| Whilst there are dozens of books on how to invest like Warren Buffett, most investors spend their lives far away from the compounding heaven in which legends like Mr Buffett reside. So why do most investors never manage to invest in great companies and stay invested for the long run? The answer lies in the classical game – the Prisoner’s Dilemma.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Phillip Fisher (1975)

Ever since equity investing became a mainstream activity in the Western world around a century or so ago, ‘Growth at Reasonable Price’ (GARP) investing for the foreseeable future has been seen as a sensible way of investing not least because it does not force investors to make the more extreme choices that “value” or “growth” investing do. However, if one delves into GARP a little deeper, the definitions of ‘growth’, ‘reasonable price’ and ‘foreseeable future’ allow further bifurcations into ‘Growth Investing’ versus ‘Value Investing’ and ‘Short Term Horizon’ versus ‘Long Term Horizon’. This in turn gives rise to what we call the ‘Investor’s Dilemma’. One can understand this further by drawing parallels between the ‘Investor’s Dilemma’ and the classical Game Theory conundrum, the ‘Prisoner’s Dilemma’.

The classical Prisoner’s Dilemma…

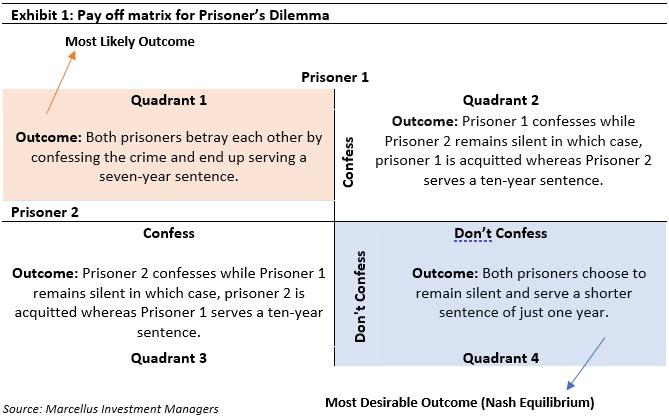

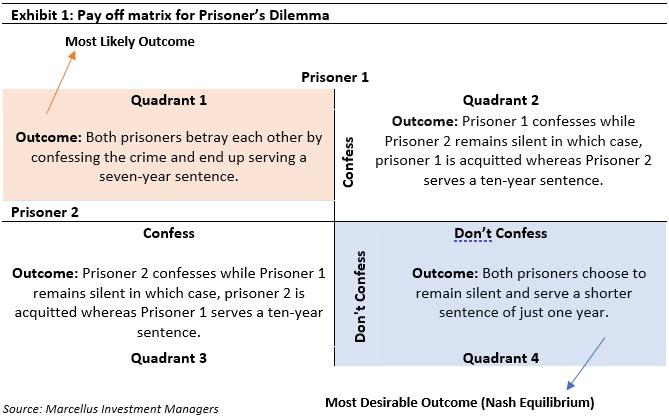

Two people commit a crime together and are then caught by the police. Due to the lack of evidence, the prisoners cannot be charged with something substantial and should be released after serving a short sentence of one year. The police officer gets an idea and decides to keep the two prisoners in separate cells. Both are given the option of confessing to the crime and betraying their partner which will earn freedom for the confessor and condemn the other partner to a ten-year-long sentence. However, they are also told that if both end up confessing, then they will serve a seven-year-long sentence each. The pay-off matrix, first created by the Nobel Prize-winning economist, John Nash, is as follows:

This celebrated game focuses on the human tendency to choose the option best suited for oneself and throw everyone else under the bus. Not knowing, what his teammate would do, prisoner 1 thinks he is better off confessing [Quadrant 3]. Prisoner 2 also undergoes a similar thought process and ends up confessing the crime [Quadrant 2]. Hence despite knowing that a one-year sentence (and therefore Quadrant 4) is an ideal situation (i.e. the Nash Equilibrium), both prisoners end up confessing – as each one tries to optimise his situation – and thus end up in Quadrant 1.

…is similar to the Investor’s Dilemma

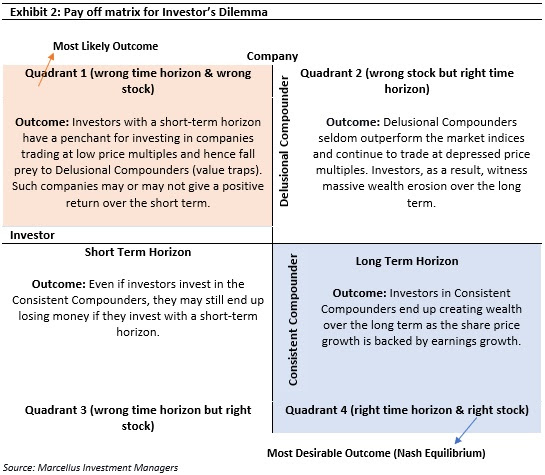

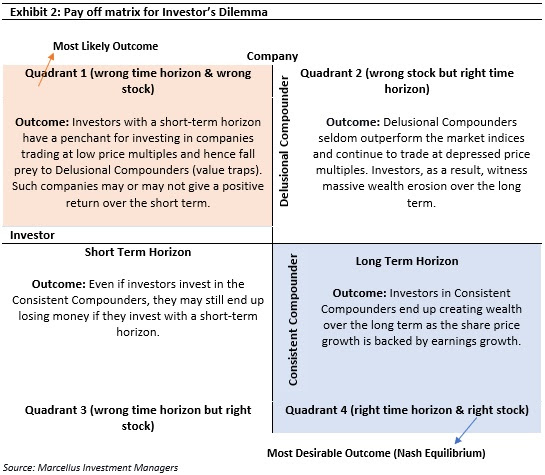

An investor often finds himself in a similar scenario in the world of investing. Whilst the prisoners knew that keeping their mouth shut was the ideal option, they chose to confess because in doing so lay personal gain. Despite knowing that investing in one type of security for the long term will earn profits, investors often choose to refrain from investing in them. The following matrix more appropriately describes options faced by investors (on the vertical axis) and companies (on the horizontal axis).

Delusional Compounders are companies with a track record of capital misallocation. Such companies have very low earnings growth. The combination of capital misallocation, low earning growth and poor corporate governance, leads such companies to trade at depressed price multiples.

On the other hand, Consistent Compounders have, almost by definition, superior capital allocation. Such companies consistently deliver very high earnings growth alongside respectable standards of corporate governance. The combination of good capital allocation, high earning growth and superior corporate governance, leads such companies to trade at elevated price multiples eg. HDFC Bank, Asian Paints, Bajaj Finance, Nestle, etc.

In the above matrix, Quadrant 4 is the Nash Equilibrium where investors should invest in Consistent Compounders with a long-term horizon. Nevertheless, investors more often that not end up in Quadrant 1 i.e. they invest in the low quality companies and have a short time horizon. So why do investors end up in Quadrant 1 than in Quadrant 4?

A. It is easier to “trade” rather than to “invest”

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.” – Bill Gates, co-founder of Microsoft (1995).

This quote is especially important in the world of investing. If there is a company that is run by an unusually capable promoter, who understands capital allocation, it makes sense to remain invested in such a company for the long term. As explained in our bestselling book ‘Coffee Can Investing: The low-risk road to stupendous wealth’ (2018), buying and holding great companies over long time periods has several benefits:

- Higher probability of profits: Stock markets can be volatile in the short term. Only a person who can correctly predict a bull or a bear run should invest for the short term. However, for the rest of us, empirical evidence suggests that the probability of making a profit increases disproportionately by investing for the long term [see pages 66-69 of the book].

- Lower transaction costs: Although brokerage costs has fallen in India over the past 20 years, it can still make a difference in the returns over the long term. A portfolio worth Rs. 100,000 compounded at 20% CAGR for 10 years would eventually become Rs. 619,000. However, if the whole portfolio is churned every year and the transaction cost plus price impact cost is around 50 bps, then the portfolio would compound to only Rs. 594,000 over 10 years. This difference of Rs 25,000 is equivalent to 25% of the initial corpus.

- Lower taxes: Short term Capital Gains Tax (CGT) is 15% in India and long-term CGT is 10% in India. The more a portfolio churns, the greater the amount of tax leakage. Once these monies are paid out as taxes, the investor loses their compounding effect forever.

B. It is easier to focus on P/E multiples than on earnings growth“If you are a long-term investor, owning shares in a good company is a much larger determinant of your investment performance than whether the shares were cheap when you bought them.” – Terry Smith, Chief Executive of Fundsmith (2015). (Link)

The price of a company’s share is mainly a function of two factors: ‘Earnings’ and ‘Price Multiple’. The most ideal companies to invest in are the ones with high earning growth potential and trading at depressed price multiples. However, such companies are seldom available. Most investors tend to focus on price multiples for investing in a company and ignore the potential earnings growth a company may generate.

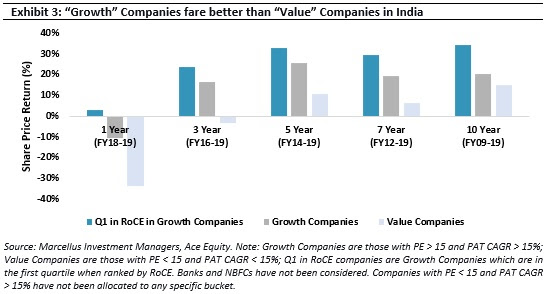

|

|

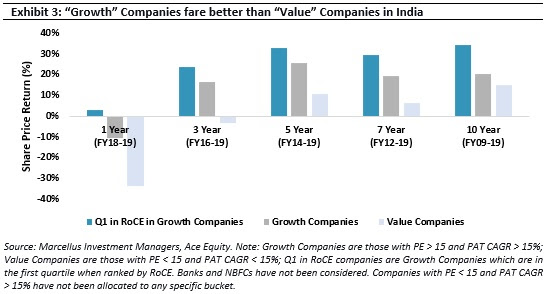

Looking at the chart above, it is apparent that earnings growth is a much more sustainable source of share price growth as multiples cannot continue to expand perpetually. Growth Companies give far higher returns than Value Companies across all the periods. In fact, as seen in “Q1 in RoCE” bar, returns get magnified by investing in those companies having high growth rates along with high RoCEs.

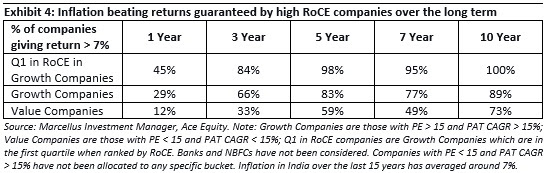

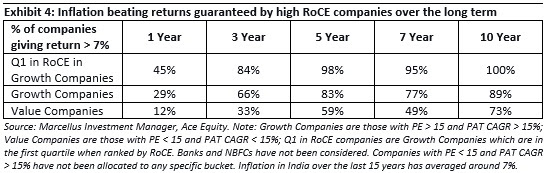

Whilst Marcellus’ objective is to create wealth for its clients, the bare minimum an investor should strive to generate is inflation-beating returns. The investor is essentially becoming poorer if she is generating returns lower than inflation. The above table shows % of companies within each basket which can generate a return greater than 7%.

The above table suggests that by investing in companies with high earning growth rates and high RoCEs, returns higher than inflation are guaranteed over the long term. At the other end of the spectrum, only 71% of the Value Companies can generate returns higher than inflation and that too if the investor stays invested in the long term. This again proves that an investor should invest his corpus in Growth companies rather than in companies with low price multiples and no growth.

C. Good vs Bad Corporate Governance

“It has been far safer to steal large sums with a pen than small sums with a gun” – Warren Buffet (1997)

Whilst nobody wants to invest in companies whose corporate governance is flawed, even institutional investors end up investing in some of the companies with poor corporate governance. At Marcellus, we believe that the following are essential checks that should be conducted to identify companies which are marred by bad corporate governance:

- Forensic check of the financial statements: We study the accounts of our potential investee companies in-depth and look for inconsistencies in their financials. Typically, companies with questionable corporate governance tend to have done some transaction in the past which has benefited the promoters at the cost of minority shareholders. Chapter 10 of our book “The Unusual Billionaires” (2016) contains the forensic ratios we find most useful. Our LCP Newsletter for the month of Dec’19 talks more about the forensic framework used at Marcellus.

- Primary Data point checks: To assess the promoter’s integrity, we find it useful to talk to around 20 people in the broad ecosystem surrounding a listed company eg. ex-staff members, suppliers, distributors, customers, ex-regulators, ex-auditors, etc.

Investment Implications

Whilst every investor knows that Quadrant 1 contains companies like HDFC Bank, Asian Paints, Bajaj Finance, etc., many end up accumulating companies in the other three quadrants. Like the prisoner in Prisoner’s Dilemma, the investor falls prey to investing in sub-optimal companies because he convinces himself that the Consistent Compounders are trading at a very high multiple. As a result, the bulk of the market cap of the Indian stock market ends up being accounted for by Delusional Compounders even as the bulk of the returns from the Indian stock market come from the Consistent Compounders.

Disclosure: Asian Paints, HDFC Bank, Nestle and Bajaj Finance are part of most of Marcellus’ client’s portfolios.

Harsh Shah is a Research Analyst, Ashvin Shetty is a Fund Manager and Saurabh Mukherjea is the CIO at Marcellus Investment Managers

|

|

|

|

|