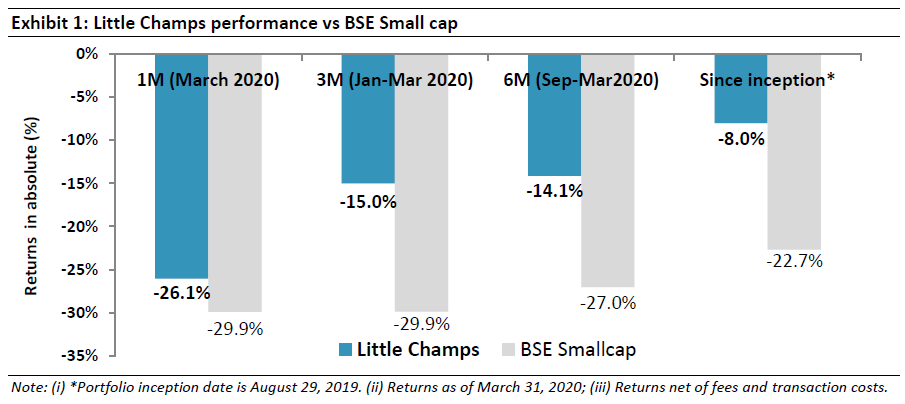

We see limited impact of COVID-19 on Little Champs’ fundamentals beyond the short-term business disruptions given: (i) their strong balance sheets will help them navigate the near-term stress much better than leveraged peers; and (ii) export oriented portfolio companies’ exposure is mostly in essential products (pharma, agro, food) or replacement markets rendering immunity from a potential global recession. In fact, Little Champs are likely to emerge relatively stronger out of the situation as they can afford to invest in business growth (product/process innovation, market expansion) through the crisis but most of their peers cannot. Hence, we expect the Little Champs portfolio to demonstrate resilience in the market downturn (portfolio down 15% since January 2020 vs BSE Smallcap’s 30%) as well as to recover faster as the uncertainty fades.

Performance update of the live Little Champs Portfolio

At Marcellus, the key objective of the “Little Champs” Portfolio is to own a portfolio of about 15 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

COVID-19: Where do we stand?

In our March 2020 Little Champs newsletter, we had discussed that we see limited long term impacts of COVID-19 on our Little Champs portfolio. Since the time we wrote that newsletter, there has been a mix of positive and negative developments concerning the disease:

- On the positive side, China and certain countries like South Korea, the earliest epicentres of the virus seem to have succeeded considerably in bringing it under control. Our channel checks with businesses having Chinese supply chain links indicate that Chinese factories have resumed production across most regions and industries in the month of March. Hence, the experience from these countries do suggest that measures like lockdown and self-distancing (currently the de-factor measures employed by most of the affected countries) do help to contain the spread of the virus.

- However, on the negative side, Europe and USA have emerged as the new hotspots over the last month with still a lot of uncertainty where we stand in the cycle of infections/deaths in these regions (although even in Europe and USA the number of new cases is now falling). Similarly, here in India, the daily numbers are witnessing an acceleration though the overall numbers suggest that the situation is still under control.

Hence, over the last one month, the concerns related to Covid-19 with respect to Indian companies has shifted from being a supply-side issue (disruption in imports from China) to a demand side issue (domestic lockdown and disruption in Europe/USA- the biggest export markets for Indian companies).

Impact on the Little Champs portfolio

In our 23rd March, 2020 webinar, we had discussed our thoughts on how we see the impact of Covid-19 on Marcellus’ portfolios including Little Champs. We reproduce those thoughts below:

- Sharp but only a brief lasting impact of the disease: Marcellus’ base case assumption for this event is that the disease will last for a few months rather than years. The improving situation in China and certain other countries (such as Korea) gives us confidence about this assumption. Hence, we believe the domestic lockdown (impacting both demand and production) will last a few months. This sharp but brief impact is somewhat similar to that of the Global Financial Crisis and Demonetisation on the Indian economy.

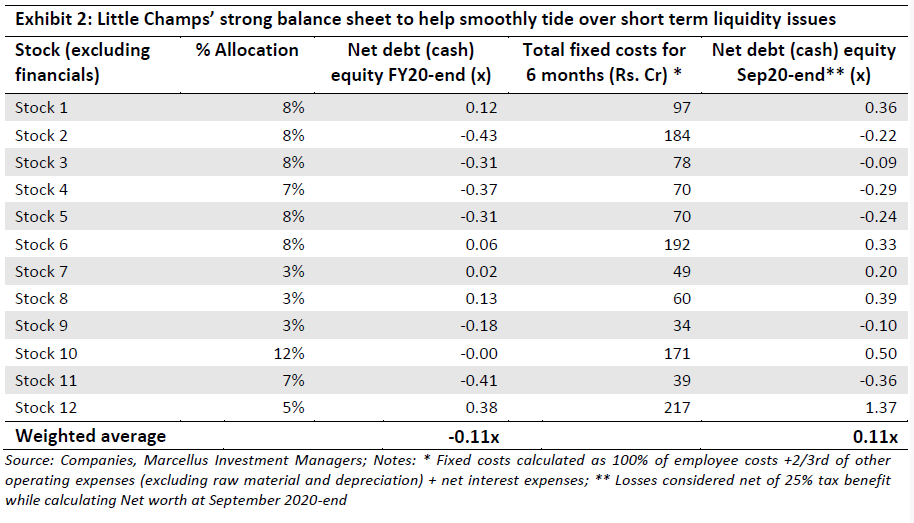

- Little Champs’ strong balance sheets will help navigate short-term liquidity stress better than leveraged peers: During the lockdown, companies will not be able to generate revenues but at the same time have to continue incurring fixed costs such as payment of salaries to the employees, rentals, retainerships, utilities etc (the RBI has announced a 3 month moratorium on debt repayments). Most of the Little Champs portfolio companies with net cash on their balance sheets would be able to withstand the net cash outflows in the interim much better than their highly leveraged peers. Just to quantify – even after conservatively assuming that Little Champs portfolio companies suffer cash fixed costs for the next six months without any corresponding revenue, the weighted average net debt (cash) equity for the portfolio (ex-financials) increases from (0.11)x (i.e. net cash) at March 2020-end to just 0.11x at September 2020-end. That still leaves a lot of firepower for our investees to invest in growing their businesses.

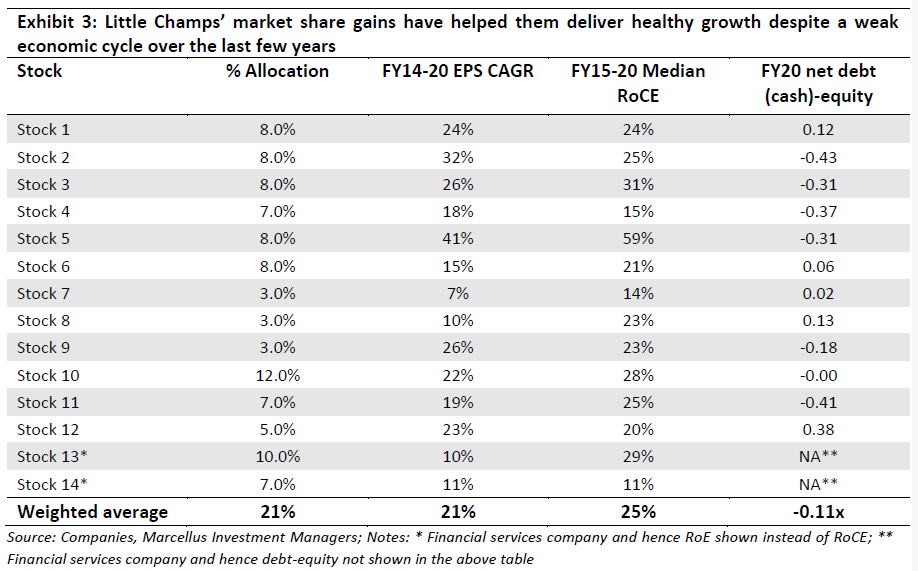

- Opportunity for Little Champs to accelerate market share gains in current situation: Little Champs portfolio companies have generated weighted net earnings CAGR of 21% over FY14-20. This healthy earnings growth is during a period where the broader corporate earnings have been hard to come by (Nifty net earnings CAGR for the same period has been only 3%) marked by disruptive events like demonetisation, GST introduction and the economic slowdown (pre-COVID) of FY20. A key part of this earnings outperformance for Little Champs has been thanks to their superior RoCEs and resulting surplus cashflows which they have deployed into strengthening their franchises viz. investing in products/people/technology, expanding distribution networks and thereby gaining share from weaker peers. We have dealt this in detail in our March 2020 newsletter Little Champs newsletter also.

We don’t see any reason why the last 5 years’ story can’t play out in the current situation; in fact logic suggests an acceleration in market share by Little Champs going forward. The strong balance sheets of the Little Champs enable them to not only survive the short-term stress but also to continue to invest for future growth unlike their cash starved smaller peers for whom survival will be the key focus over the next few months.

- Financial Services stocks in the portfolio well placed to consolidate market share: The ongoing ‘lockdown’ in domestic economic activity will certainly lead to short term (2-4 months) suppression in revenues, earnings and cash flows of businesses across most parts of the economy. Undoubtedly this will result in a rise in NPAs and reduction in loan book growth rates for lenders during the 2-4 months period of lockdown. In our 1st November 2019 Consistent Compounders newsletter, we had explained how great lenders undergo a temporary deterioration in their financials during such a crisis, but are best placed to consolidate their market share once the crisis is over.

We believe that financials stock in our portfolio (one bank and one NBFC) are best positioned to consolidate lending market share over the next 3-4 years because of a combination of: a) a strong liabilities franchise with favorable Assets Liabilities Management (ALM) profile; b) comfortable capital adequacy ratios; c) superior quality of loan book compared to their competitors; and d) superior collections capabilities vs peers. Hence, any short-term moderation in earnings growth trajectory of these firms is likely to be more than offset by acceleration in earnings growth through market share gains over the next 3 years.

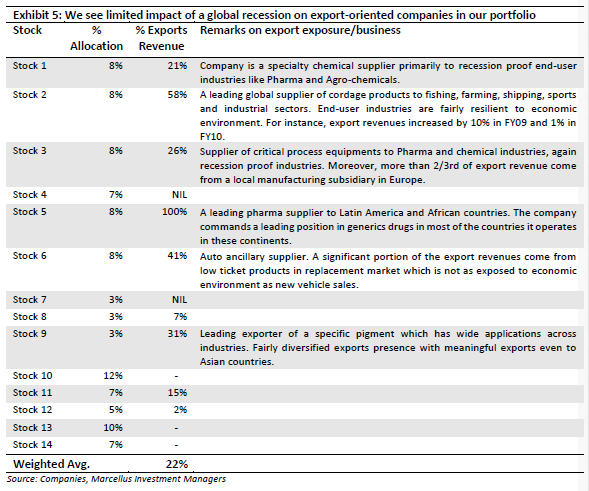

- Limited impact on exporters in our portfolio

With Europe and USA, the key destinations for Indian exporters (also for the Little Champs portfolio companies with exports exposure) witnessing a lockdown and a possibility of near-term recession, there are genuine concerns surrounding the companies with export exposure. In our Little Champs portfolio, there are six stocks where revenues from exports exceed >20% of total revenues (weighted average export revenue share for the portfolio is close to 22%). However, we see limited impacts due to the reasons mentioned in the below exhibit.

- Some mitigating factors that can also help cushion Little Champs’s fundamentals in FY21

- Most of the Little Champs portfolio companies deal in products & services (Financials, auto, pharma, light industrials, retail) where demand may be deferred in a weak economic environment but certainly not cancelled unlike sectors such as media & entertainment. Hence, pent-up demand in such cases can led to a sharper recovery for the Little Champs portfolio.

- Liquidity easing measures by most of the Central Banks globally which has more spending power in the hands of the consumer which can also aid faster recovery when the uncertainty fades.

- A sharp fall in crude oil prices which is positive for earnings of many of our portfolio companies.

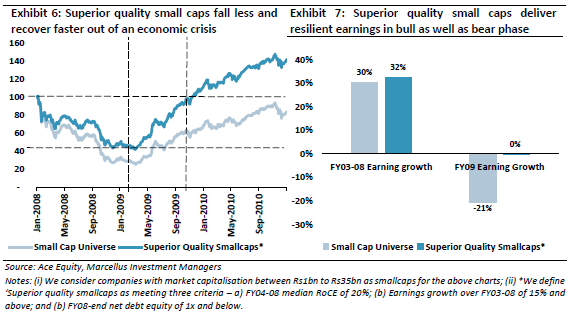

Lessons from the past: Superior quality smallcaps recover faster than the broader smallcaps universe

After a 14-month long fall in the stock market during the 2008 global financial crisis, the market bottomed out on 9th March 2009. As shown in the exhibit below superior quality small-caps (We define ‘Superior quality smallcaps as meeting three criteria – a) FY04-08 median RoCE of 20%; (b) Earnings growth over FY03-08 of 15% and above; and (b) FY08-end net debt equity of 1x and below) recovered back to its pre-crash levels by November 2009 i.e. within 8 months of the market bottoming out in March 2009. This is mainly on account of all the factors explained above on how strong franchises are able to consolidate their position in a downturn, emerge stronger and hence gain disproportionate benefits of a market recovery.

On the other hand, weaker smaller peers get structurally damaged during a slowdown as most of them face existential issues. Similarly, in a market slowdown, a whole host of smallcaps with questionable corporate governance go down the drain. This is suitably demonstrated in the below chart where the broader small-caps universe had not even managed to reach the pre-crisis level by November 2010 (i.e. nearly 20 months from the market bottoming out). Not surprisingly, the BSE SmallCap Index recovered to its January 2008 level in February 2017 i.e. after nearly 9 long years.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.