The road to free cash flow (FCF) compounding is filled with several challenges related to the strength of the business model as well as the capability of the management to grow the business profitably. Hence, only a handful of Indian small-midcap companies manage to generate healthy FCF compounding. Helped by an economic environment conducive for market share consolidation in favour of well-run franchises and thanks to effective capital allocation initiatives (relating to investment in technology, products, distribution, capacities and acquisitions), the Rising Giants are that elusive list of companies who are witnessing exponential FCF compounding in recent years (median 41% FCF CAGR for the portfolio over FY19-21).

Rising Giants PMS investment philosophy

This PMS intends to invest primarily in high quality mid-sized companies (less than INR75,000 crores market-capitalisation, predominantly in the INR 7,000 crores – INR 75,000 crores range) with: 1) Well moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and impeccable corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing framework. The RG PMS was launched on December 27, 2021 and has generated (-)5.3% returns since inception (as on 9th Feb 2022) vs a benchmark (BSE500 TRI) return of +2.6%.

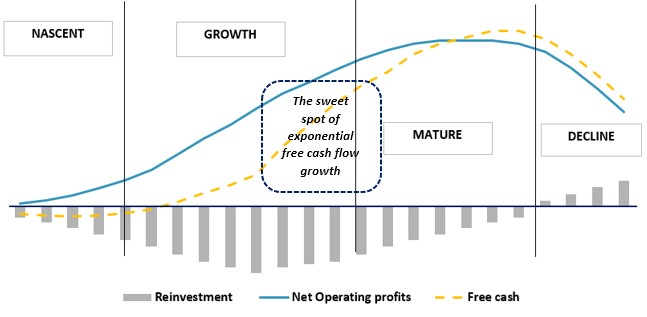

The tough road to ‘exceptional’ free cash compounding

Free cash flow (FCF) is calculated as the difference between operating profits generated by a Company for the year and the amount reinvested back into the business through: (a) investments into working capital; and (b) investments in fixed and intangible assets. In our January 2022 Little Champs newsletter, we highlighted how every firm typically goes through four stages in its lifecycle – Nascent, Growth, Maturity and Decline – see the exhibit below. The interplay of key determinants of FCF i.e. operating profits, reinvestments and thus the quantum of FCF generation is significantly influenced by the stage of a company’s lifecycle as shown in the exhibit below.

Source: Marcellus Investment Managers. Note: (i) Reinvestment above includes both working capital and fixed assets/intangible investments; (ii) Free cash is calculated as Operating profits post tax (i.e. Net Operating profits) less Reinvestment

While FCF is generally non-existent during the nascent phase (due to lack of operating profits and heavy reinvestment needs), its starts building up as the operating profits start growing (growth phase). Then, after an inflection point when operating profits become sizeable enough to more than meet the reinvestment needs, there is an onset of exponential FCF compounding phase. More details regarding these phases can be found using the above link to the January 2022 Little Champs newsletter.

While from the above chart, it may seem a natural progression for every company to move up the free cash flow curve, in reality only a small subset of the companies at the beginning of each phase, irrespective of the longevity of its operations, graduates to the next higher phase of free cash flow cycle. In fact, a large number of companies, which have had operations for years or even decades are unable to generate operating profits and generate positive free cash flow due to a variety of reasons including the lack of competitive advantages. At the same time, we have seen several instances of companies which are able to grow operating profits but continue to find FCF elusive – such companies are typically in capital-intensive low margin sectors. In such companies, the high reinvestment in capex and working capital days is a must for growth and these continue eating away at operating profits resulting in low or no FCF.

The following data points illustrate the challenges associated in the FCF journey even for companies with a decent scale of operations and with at least 1-2 decades of operational history:

- Of the total about 450 listed companies in the Rs35-750bn market cap universe (the universe for the Rising Giants portfolio), nearly 12% of companies did not generate positive FCF in any of the last three financial years (FY19-21).

- For the above universe if we extend the time period to the last five financial years (FY16-21), only 1/3rd of the companies generated positive FCF in three or more years; and

- For the above universe, the median growth in FCF over FY6-21 has been a paltry 5% CAGR.

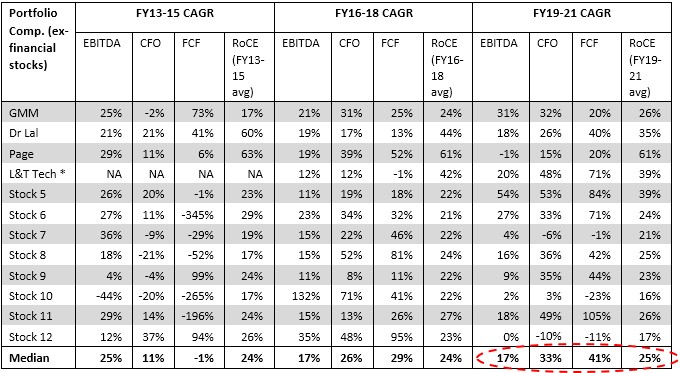

Rising Giants’ journey towards exceptional FCF compounding

Whilst we have highlighted the challenges involved in FCF generation above, on the other hand, Rising Giants are an exceptional set of Companies with not only consistent positive FCF but also a clear acceleration in FCF growth in the recent years (median FCF of portfolio improving from -1% over FY13-15 to 29% over FY16-18 and further to 41% over FY19-21) – please refer to exhibit below.

Source: Companies, Marcellus Investment Managers Note: (1) The above does not include financial services stocks in the portfolio

(2) * L&T Tech Services started business only in last quarter of FY14, hence data is not available for FY12-15.

What is even more impressive is that besides the acceleration in FCF for Rising Giants, in recent years this acceleration has come amidst significant challenges surrounding the economic environment like the Covid induced disruptions amidst an economic slowdown. We discuss now the key factors driving such a huge divergence in the Rising Giants’ FCF performance vs the broader corporate world:

- A networked economy benefits efficient companies: Over the past ten years (FY11 to FY21), the length of India’s national highways has doubled to 136K kilometres implying a compound annual growth rate (CAGR) of 7% [1] . The number of broadband users has increased from 20 million in FY11 to 687 million at the end of FY20 (CAGR of 48%) [2] . A decade ago, in 2010 India’s airports handled 80 million passengers. The corresponding figure in FY20 was 340 million implying a CAGR of 16% [3] . 15 years ago, only 1 in 3 Indian families had a bank account; now nearly all Indian families have a bank account. As a result of this networking of the Indian economy, efficient companies with strong distribution systems have pulled away from regional & local players. For example, as the economy gets integrated, lending, which was once dominated by regional players is now seeing the emergence of a few national players with superior underwriting and risk management capabilities (underpinned by greater investment in talent and technology). Such lenders are part of the Rising Giants portfolio.

- Access to and adoption of low-cost technologies: Until about a decade or so ago, using technology extensively to drive revenue growth or business efficiencies was largely the privilege of large companies. Due to the rise of cloud, mobile and software-as-a-service (SAAS), the technological landscape has evolved significantly over the past decade resulting in much wider access for smaller companies to world class technology. The Rising Giants have been at the forefront of adopting these modular low-cost SAAS solutions which are hosted on the cloud (eg. Salesforce, SAP) and IOT (eg. Industry 4.0). The technologies have not only helped drive significant business value on the front end (eg. – better customer insights through datamining) but has also helped these companies to improve their working capital cycles, asset turns, profit margins and hence RoCE. We highlight some of the initiatives taken by the Rising Giants companies on this front in the exhibit below.

|

Company |

IT initiatives |

|

Dr Lal Path Labs |

Investing in technology to: § Enhance consumer experience e.g., faster TAT § Operating efficiencies – e.g., route optimization § Lab Automation |

|

Page Industries |

§ Investment in Supply Chain tool – ‘BlueYonder’ § Sales Force Automation, Distributor Management System |

|

Stock 3 |

§ Sales Force Automation, Distributor Management Systems § Low-cost automation, better manufacturing technologies at plants |

|

Stock 4 |

§ Tech spends on improving UI/UX through use of AI/ML § Standardising the taxonomy of all metrics in a job application/posting |

|

Aavas Financiers |

§ Leads captured through app, platform integrated with credit bureaus § Analytics model for bounce prediction and assessment of warning signals § Geotagging for smart customer allocation |

|

Stock 6 |

§ Focus on enhancing functional capability in Co-Lending and use of technology for collections |

|

Stock 7 |

§ IL Take Care App – Comprehensive platform for both health and Motor business § InstaSpect – ~80% of Motor OD claims serviced through video app |

|

Stock 8 |

§ Investment in product life cycle management for standardisation of new product launch/change management (example Enovia of Dassault Systems) |

|

Stock 9 |

§ Migration to IoT in several operations to reduce manual intervention |

Source: Companies, Marcellus Investment Managers

§ Capital allocation initiatives by Rising Giants companies: A persistent economic slowdown in the recent years marked by disruptive events like demonetisation, GST introduction and the recent COVID-19 crisis has only served to widen the gap between stronger and weaker companies. Market leaders helped by their superior return on capital employed (RoCEs) are able to generate healthy cash flows and in turn deploy them into strengthening their franchises further through investments into products, people, and technology, expanding distribution networks and gaining market share from weaker players.

On the other hand, weaker peers have been structurally impacted and many of them now face existential issues. Hence, stronger cashflow generating companies are able to benefit more from both an economic crisis as well as economic recovery. While it may sound counter-intuitive that investments (as described in this para) can result in FCF growth (since investments at a practical level reduce FCF), well thought through investments generate much more operating profits in future than the cash outflow entailed by them initially. Such investments have been an important driver of Rising Giants’ FCF growth of recent years.

Source: Companies, Marcellus Investment Managers

The implication of all the above factors is that despite tough economic environment, the Rising Giants have been able to continue generating healthy operating profits, lower the working capital days (thanks to investments into technology and rising market share which results in better bargaining power vs customer and vendors). The exhibit below summarises the key FCF drivers for Rising Giants in recent years.

Source: Marcellus Investment Managers

Investment implications: Invest in companies with maximum FCF compounding over their lifecycle

The fair value (or intrinsic value) of a company is the net present value of all its expected future FCF over its life cycle. The future FCF that the company generates over its lifecycle are in turn dependent on the longevity of and the growth in ‘positive’ FCF. The longer a company stays in the zone of exponential FCF growth the higher the intrinsic value generated by that company. Through their own attributes/efforts while the Rising Giants have achieved exceptional FCF growth phase, it becomes equally important to monitor them closely lest they enter the next phases of FCF cycle prematurely i.e. maturity and decline.

Great companies generate several decades of growth in FCF. As explained in our December 2021 Consistent Compounders Portfolio newsletter, some of the factors that positively impact the longevity and growth in the FCF of a Company as assessed through our longevity framework are:

1. Inherent advantages enjoyed by the Company like strong pricing power (i.e. strong moat).

2. Focus on operating efficiencies (how the firm achieves the same revenues as its competitors but with lower expenses).

3. Prudent capital allocation/adding profitable new growth initiatives.

4. Softer aspects around management quality and succession planning.

The above framework for assessing the longevity and growth of the cash flows is also applied to the Rising Giants Portfolio. This framework, called the longevity framework at Marcellus, helps in assessing using objective set of parameters, how long the Company is likely to sustain the healthy growth in FCF and a Company’s score in the longevity framework forms an important basis in deciding not only whether a company makes it to/remains in the portfolio but also the inter-se position sizing amongst the portfolio companies.

Source: Marcellus Investment Managers

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Copyright © 2021 Marcellus Investment Managers Pvt Ltd, All rights reserved

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.