Little Champs portfolio companies’ dominant position in their niche markets forms the key basis for their superior pricing power, profitability, RoCE and free cashflow generation vs. peers. However, a key pitfall of ‘niche focus’ is a high probability of hitting a growth ceiling after reaching a dominant position in a niche industry – a concern often raised for Little Champs and more generally for B2B companies. Our Little Champs are successfully mitigating these growth concerns through their globalisation strategy – nearly 50% of the non-Financial portfolio companies now derive more than 25% of their revenues from outside India. More importantly, these global forays are based on product innovations, process improvements and people management, clearly more enduring moats than competitive pricing. Besides a significant growth runway, globalisation gives the Little Champs learnings which further enhance their domestic market dominance.

Performance update of the Little Champs Portfolio

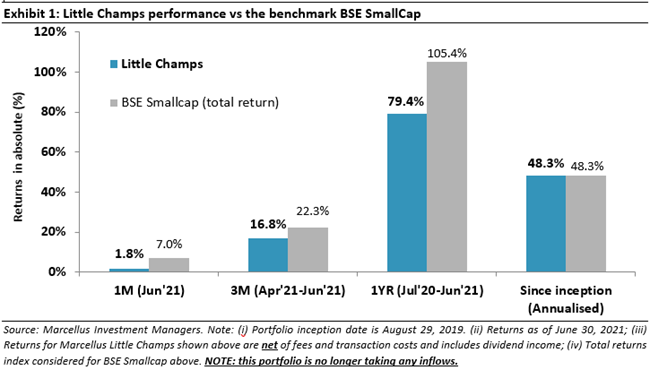

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Portfolio updates

We have exited from Sterling Tools recently. The sale proceeds from these exits have been re-invested in the other portfolio stocks basis our position sizing frameworks. The key reason for exit from Sterling Tools is deterioration in its accounting score under the Marcellus’ proprietary forensic accounting model triggered by below par scores on the following ratios: (i) growth in auditor’s remuneration relative to the revenues; (ii) contingent liabilities as % of networth; (iii) miscellaneous expenses as % of total revenues; and (iv) yield on cash and cash equivalents.

More details on Marcellus’ approach to forensic accounting can be read in our December 2019 newsletter (The Importance of Accounting Quality) and viewed in September 2020 webinar (Forensic Accounting).

Globalisation – Little Champs’ answer to the growth challenges of a niche industry

A key objective of our Little Champs portfolio is to invest in ‘dominant’ franchises. This ‘dominance’ forms the key basis for Little Champs’ superior pricing power, profitability, RoCE and free cashflow generation. Given the smaller size of the companies that we target for the Little Champs portfolio (we typically invest in <US$500 mn market cap companies), it is but logical that most of the portfolio companies, albeit dominant, cater to niche markets. In fact, in a way the unwavering focus/commitment to their niche markets is a key driving force behind Little Champs achieving & maintaining their dominance. However, a potential pitfall of focusing on a niche market is that there is a high probability of hitting a growth ceiling after reaching a dominant position in the niche industry. Indeed, we often face questions from clients regarding the growth prospects of the Little Champs portfolio companies due to their dominance of a specific niche. This concern is particularly directed towards Little Champs that operate in niche B2B sectors where typically there is no large ‘unorganised’ segment unlike most of B2C markets (where the ‘formalisation’ of the sector can provide long term sources of market share gain and hence growth).

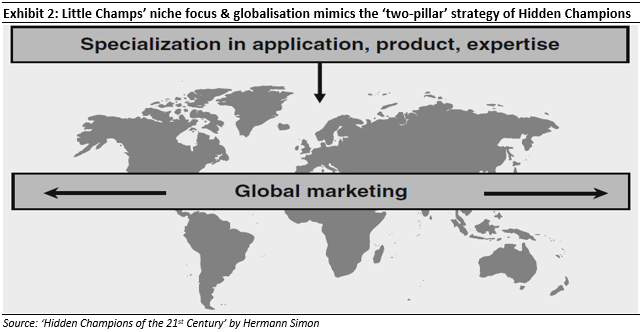

However, despite the above odds, the Little Champs portfolio companies have delivered weighted average revenues and profit CAGR of 11% and 20% respectively over FY16-21 against the backdrop of relatively muted revenue/earnings growth seen across the broader Indian corporate landscape. Thus, Little Champs seem to have defied the growth challenges of their niche industries. How have they managed to do so? The answer to this lies in the two-broad growth strategies of ‘soft diversification’ and ‘globalisation’ employed by them. We will focus on globalisation strategy in this month’s newsletter.

“Globalisation not only makes even the narrow markets large, it further contributes to growth in profits through economies of scale. The foundation for the success of this strategy is that customers in the same industry tend to have similar needs across countries.” – Hermann Simon in ‘Hidden Champions of the 21st Century’.

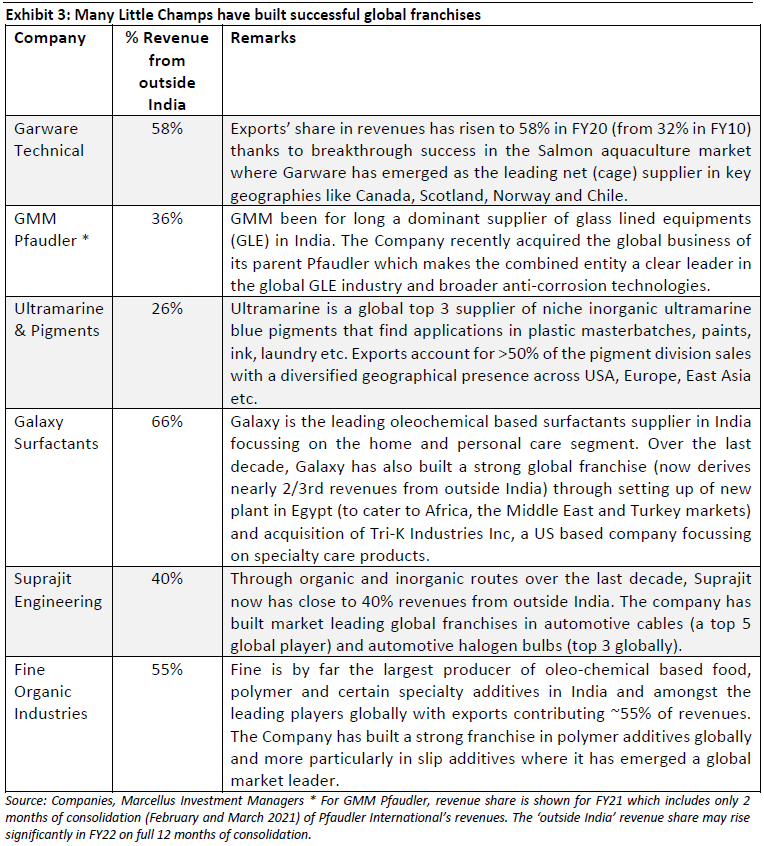

Globalisation has played an important role in the revenue growth of a number of Little Champs companies over the last decade. In FY10, the weighted average revenue exposure of Little Champs portfolio companies (excluding Financials) was 18% to geographies outside India. This has increased to 24% in FY21, implying a revenue CAGR of 16% over FY11-21. Furthermore, Little Champs’ successful global franchises have been built around products, processes and people- as we illustrate below. In fact, the global success of these firms contradicts two commonly held notions in India: (a) that the most successful Indian exporters’ competitive advantages are centered around competitive pricing (leveraging India’s low labour cost arbitrage vs developed markets); and (b) that only large Indian companies possess the wherewithal to succeed in the global markets.

Little Champs’ global success has been driven by the following factors:

A) Product – Innovations that address customer’s needs

Little Champs have focussed on innovations rather than pricing as the key differentiator to gain market shares. Their innovation, in turn, has been a result of relentless focus on a niche segment, often driven by a technocratic top management and a sound understanding of the customer needs. Some examples of Little Champs that have been successful in this aspect are described below.

Garware Technical Fibres

Coming up with innovative products has been the cornerstone of Garware’s success in the recent years particularly in aquaculture. Garware’s innovative value-added products (through priced higher) help in bringing down the overall cost of as well as risks involved in the operations for the user and hence customers are more than willing to pay a premium price for the same. Some examples of the breakthrough innovations by Garware in the recent years: (i) V2 nets for anti-fouling properties; and (ii) X12 nets for sea-lice solutions:

The key enablers for Garware’s product innovations have been:

- Strong understanding and experience in polymer engineering with several decades old focus on and presence in the field of polymers;

- Focus on R&D with a separate in-house R&D unit set up as far back as the early 1990s. The company’s R&D spend has also been on a rising trend with 1.5% of sales in FY18-20 compared to an average of 1.1% over FY15-17. The company now has close to 60 patents filed across various geographies.

- Many of the cues for Garware’s product innovation come from a sound understanding of the customers’ business needs and how Garware’s products can help address needs like reducing costs, improving productivity and more specific needs like addressing environmental concerns, high cost of maintenance (V2 nets), and attacks by sea creatures like Seals. This is facilitated through strong involvement with customers right from the top management (who personally oversee key client accounts) to regional managers. Furthermore, an extensive front end overseas infrastructure (five overseas offices in UK, Norway, Canada, Chile and Australia) and strong distribution partners like Knox in Scotland and Selstad in Norway ensures a steady flow of critical customer feedback.

Fine Organics

Fine’s R&D prowess has played an integral role in the Company scaling up to more than 400 products in the oleochemical additives space across varied industries over the years. Some instances of product innovations from Fine are: (i) Oleochemicals based additive alternatives for many crude oil or animal fat-based products across food and plastic portfolios. For instance, Fine introduced oleo additives for the packaging industry which replaced additives that were derived from animal fats making it suitable for vegetarian food items. (ii) Recently the Company has recently come up with an innovative additive to replace conventional antibiotics in the meat & poultry industry. For instance, this additive alters the enzymes and digestion process in cattle to lower the content of harmful saturated fats and increase unsaturated fat in the milk produced by the cattle.

Fine’s R&D’s capabilities have been driven by a technocratic top management, an experienced R&D team built over the years (with recruitment from India’s top chemical engineering colleges) and the organisational expertise & know-how in oleo chemistry developed over decades of experience. Over the years Fine has built a strong R&D team (consisting of 18 scientists, engineers and technologists now) to cater to product and process development. Graduates from the renowned ICT are preferred in the R&D team.

B) Processes – driving operational efficiencies and integration of global operations

The Little Champs are amongst those rare Indian companies to make a success out of their global acquisitions and/or generate healthy profits at their global manufacturing facilities. The key to this is: (a) a well-defined vision for & long-term commitment to their global business; (b) a clear roadmap for improving operational efficiencies through networking/collaboration with and sourcing from efficient Indian plants; and (c) making the necessary investments to enhance the product portfolio & marketing muscle. Some examples of Little Champs who have done this successfully are:

GMM Pfaudler

In 2008, GMM acquired Mavag AG, a Swiss company engaged in the manufacture of equipment for critical Filtration, Drying and Mixing applications to the pharmaceutical and biotech industries. In the first full year after acquisition (FY10), Mavag had revenues of CHF 9.2 million and a negative EBITDA of CHF 0.18 million. Since then, the company has, through the integration of Mavag with the global network of Pfaudler Inc, increased revenues to about CHF17 million in FY21. Also, with a focus on product mix, efficiency improvement and increased sourcing from India (GMM Pfaudler), Mavag’s gross margins have increased from 56-57% in FY10, to 63% in FY20; and EBITDA margin from negative to nearly 13.5% in FY20.

Suprajit Engineering

Over the last six years, Suprajit has made two relatively significant acquisitions outside of its core automotive cable business and with significant presence outside India: (i) Phoenix Lamps, a leader in automotive halogen lamps in FY16; and (ii) the acquisition of a 100% stake in US-based Wescon Controls, a leading supplier of control cables to the outdoor power equipment and certain other non-auto segments in USA in FY17. Phoenix and Wescon, while profitable and cash generating franchises at the time of their acquisitions, have seen their addressable market expand substantially. In parallel, Suprajit has taken significant measures to improve the efficiency of these two businesses.

For Phoenix, the following steps have been taken:

- Addressing product gaps: Under Suprajit, Phoenix has commissioned a new automated H7 line with latest technology which it has given it considerable scope to increase market share in the European Passenger Vehicle headlight lamp aftermarket dominated by H7 bulbs.

- Operational & organisational reorganisation: Phoenix earlier had two assembling units in Europe viz. Trifa (Germany) and Luxlite (Luxembourg) which have now been consolidated under a single entity thus making the firm more competitive.

- FY20, Phoenix Lamps division (PLD) acquired the Indian manufacturing assets of Osram with a simultaneous long term buy-back agreement with Osram to supply its Indian requirements. Over the longer term, the company is targeting the global halogen lamps supply chain of Osram.

For Wescon, the following steps have been taken:

- Launched ‘operations catalyst’ in Wescon – With the Wescon team taking the lead and with their Indian colleagues supporting them, Wescon worked on inventory reduction, facility transformation (reorganising the shopfloor), business process revamping, supply chain optimisation and enhanced customer contacts.

- At the time of the acquisition, Wescon Controls has manufacturing facilities in USA (Kansas) and Mexico. The company now has the added advantage of access to the low cost-efficient manufacturing plants of Suprajit in India.

- Building/beefing up sales team for expanding footprint to South America and beyond Outdoor Power Equipment (OPE).

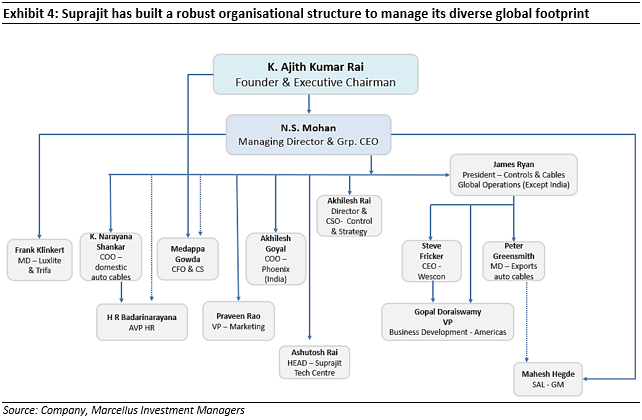

C) People – building talent commensurate for a global franchise

Management bandwidth allocation with sufficient delegation of responsibilities has been a key success factor for Little Champs in integrating the acquisitions and managing businesses with diverse geographical footprint. It has also played an important role in executing the operational efficiency enhancements highlighted in the preceding bullet. There is a fair degree of incentivisation for the senior management through performance linked pay and in some cases stock options.

For instance, Suprajit has been successful in retaining the existing management of acquired entities as well as making changes when required. N S Mohan, a non-promoter professional, has been appointed the Managing Director and Group CEO and he is responsible for all the operational matters including the subsidiaries. There are chief operating officers for key business such as domestic auto cable, export auto cable, Phoenix Lamps India, Phoenix Lamps Europe and Wescon. All of these COOs report to N S Mohan. The Company has also recently hired James Gerard Ryan, a veteran in the control and cables space to head the controls & cables global business (except India). In addition, the company has also launched an Employee Stock Appreciation Rights for high performing employees which can also help in talent retention. Indeed, Suprajit has one of the best scores amongst our portfolio companies in our proprietary succession planning framework.

|

|

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.