| Unlike their peers, Little Champs portfolio witnessed a healthy recovery in earnings (EBITDA up 14% YoY) in 2QFY21. More importantly, Little Champs’ net cash position has remained intact through 1HFY21 giving them the firepower to gain market shares from their weaker peers. This month we place the spotlight on Suprajit Engineering which has consistently outpaced the growth of the underlying Indian automotive delivering 17% EPS CAGR with average pre-tax RoCE of 24% over the last ten years. The key drivers underpinning Suprajit’s success are: (i) low-cost focus and locational advantage over MNC peers across products (auto/non-auto cables and lamps) and markets (India, Europe, USA); (ii) prudent capital allocation involving continuous investment in capacities and measured acquisitions complementing its strategic focus on mass volume products for global markets; and (iii) the creation of a scalable organisation through effective delegation of power & responsibilities.

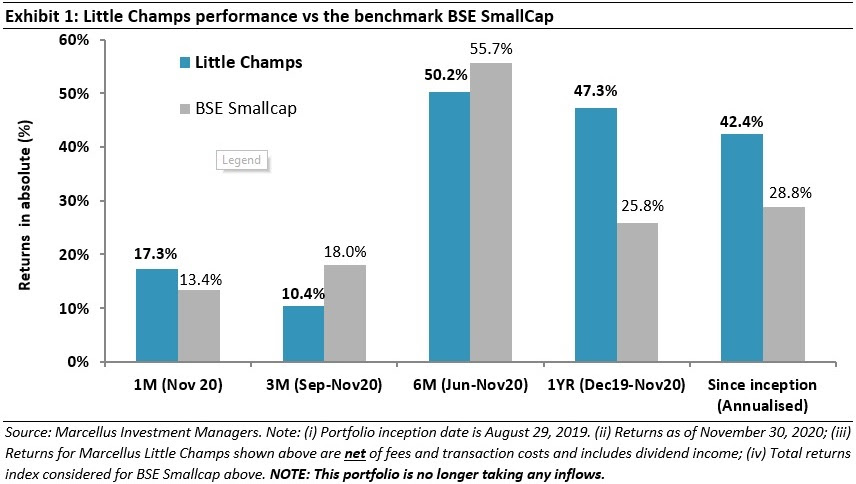

Performance update of the live Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

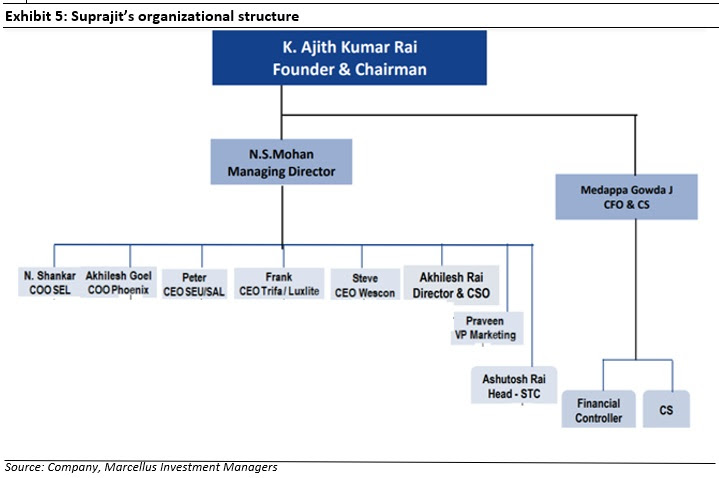

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table:

As expected, Little Champs are emerging stronger out of the crisis

We have been consistently highlighting in our Little Champs’ newsletters (LINK – April 2020, July 2020 and September 2020) that the Covid-19 crisis presents an opportunity for Little Champs to further improve their already strong market position and that they are likely to recover faster and emerge stronger as things start normalising. This was on the back of their strong financials (balance sheet, RoCE) and formidable competitive advantages. This dynamic seems to have started playing out in 2QFY21 as evidenced by the financial performance reported for most of our portfolio companies. On a weighted average basis, the Little Champs portfolio companies posted similar YoY revenues (implying flat revenue growth) and nearly 14% YoY increase in EBITDA. Against this, the broader small-caps universe (ex-Financials) reported, on an average, almost 10% YoY decline in revenues and a much higher 33% decline in earnings. Furthermore, contrary to our expectations of a net cash drain, the Little Champ portfolio on a weighted average basis, were able to sustain their net-cash equity position (0.1x) between March 2020-end to September 2020-end despite operating at sub-optimal levels for 1HFY21. Hence the net result of the crisis is that Little Champs are placed on a relatively stronger wicket compared to their peers.

Going forward, we continue to expect healthy earnings growth for the Little Champs driven by a normalisation in demand across most end-user industries, sustained benefits of cost reduction measures initiated in the last few months and strong balance sheet/liquidity giving them the firepower to further consolidate their market shares.

Garware Technical Fibres – share buyback a step in the right direction

In continuation of minority shareholder friendly measures seen in some of the Little Champs portfolio companies in the recent months (please refer to November 2020 newsletter) for our take on Music Broadcast’s proposed issue of bonus non-convertible redeemable preference shares to minority shareholders and Mold-Tek Packaging’s recently concluded rights issue), Garware Technical Fibres’ (GTF’s) Board of Directors approved a buy-back of upto 1.52% of outstanding equity shares at Rs2,300 per share (which is a 6% premium to the current market price and a ~28% premium to last 6 months average traded price prior to the date of buy-back price announcement). At full subscription, this buyback would result in a total cash outflow of ~Rs730 mn. GTF already has net surplus cash of close to Rs3,730 mn as at September 30, 2020. Hence, despite returning the above amount back to shareholders, the net cash position would continue to remain healthy. Moreover, GTF operates an asset light business model with low capex intensity and lean working capital, hence internal cash accruals are expected to continue adding on further to the existing cash balance. In the absence of any significant opportunity, returning money to the shareholders is one of ideal measure to enhance shareholder value and we believe GTF has taken the right step.

Stock in the spotlight: Suprajit Engineering

“Globalisation not only makes even the narrow markets large, it further contributes to growth in profits through economies of scale. The foundation for the success of this strategy is that customers in the same industry tend to have similar needs across countries. Hence, it is better to expand regionally in a narrowly defined market than to enter different markets in the same region” – Hermann Simon in ‘Hidden Champions of the 21st Century’

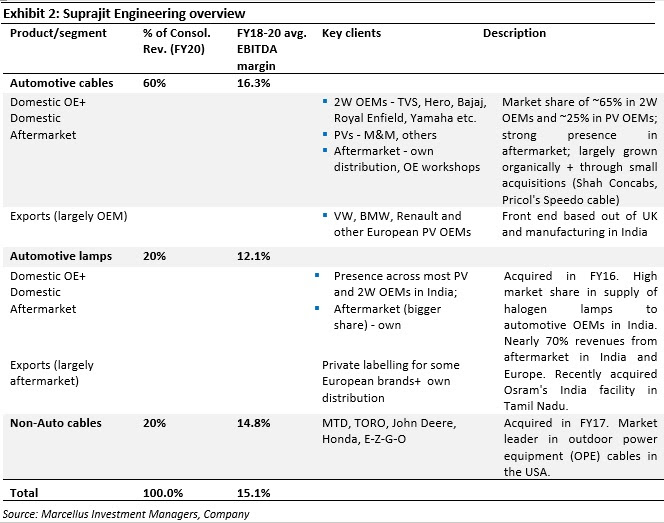

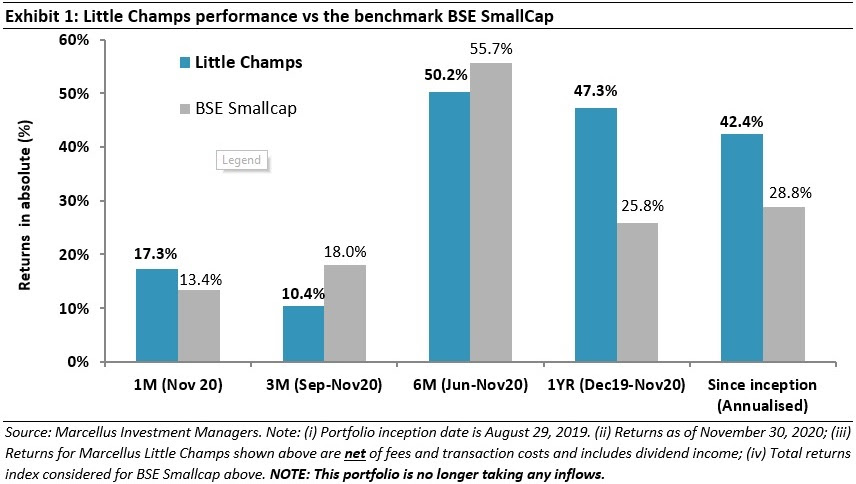

Company background: Suprajit Engineering (Suprajit), promoted by Mr Ajith Kumar Rai, started as a single-product supplier (mechanical control cables) to a single client (TVS Motor) in 1985. Over the years, Suprajit has emerged as the largest supplier (market share of ~65%) of mechanical cables to the domestic 2W segment, enjoying high share of business across all major 2W OEMs. It has also emerged as a significant supplier to domestic passenger vehicle (PV) OEMs with a rising revenue share from aftermarket and exports (primarily global PV players). A key part of Suprajit’s growth strategy in the recent years has been acquisitions. This has not only helped strengthen its core automotive cable business (through the acquisitions of Shah Concabs and Pricol’s Speedo cables which helped the firm gain footholds in the CV and PV segments respectively) but also helped diversify into newer products such as automotive headlight lamps (Phoenix Lamps) and the non-auto segment (US based Wescon Controls).

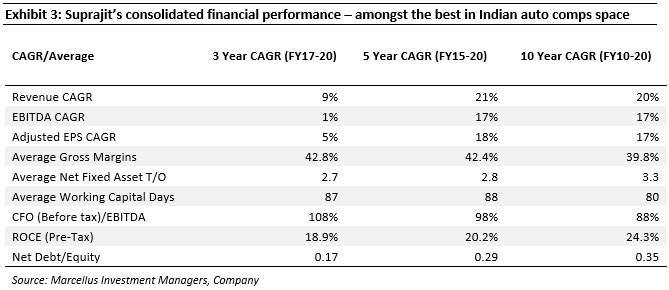

Financial performance: Suprajit has delivered healthy financial performance over the years with its revenues consistently outpacing the growth of the underlying Indian automotive market. The company also has been able to generate healthy margin and RoCEs and is one of the few auto component companies to do so on a consistent basis. Further, in the context of the sharp decline in automobile sales over FY19 and FY20 and despite some negative impacts of restructuring efforts at Phoenix Lamps and Wescon, Suprajit’s earnings CAGR of 5% and average RoCE of 19% over FY18-20 stands out in the Indian auto component space.

|

|

Key success factors for Suprajit

A. Clear cost advantages over its peers

Suprajit has as well-thought strategy/vision of emerging as a global leader in all its product lines i.e. automotive cables, automotive lamps and non-automotive cables. The key to achieving this leadership is to be an efficient low-cost supplier of these products while meeting the customer expectations on quality, delivery and designs.

- Low-cost culture within the organisation: Suprajit has imbibed a low-cost culture within the organisation by making it an important part of performance evaluation and incentivisation. For instance, the company has a rigorous budgeting exercise wherein the budgets are decided by the plant manager with an endeavour to better the previous year’s performance/targets. The Plant manager’s KRA considers not only the plant output but the P&L (productivity, profitability) of the plant also (in effect, the plant manager is evaluated as a business manager). The chief operating officers (COO) of different businesses (such as automotive cables, automotive lamps, etc) are responsible for the overall performance (including profitability) of the division. The top management maintains a tight control on plant level productivity through monthly reviews. Such a culture of empowerment as well as responsibility has gone a long way in inculcating a frugal operating environment within the company.

- Indian manufacturing base provides locational advantage over its MNC peers: Across all the key businesses, Suprajit’s major competition is from MNC peers in both Indian and global markets. In this regard, Suprajit enjoys some inherent cost advantages as below:

- Automotive cables: In case of the domestic automotive cables, while the largest competitor, a Japanese supplier has a plant in India, it suffers from high costs due to presence of large number of high paid Japanese expats as well as high overheads. Similarly, in export markets for automotive cables, Suprajit supplies from India which gives it a strategic low-cost edge over most Japanese and Korean competitors.

- Automotive halogen lamps: Similar to the automotive cables business, Phoenix Lamps (which houses automotive lamps) mainly competes with Osram and Phillips in auto lamps in both Indian as well as European markets. Osram and Phillips now have limited manufacturing capacity in India (in fact, Osram has now sold its only Indian plant to Suprajit/Phoenix in 2019) and supply from their global locations in both India as well as European market, placing them at a cost disadvantage vs Phoenix Lamps.

- Non-automotive cables: Like the above two businesses, Wescon post acquisition by Suprajit now has access to the Indian plants of Suprajit (in additions to its legacy US and Mexico plants). This gives it significant cost advantage versus US/European peers in the non-auto space (such as Leoni).

B. Prudent Capital allocation

- Continuous investment in manufacturing capacities: Suprajit has been proactive in expanding its cable manufacturing capacities leaving little room for its peers to benefit from the market growth. In the last ten years itself, it has organically tripled its cable manufacturing capacities (without accounting for the new additions from the Wescon acquisition) reinvesting nearly 40% of its standalone cashflows in capex (excluding the acquisitions). Besides the increase in overall cable manufacturing capacities, there are two other dimensions to Suprajit’s organic expansion strategy:

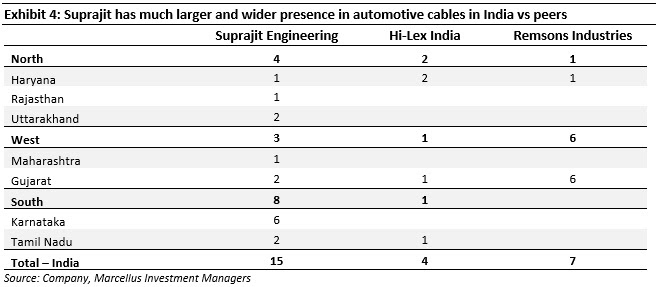

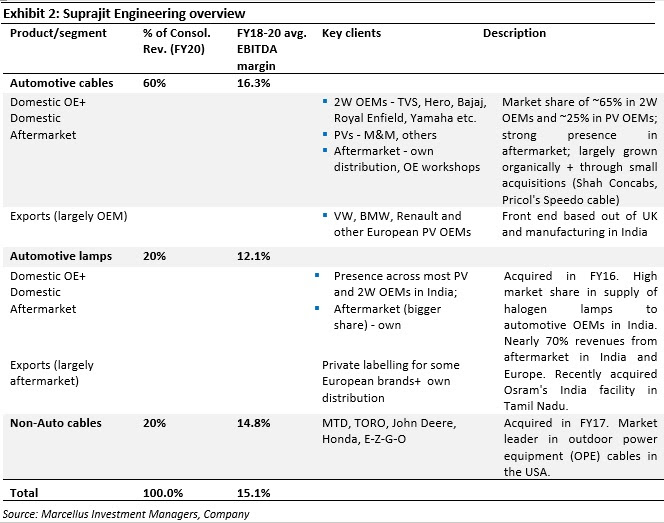

- Getting closer to the clients : Suprajit has also focussed on having a multi-locational presence closer to the key customers which gives it enormous competitive advantages. It enables close interactions and involvement of the onsite design/development team with OEM customers, aiding both shorter response time for product development, customising requirements and getting entrenched in the OEMs’ supply chain ecosystem. Today, Suprajit has a significantly higher number of plants compared to peers in the domestic cables in India as shown in the exhibit below:

|

|

- Indian capacities for the global markets: In line with the Company’s strategy of being the low-cost supplier of its products, the Company has also focussed in setting up/ramping up its India capacities to cater to the global markets. For instance, it recently commissioned a new plant in Doddaballapur Industrial Area (Bengaluru) in December 2019 for cater to automotive cable export markets.

- A measured inorganic growth strategy playing to its strengths: Suprajit has made around five acquisitions in its history. The first three acquisitions were largely to diversify its customer base, increase presence in new vehicle categories and get into new geographies but all three were related to the automotive cable business and were relatively small in size: (i) Shah Concabs acquired in FY03 was used to diversify into commercial vehicle cable business; (ii) acquisition of CTP Gills (later renamed Suprajit Europe Limited) in 2007 was to get a foothold in export markets; and (iii) acquisition of Pricol’s Speedo business in 2015 was to strengthen Suprajit’s presence in the passenger vehicle space.

However, over the last five years, Suprajit has made two relatively larger acquisitions outside of its core automotive cable business:

- It acquired Phoenix Lamps (a listed company then), a leader in automotive halogen lamps in FY16 – valuing the entire transaction at Rs2.72bn – Rs1.54bn paid for acquiring 61.88% stake from private equity firm Actis and the balance stake valued at Rs1.18bn through open offer and Suprajit shares swap to Phoenix’s minority shareholders; and

- Acquisition of 100% stake in US-based Wescon Controls, a leading supplier of control cables to the outdoor power equipment and certain other non-auto segments in USA for Rs2.75bn in FY17.

While Phoenix Lamps and Wescon Controls were relatively large acquisitions, we believe Suprajit took measured/prudent financial risks in the acquisitions due to the following reasons:

- Though outside of the automotive cables business, the acquisitions were in-line with the company’s strategy of pursuing mass volume products for global markets where Suprajit can leverage its low-cost structure and operational efficiency strengths. In fact, Wescon’s cables business, albeit non-auto, is largely an extension of the automotive cable business.

- Suprajit’s pursued these acquisitions after reaching a reasonable size (Suprajit’s consolidated networth stood at Rs2.42bn at FY15-end), healthy cash generation levels in its core automotive cables business (Rs670 mn in FY15) and comfortable debt-equity levels (0.3x at FY15-end). While Suprajit could have funded the Phoenix acquisition through cash plus some incremental borrowings, it raised a QIP of Rs1.5bn in February 2016 to keep the debt-equity under check.

- Phoenix and Wescon were not distressed companies. In fact, they were relatively profitable and cash generating franchises at the time of their acquisitions. For instance, Phoenix Lamps’s free cash flow averaged Rs152 mn for five years (FY11-15) prior to its acquisition in FY16 by Suprajit. Similarly, Wescon generated free cash of US$3.5 mn in year ended October 2016 before its acquisition by Suprajit. Hence, both these entities had sufficient internal cash generation to take care of their future investment needs and not were not likely to depend on automotive cables’ cash flows.

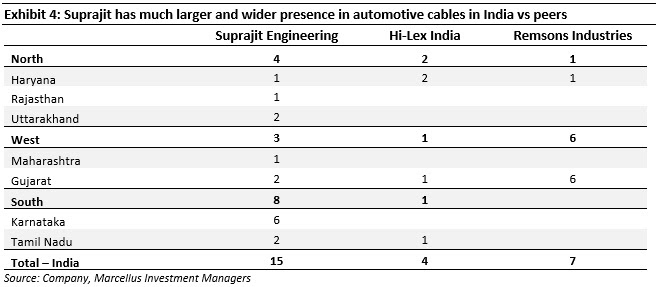

C. Building management bandwidth allocation to build a scalable organisational structure

Sufficient integration of acquisitions and managing business with diverse geographical footprint require efficient allocation of management bandwidth. Suprajit has been successful in this regard through retaining existing management of acquired entities as well as making changes when required.

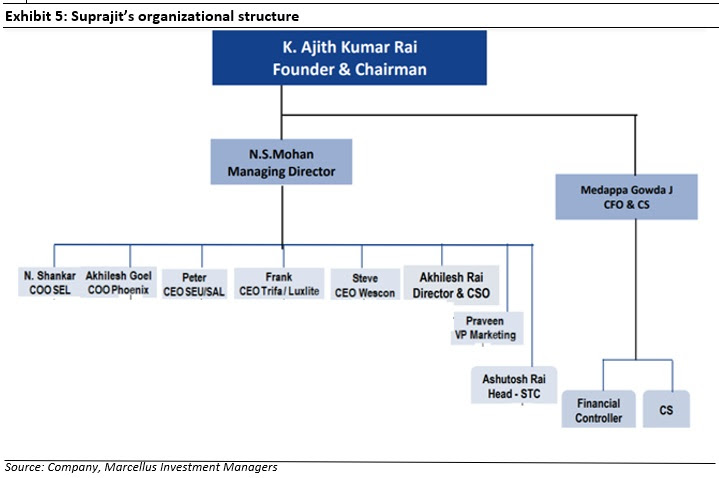

Over the years, Ajith Rai has successfully delegated powers & responsibilities over the years which has helped scale the business across multiple products and geographies. N S Mohan (non-promoter) has been appointed the Managing Director and Group CEO and he is responsible for all the operational matters including the subsidiaries. There are chief operating officers for key business such as domestic auto cable, export auto cable, Phoenix Lamps India, Phoenix Lamps Europe and Wescon who all report to N S Mohan. Mr Rai’s sons Akhilesh and Ashutosh work in the company and report to N S Mohan. Akhilesh Rai looks after the strategy including new integration of acquisitions, improvement programs and IT initiatives whereas Ashutosh Rai is in charge of Suprajit Technology Centre focussing on new products, R&D, etc. Besides, the company has also launched an Employee Stock Appreciation Rights for high performing employees which can also help in talent retention.

|

|

Key risks

- Impact of LED on automotive lamps business: The adoption of LED is gaining prominence in automotive lighting and hence presents risks to the halogen lamps business of Phoenix. LED adoption has reached around 20-30% levels in the new vehicle sales in the 2W and PV segments. Phoenix current does not have a presence in LED technology nor does it seem to be a key focus area for the Company. However, we see limited impact of LED adoption on Phoenix because of the following reasons:

- Phoenix derives around 70% of its revenues from the aftermarket segment. In other words, the key target segment for Phoenix in India and Europe is the existing population of cars with conventional lighting (which makes use of halogen lamps). It will take significant time(many years) before LED reaches any meaningful level in the total car population and starts impacting the halogen lighting pie.

- Key strategy of Phoenix is to gain market share in halogen aftermarket. While it has a market leadership in India, its market share is miniscule in Europe. Hence, even if the overall pie of halogen aftermarket lamps does not grow or starts shrinking, it should be mitigated through gain in market share.

You want to read the notes we have published so far on the other stocks in the Little Champs portfolio at the following links: Garware Technical Fibres (August 2020), GMM Pfaudler (September 2020), V-Mart Retail (October 2020) and Alkyl Amines (November 2020).

|

|

|

|

|

|