue their growth and profitability and those which have stagnated and have become fragile and ripe for disruption. Quoting from our July 2020, Consistent Compounders newsletter: “Our lethargy tests proactively aim to understand how our portfolio companies are deepening their competitive advantages, strengthening ties with various stakeholders, and refreshing their offerings so as to leave no room for a competitor to take away market share through such actions. For instance, in addition to speaking to dealers post-facto about JSW Paints’ aggressive entry into decorative paints, our lethargy tests done in the years prior to such competitive changes have to understand whether Asian Paints has left enough room for any new entrant to make a successful entry into the sector”“

“Steve Jobs: “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully. I’m actually as proud of the things we haven’t done as the things I have done. Innovation is saying no to 1,000 things.” ― Nassim Nicholas Taleb in ‘Antifragile: Things That Gain from Disorder’ (2012)

4) Sustained focus is essential for creating antifragility – Once a business becomes successful and begins generating copious free cash, the owners and managers of such businesses get many tempting ideas for using the cash. In most of the cases, the cash is spent on sub-optimal projects like forays into unrelated sectors, fruitless mergers & acquisitions, or financing of the pet projects of the owners. A key differentiator between fragile and antifragile companies is their focus. Companies like Page Industries, Relaxo Footwear have the option to enter fashion clothing and leather footwear industry respectively but their management is obsessively focused on expanding only to adjacencies of their existing business and in areas which benefit from their existing strengths and capabilities. It is exactly because these companies are able to resist temptation that they are able to keep honing their strengths and at the same time adding complimentary skills and capabilities in adjacent activities which helps them grow their businesses sustainably. Thus, strengthened and muscled up they are then able to profit handsomely from exigencies live Covid-19.

Disclosure: Asian Paints, Berger Paints, HDFC Bank, Kotak Bank, Bajaj Finance, Page Industries and Relaxo Footwear are part of most of Marcellus’ client’s portfolios.

Sudhanshu Nahta is a Portfolio Counsellor at Marcellus Investment Managers.

|

|

|

|