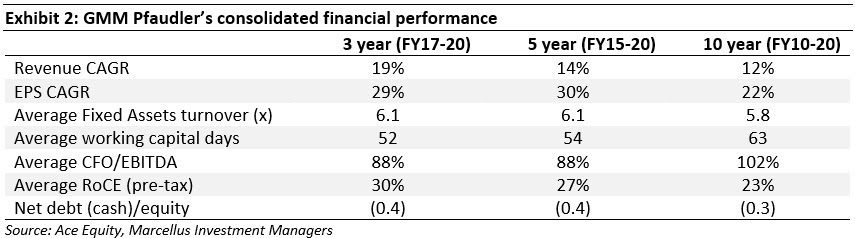

| As expected, 1QFY21 was a tough quarter for the earnings of most Little Champs portfolio companies. However, management commentaries pointed towards several positives on demand recovery, cost reduction measures and market share gains – all pointing to a healthy recovery in earnings over the coming quarters. This month, we place the spotlight on GMM Pfaudler, the undisputed market leader in the supply of glass-lined equipment to the domestic pharma & chemical industries. The key success factors for GMM have been access to parent Pfaudler’s technology, long-standing customer relationships and the scale benefits. GMM has announced two big-ticket acquisitions: of De Dietrich’s Indian facilities and then of Pfaulder’s International operations. Our analysis of the impact of these acquisitions on GMM’s debt levels/cash flows and its past track record of successfully integrating Mavag makes us confident of significant value accretion from these acquisitions.

Performance update of the live Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector-leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

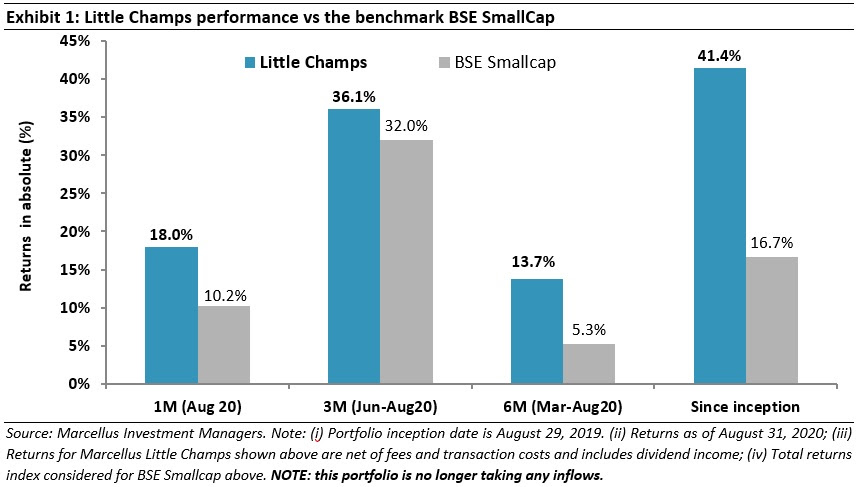

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Portfolio update – a new addition to the portfolio

We have added Fine Organic Industries to our portfolio. Fine Organic is the largest manufacturer of oleochemical-based niche additives in India. It is among the five largest global players in polymer additives and among leading global players in specialty food emulsifiers. Fine Organic’s product portfolio comprises of over 400 products including food additives, polymer additives, emollients for cosmetics, additives for rubber & elastomers, etc. Although the volume of additive used in end products is low, these are very critical in imparting the requisite properties to the products which gives Fine’s products ready buyers. Further, Fine’s in-house developed technology, processes and solution-based approach to customers has led to long standing relationships with most clients and also created strong entry barriers for competitors. The shift from synthetic chemicals-based additives to oleo-chemicals based additives is also a growth generator for the company. Fine’s management has been conscious about increasing the composition of value-add products in its mix of portfolio ad has been prudent in capital allocation. While Fine Organic’s revenues have grown at 11% CAGR over the last 7 years, its earnings have grown at a 34% CAGR during this period and the average pre-tax ROCE has been 38%.

Some silver linings from the 1QFY21 management commentaries

1QFY21 as expected was a tough quarter…

As expected 1QFY21 was a forgettable quarter for most of the portfolio companies. On allocation-weighted basis, portfolio companies witnessed YoY revenue decline of ~40% and net earnings decline of about 54% (one portfolio company i.e. Garware Technical Fibres is yet to report its 1QFY21 results). The YoY revenue fall was the sharpest in the case of auto ancillary stocks. The auto companies endured one of the worst ever quarterly production volume declines due to crippling lockdown in their own plants as well as disruptions in the vendor supply chains. While muted, the 1QFY21 performance has however been along the expected lines.

…however, management commentaries pointed to a brighter future

A. Clear signs of demand recovery across a large part of the portfolio

- Companies exposed to pharma, chemicals recovering very fast as expected: The portfolio stocks catering to the pharma companies, agrochemicals, food and personal care industries witnessed a resilient performance in 1QFY21 (the median YoY revenue decline was only 4% despite having no production in the month of April 2020). Further, the management commentaries of these companies suggest a significant normalisation in the operations as the demand for these industries continue to be resilient.

- Demand for Automobiles specially 2Ws & passenger vehicles clearly on a recovery mode: As highlighted above, 1QFY21 was an especially weak quarter for auto ancillary companies. However, there was a near unanimous indication from the management that the demand for the auto sector (particularly 2Ws and value cars) is clearly on the mend since June 2020. This is also corroborated by the August 2020 volumes reported by the auto companies in wherein domestic sales of 2W companies (for top 6 companies), Passenger Vehicle manufacturers (Maruti & Hyundai) and tractor makers (3 of the top 4) witnessed aggregate YoY growths of 3%, 20% and 73% respectively. In fact, the demand trend is expected to accelerate as we head into the festive season lasting over the next few months.

- Some greenshoots in the Financial Services sector: Both the lenders in our portfolio indicated some greenshoots in the form of improving collection efficiencies, decline in moratorium levels and increased disbursements in specific sectors where they have increased visibility on demand such as home loans, auto loans, etc.

B. Cost reduction efforts may yield long term benefits

- As indicated above, the portfolio companies witnessed revenue decline of ~40% YoY and net earnings decline of ~54% in 1Q FY20. The decline in the net earnings would have been much sharper but for the cost reduction measures taken by almost all the portfolio companies. On a weighted average basis, the portfolio companies recorded 30% YoY decline in the ‘non-material’ costs (a significant portion of which would be fixed costs like employee salaries). Besides the obvious savings in the travel costs due to the lockdown restrictions, most companies found an opportunity to take at a hard look at their cost structure resulting in a reduction in discretionary overheads, employee layoffs, salary cuts and introduction of a more variable component in salaries. Most companies hinted that some part of the cost reductions would continue to sustain even as the revenue normalises. This augurs well for the longer-term margin of the portfolio companies.

C. Early signs of market share consolidation

As highlighted time and again in our earlier newsletters, one theme which we believe would benefit most of the Little Champs is the opportunity to consolidate their market share from weaker peers. Our belief is predicated on the strong balance sheets of the Little Champs (most portfolio stocks have net surplus cash on their balance) and their strong RoCE/operational cash generation profile which is not the case for the most of their peers. We saw specific instances of these in a few of our portfolio stocks:

- On June 30, 2020, GMM Pfaudler announced that it has agreed into a binding agreement with De Dietrich India (DDPS India) for the acquisition of the latter’s sole Indian manufacturing facility located in Hyderabad. DDPS has been in India for a number of years but has not been able to scale up the operations meaningfully. At the time of announced acquisition, DDPS India’s revenues accounted for less than 20% of GMM’s revenues with an operating loss. We see enormous benefits to GMM from this acquisition in the form of: (i) Opportunity to establish a dominant position in the South Indian pharma belt (except for the acquired DDPS India, there is only one competitor in south India, HLE Glasscoat, which has a manufacturing facility in this region); and (ii) Ready access to DDPS India’s staff and clients who would have taken several years to cultivate had GMM set up its own greenfield facility in south India (that plan has now been scrapped). We see significant boost to GMM’s already high market share in India from this acquisition.

- Suprajit’s management in the 1QFY20 results call indicated that their US non-cable business is benefitting from additional customer orders due to a key competitor going through financial stress.

- Mold-Tek Packaging’s management have been indicating in the recent quarterly calls that post Covid-19 their market share with key customers like Asian Paints have witnessed an increase [although it remains to be seen whether the increased market share will sustain].

Overall, we continue to believe that market share gain would be an important driver of growth for most of the Little Champs over the next 2-3 years.

Stock in the Spotlight: GMM Pfaudler

As stated earlier, will be communicating our detailed investment rationale on each of our portfolio stocks on a periodic basis. This month we detail our investment rationale for GMM Pfaudler.

Company Background: GMM Pfaudler (GMM) is a JV between Pfaudler Inc (50.4% stake) and the Ashok Patel family (24.6%). The Patel family started the Company in 1962 as Gujarat Machinery Manufacturers (and hence the abbreviation GMM in the Company’s name). Pfaudler Inc became a shareholder in 1987 and stepped up its stake to 51% in 1999 becoming the majority shareholder. Pfaudler Inc is a 130-year old Company, founded by the inventor of the process of the glass-lining of steel. Glass-lined equipment is a necessity in industries such as chemicals, pharmaceuticals, food and beverages etc., where the production process requires equipment with corrosion resistance or cleanliness properties.

After changing hands multiple times over its history, Pfaudler was until recently controlled by a German Private Equity Group, DBAG. While GMM is headed by Tarak Patel (Ashok Patel’s son) as the Managing Director since June 2015, Pfaudler is represented through 2 directors on the Board of GMM (with 2 directors representing the Patel family). In a reorganisation of the Pfaudler Group done recently, GMM acquired a majority stake (54%) in the global business (ex-India business of Pfaudler) from DBAG (whose stake came down from earlier 100% to now 20% post the transaction). The shareholding in the India business i.e. GMM, remains unchanged, with DBAG retaining a majority 50.4% stake.

Key success factors for GMM:

- Technology edge: The quality of glass-lining is a key differentiator in this business for two reasons. The first is that the end-products made by customers need to have very specific chemical properties and there can be no compromise on the purity of these products during production process. Secondly, chemical reactions tend to corrode the reactor vessels, and poor quality of glass-lining would mean more frequent replacement/refurbishment of the reactors thus increasing the cost for the customers. GMM’s majority ownership by Pfaudler gives it a clear technology edge – and a critical competitive advantage – in the Indian market. Pfaudler is the inventor of glass-lining technology and has continued to set the bar for innovation and advancements in the industry globally. For example, they have developed Pharma Glass, a patented enamel specifically for the production of active pharma ingredients (APIs), vitamins etc., which is now the global standard for the user industry. With over 20% global share in what is largely an oligopolistic market, Pfaudler is only likely to strengthen its position going ahead. This augurs well for GMM too, as it continues to have access to best-in-class technology, an attribute essential to the business.

- Long-standing customer relationships: GMM Pfaudler has been operating in India for close to five decades and has been a credible supplier to most of the large Indian companies in the pharmaceuticals, chemicals, and petrochemicals sectors. By leveraging its technology edge and supplying high quality reactors, GMM has won repeat orders on a recurring basis and built long-standing relationships with all its key customers. Some customers in the pharma/chemicals space we spoke to indicated that GMM is their first choice in procurement of glass-lined vessels and that has been the case for many years. GMM accounts for over 90% of the installed equipment base of these companies. The only time they have considered other suppliers is when their requirements were urgent and GMM, being flush with orders, had a slightly longer delivery schedule. With GMM adding capacity at its Gujarat plant, it is likely to become the default supplier for these customers again.

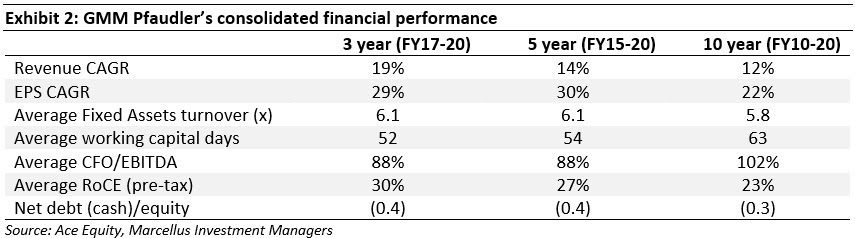

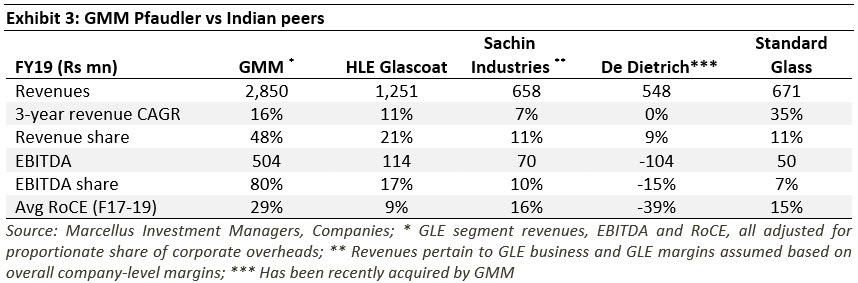

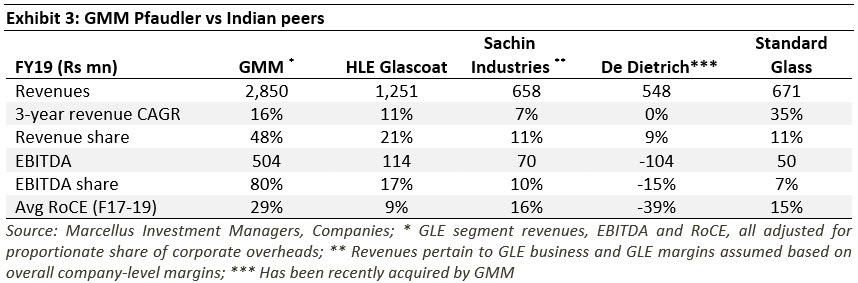

- Scale benefits: GMM is the largest glass-lined equipment maker in India by a wide margin. Using their technology edge and leveraging on their execution skills and local customer relationships, GMM has expanded capacity by 50% in the last 3 years. The company now has more than twice the revenues of the second-largest player and has a 48% overall share of industry’s revenues. The dominant market share leads to substantial scale benefits, which translates into better profitability. GMM’s EBITDA margins are nearly double of its nearest competitor and so is its RoCE. The significance of the scale advantages GMM has built is reflected in its dominance of the profit share of the industry – over the period FY16-19, GMM earned 80% of the industry’s EBITDA.

|

|

|

|