Across the world, supply vs demand mismatches are fuelling inflationary pressure. In such circumstances, contrary to the popular notion of high-quality stocks taking a beating, history shows that such companies have outperformed the broader market even more strongly (when CPI inflation exceeds 6%) on revenue growth, profit margins and shareholder returns. This construct bodes well for the continued strong performance of Marcellus’ CCP and KCP portfolios.

Limited resources versus unlimited wants

As the global economy recovers from the impact of Covid-19, across the world we are seeing a strong resurgence of broad-based demand for new homes, new cars, holidays, consumer durables, takeaway food, OTT entertainment, etc (Source: McKinsey Report: Consumer demand recovery and the lasting effects of COVID-19, 2021). The width and depth of the demand resurgence suggest that the US$13 trillion of fiscal and monetary stimuli injected by the OECD countries is playing a significant role in this demand recovery (Source: Reuters: Fiscal stimulus fires up US consumer spending, 2021).

Unfortunately, this demand resurgence comes at a time when Covid-19 has disrupted a range of supply chains in different parts of the global economy. As a result, we are seeing shortages of everything from semiconductors to shipping containers to truck drivers (Source: The New York Times: How the world ran out of everything, 2021).

With demand growing faster than supply, in most large economies inflation is rising. In fact, in several countries, including India, we are seeing the strongest CPI prints in 20 years (Source: CNN: Global inflation hasn’t been this high since 2008, 2021). CPI inflation in India has now been above 6% for the last 2 consecutive months and it seems unlikely to come down below 6% (which is the upper end of the RBI’s targeted range) anytime soon.

The impact of high inflation on stock prices

In such circumstances, a theory that has been widely propounded is that as interest rates rise to dampen inflationary pressures, stocks with high P/E multiples will come under pressure (Source: CNBC: Investors see higher interest rates as the biggest threat to stocks, 2021).

Not only does this theory lack any empirical support (for example, from 2004 to 2008, interest rates were steadily rising – both in the US and in India – and so were the so-called expensive stocks), more rational thinkers have highlighted that high-quality stocks outperform the broader market even more strongly in times of high inflation.

For example, the investment team at the global asset management firm, GMO, found that for the American stock market, over the past hundred years, high-quality stocks outperformed the broader market index in most high inflationary periods.

“…quality stocks have tended to fare well compared to the broader markets in times of rising prices, and that paying attention to valuation alongside quality delivered even better results.” (Source: GMO newsletter: Quality Investing and Inflation, 2021). Note: The GMO team defined high inflation as periods where CPI inflation was above 5%.

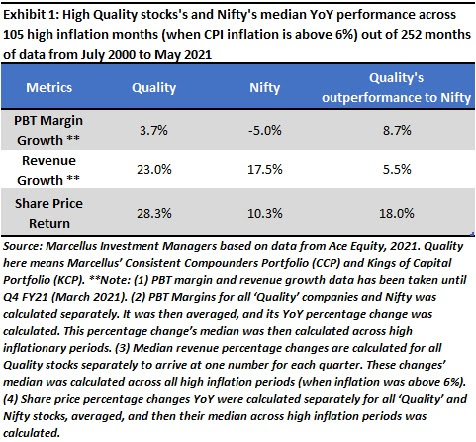

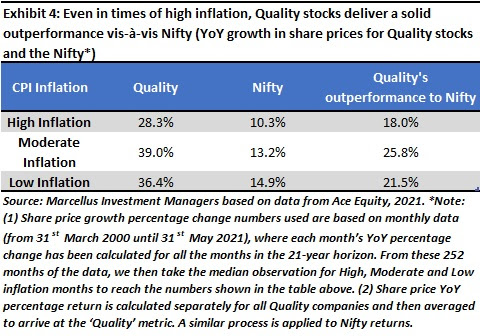

We conducted a similar exercise for the Indian market using data for the past 21 years and found that high-quality stocks’ outperformance of the Nifty is even stronger when CPI inflation is above 6%.

High-quality companies outperform even more when inflation is high

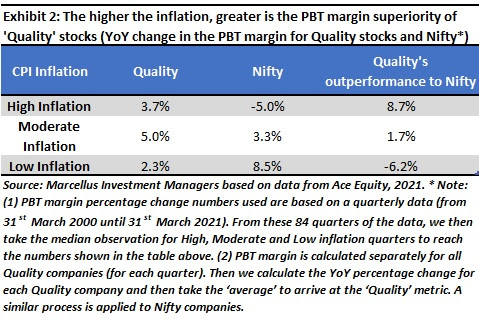

We define “high” inflation to be months where CPI inflation was above 6% and “low” inflation to be months where CPI inflation was below 4%. “Moderate” inflation is therefore the remaining months (when inflation is above 4% but below 6%). Over the last 21 years (starting in July 2000 and ending in May 2021), India has seen 105 months of high inflation, 75 months of moderate inflation and 59 months of low inflation.

As per Marcellus’ investment philosophy, high-quality companies should have clean accounts, rational & effective capital allocation and strong barriers to entry to first thwart and then decimate the competition. We define high-quality stocks to be the 14 stocks in our Consistent Compounders Portfolio (CCP) and the 12 stocks in our Kings of Capital Portfolio. Since there is some overlap between these portfolios, the total number of unique names in our high “Quality” stock list is 22. Our reasons for deeming these names to be high-quality stocks are as follows:

- The CCP stocks are chosen from a universe of stocks whose market capitalisation exceeds Rs 100 crores and who have over the past 10-15 years consistently grown their revenues at 10% or more per annum alongside Return on Capital Employed of 15% or more per annum. The stocks which make it into the CCP portfolio also have to pass our proprietary forensic screens. More details on Marcellus’ approach to forensic accounting can be read in our December 2019 newsletter (The Importance of Accounting Quality) and viewed in September 2020 webinar (Forensic Accounting).

- The KCP stocks are chosen from a universe of Financial Services stocks (including banks, NBFCs, insurers, brokers, and asset managers) which over the past 10-15 years have consistently grown their business (loan books or premiums) at more than 15% per annum alongside Return on Equity of more than 15% per annum. To enter our KCP portfolio, these companies must also pass our proprietary accounting screen for lenders. [Click here for our Sept 2020 Kings of Capital newsletter to understand how our Financials forensic screen works: https://marcellus.in/

newsletter/kings-of-capital/ how-to-spot-naughty-lenders- in-india/]

Having defined Quality as the 22 CCP and KCP stocks, we then compared the performance of these stocks versus the Nifty on three counts – PBT margins, revenue growth, and share price returns – across High, Moderate and Low inflation environments.

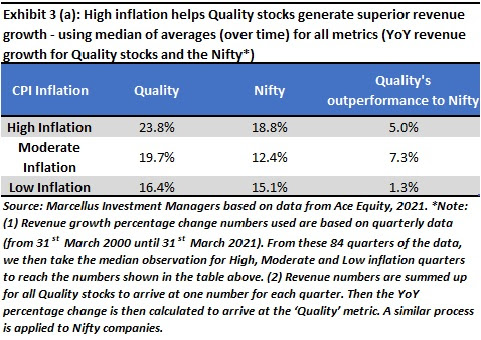

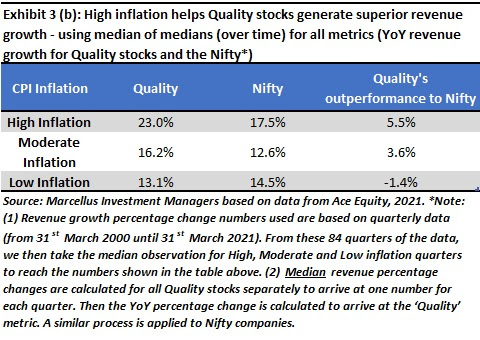

As Exhibit 3 (a) shows, unlike in the PBT margin case – where the extent of outperformance for Quality stocks vis-à-vis Nifty is the largest when inflation is high (i.e., above 6%) – when it comes to revenue growth, the Quality stocks outperform the Nifty companies most during periods of moderate inflation (i.e., between 4% to 6%). However, in the case of 3 (b), a similar trend as seen in PBT margins for quality and Nifty can be seen where Quality companies’ revenue growth outstrips that of Nifty’s the most (5.5%) during high inflationary periods (when inflation is above 6%), followed by the outperformance (3.6%) in moderate inflationary periods (when inflation is between 4%-6%). Nonetheless, a key point to note is that in both the scenarios, in times of high inflation, Quality companies’ revenue growth significantly outstrips that of Nifty companies. For both, PBT margin and revenue growth, Quality companies’ superiority ebb away when inflation is below 4%.

Investment implications

As the three exhibits shown above demonstrate, once CPI inflation crosses 6%, high-quality stocks increase the extent of their outperformance vis-à-vis Nifty stocks in terms of revenue growth, profit margins and, consequently, share price outperformance. Why does this happen?

The answer lies in sustainable competitive advantages. A small minority of franchises in the Indian market (no more than 30 listed companies our Research team says) have been able to erect barriers to entry so high that their competitors are constantly on the defensive even in normal economic circumstances.

These barriers to entry can be around the innovative use of technology (see our Oct 2020 CCP newsletter (https://marcellus.in/

It is as the famous saying goes, what doesn’t kill you makes you stronger. High inflation hurts weaker franchises and makes the CCP and KCP franchises stronger. To understand better how high-quality companies keep pushing their sub-par competitors onto the backfoot, please refer to our Dec 2020 KCP newsletter (Covid-19 and market share gains for the Kings of Capital) and June 2021 CCP newsletter (India’s greatest cash generation machine keeps compounding).

Nandita Rajhansa and Saurabh Mukherjea are part of the Investments team at Marcellus Investments Managers. Marcellus’ forthcoming book “Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth Creation” will be published by Penguin in August.

Disclaimer

Copyright © 2021 Marcellus Investment Managers Pvt Ltd, All rights reserved

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services and as an Investment Advisor. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.