Life Insurance works on the concept of pooling of risk where policyholders come together and pool small amounts of money (premium) to cover those who might need the money in the event of a death or a debilitating disease. This premium paid by policyholders is invested to pay for claims which might arise in the future. The investment income and premiums collected should exceed the eventual claims and operating expenses for a life insurer to generate profitability. While life insurance in India has been synonymous with LIC, private companies have made rapid progress since the sector was opened up in 2000. HDFC Life was the first private life insurer to launch operations in India. Its differentiated strategy of maintaining a balanced product mix and distribution mix along with a focus on technology and product innovation has delivered consistent market share gains (private life insurance market share of HDFC Life has increased from 8.7% in FY10 to 21.5% in FY20). We explain now how life insurance works and why we hold HDFC Life.

Performance update of the live fund

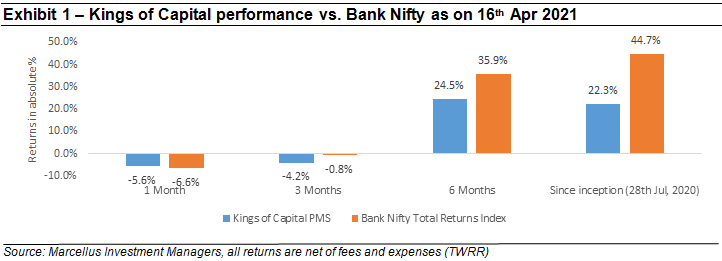

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

HDFC Life is one of the four savings plays in the Kings of Capital portfolio. Given the complexity of the insurance sector, we have tried to first simplify the life insurance business and then explain why we hold HDFC Life in the portfolio.

HDFC Life is one of the four savings plays in the Kings of Capital portfolio. Given the complexity of the insurance sector, we have tried to first simplify the life insurance business and then explain why we hold HDFC Life in the portfolio.

Evolution of the life insurance industry

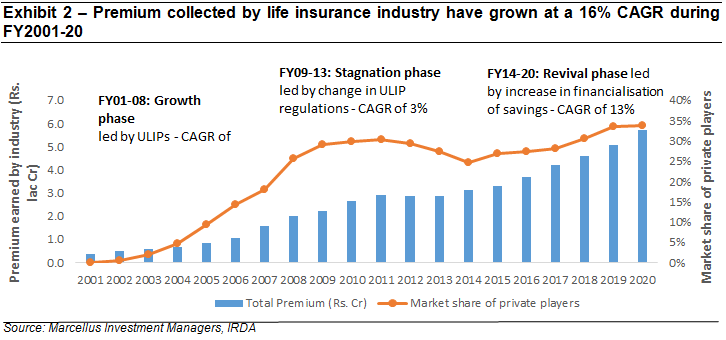

The Indian life insurance industry is relatively nascent, and its evolution can be described in three distinct phases:

(i) Phase 1 (2001-08): The Indian life insurance industry was opened up to private players in 2000 and during this period the private players flourished due to strong growth led by ULIPs.

(ii) Phase 2 (2009-13): ULIP regulations were tightened in 2009-10, which led to a phase of low growth and stagnation for the life insurance industry. The regulatory changes which were introduced during this period were – (a) ULIP lock-in period increased to five years from three years, (b) an even distribution of charges during the lock-in period to ensure that front loading of expenses is eliminated, (c) minimum premium paying term of five years for all ULIP products except single premium products, and (d) all ULIPs needed to provide a minimum mortality cover or a health cover thereby increasing the risk cover component in such products. Owing to these changes, the private life insurance industry which was growing rapidly on the back of ULIPs slowed down during 2009-14.

(iii) Phase 3 (2014 onwards): The life insurance industry saw a resurgence post 2015 as the focus of private life insurers gradually started to shift towards protection and other higher margin products.

Bank backed players benefiting by leveraging the distribution network of parent/ group companies

Bank backed players benefiting by leveraging the distribution network of parent/ group companies

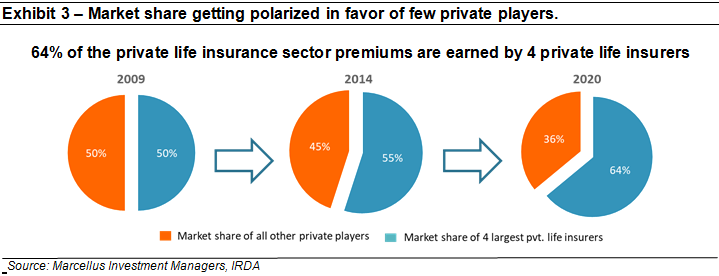

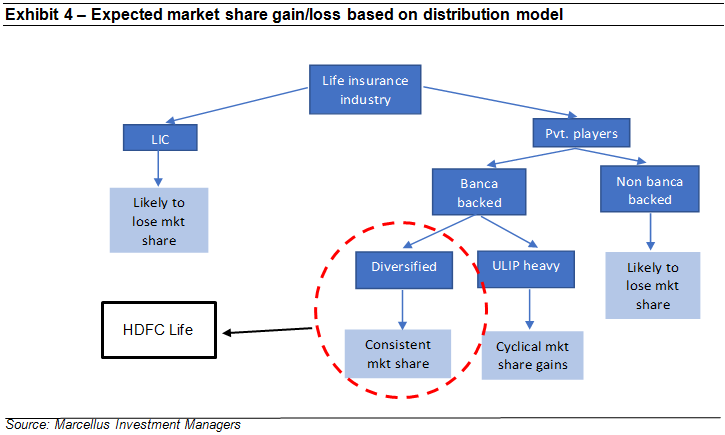

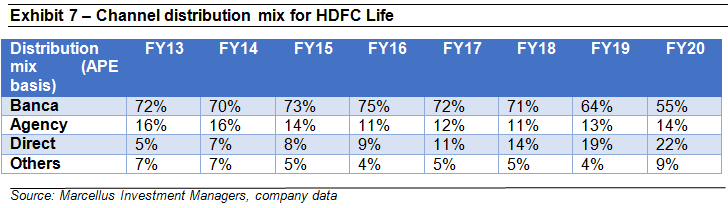

The life insurance business requires a large distribution footprint. The private life insurance industry started with the agency distribution model (a distribution channel wherein an independent certified agent sells insurance products on behalf of an insurance company against commission for all policies sold). Then as capital started becoming a constraint and new regulations made the agency channel less profitable, the industry moved towards the banca channel i.e. use of bank branches to sell life insurance products. Bank owned life insurers have a readymade low-cost distribution network available to them in the form of their parent’s bank branches. This is a massive advantage for them and has led to market share gains for banca backed players vs. non banca backed players in the private life insurance industry (see Exhibits 3 and 4).

Overview of the life insurance business

![]()

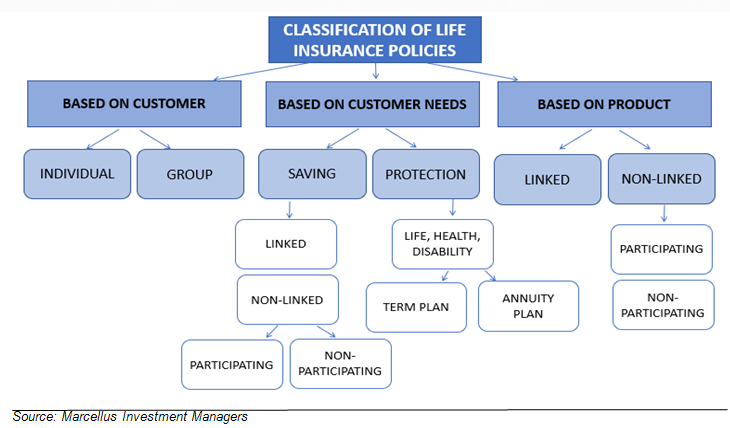

Life insurance policies can be primarily divided into the following categories:

1. Participating Policies – With this policy, the policyholders participate in the profits of the underlying investment pool during the term of the policy. Here, the profits earned are shared in the form of bonuses or dividend. The key benefit of the participating policy is that it provides protection as well as returns in the form of bonuses/dividend.

2. Non-Participating Policies – In this policy, the policyholder receives a guaranteed payout at fixed intervals and assured cash flows. Unlike participating policies, the policyholders do not participate in any upside.

3. Term insurance – Term insurance policies are the purest form of life insurance cover. The policy promises a fixed payout in the event of death during the term of the plan.

4. Annuities – Insurance products that guarantee a stream of fixed periodic cash flows at equal intervals over the balance life of the policyholder. This is in return for either a lumpsum upfront premium or periodic premiums for a fixed duration before annuity payment begins. Annuities are a good retirement planning tool.

5. Linked Policies – Linked policies combine mutual funds and insurance in one product. Here, the value of a policy varies according to the current net asset value of the underlying investment assets. The premium paid is used to purchase units in investment assets chosen by the policyholder and provides protection benefits as well.

What differentiates HDFC Life from other private life insurers?

HDFC Life differentiates itself from the other private life insurers because of the following:

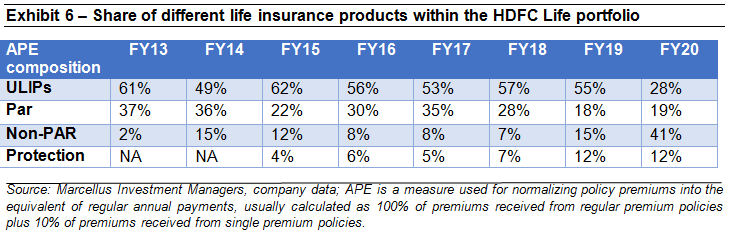

(i) Diversified product mix and distribution mix: HDFC Life has the highest margins (26% new business margins i.e. the profit margin on new policies issued during a period) due to a superior product mix which has relatively low reliance on ULIPs. As the Indian life insurance industry matures, the contribution of ULIPs to the profitability and revenue of life insurers will substantially reduce as insurance companies and consumers move towards protection and annuity-based products. A diversified product mix and distribution mix also helps HDFC Life tackle the cyclicality of capital markets and changes in the regulatory and macro environment. Exhibit 6 below illustrates how HDFC Life has gradually reduced its reliance on ULIPs over the years.

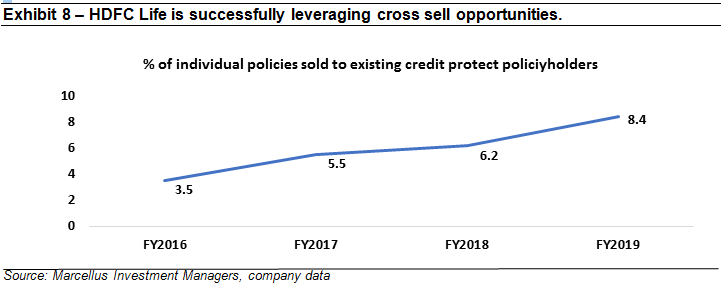

(ii) Cross sell opportunity: HDFC Life has tied up with 270 partners (Micro finance Institutions, Small Finance banks, banks) for selling credit protect policies (designed to pay off a borrower’s outstanding debts if the borrower dies). The customer data from these partnerships is now being used to cross sell other insurance products. Exhibit 8 below shows that now over 8% of total individual policies are sold to existing credit protect customers.

(iii) Open architecture at HDFC Bank: HDFC Life has a diversified distribution mix and is not over reliant on one specific channel. Unlike the other large life insurers, HDFC Life is not owned directly by a bank and while HDFC Bank is a group company, all transactions between the two companies are at an arm’s length basis. Even though HDFC Bank has already onboarded and distributes policies of other life insurance partners, HDFC Life continues to retain its market share within HDFC Bank. As a result, if the mooted regulations around reduction of ownership by banks in life insurance companies do get implemented, it will not affect HDFC Life. In contrast, most other large banks who continue to distribute life insurance policies of only their group companies are far more vulnerable in the face of such regulatory change.

(iv) Leader in product innovation, marketing, and technology: HDFC Life made pure protection, guaranteed products and lately, annuity products popular through their attractive value proposition and smart marketing. While its tie up with HDFC Bank gives it scale, none of HDFC Life’s products are channel monopolies. At the heart of this flexible model is its early investment in technology which is moving beyond being just a business enabler to being a driver of business decisions. While products can be copied, the DNA of being first to market with a new product has become a part of HDFC Life’s culture. HDFC Life’s constant knack of innovating and its smart marketing differentiate it from other insurers.

Understanding Embedded Value

Life insurance policies are long term contracts, as policyholders continue to pay premiums for several years into the future, the performance of life insurance companies is better measured by embedded value rather than accounting profitability. The embedded value (EV) represents the sum of present value of all future profits from the existing business and shareholders’ net worth. The components of Embedded value are:

· Adjusted Net Worth: it represents the market value of assets attributable to shareholders and is usually the shareholders’ funds as shown in the audited financial statements adjusted to bring shareholder assets to a market value basis, net of tax.

· Value in force (VIF): Value in force is the discounted value of future expected post-tax profits from the business which has already been written. It includes anticipated renewals of the in-force business but excludes any value relating to future new business.

HDFC Life’s embedded value has grown at 19% CAGR over FY15-20 which signifies that HDFC Life is underwriting profitable business.

Financials of Indian life insurers understate true profitability.

The profitability of Indian life insurers is understated because of two reasons:

· Frontloading of customer acquisition expenses and reserving/ new business strain: Indian life insurers are not allowed to amortise expenses incurred to acquire the customer over the life of the insurance policy. As a result, while the premium income is earned over a period of time, the customer acquisition expenses are debited to the P&L in the year of acquisition itself. Given that life insurance policies are long term in nature and extend to more than 20 years in many cases, upfronting of expenses for revenues which will be accrued over the next twenty years substantially understates accounting profitability of life insurers.

· Booking of unrealised mark to market gains/losses not allowed: Indian life insurers are not allowed to book unrealised gains/losses from non-linked shareholder and policyholder funds. While some years will have unrealised mark to market gains which will increase adjusted profitability, some years will also have unrealised losses. Amongst the large life insurers, HDFC Life has the least exposure to equity (~10% vs. 15-20% for the other large life insurers) on its non-linked funds and therefore even the adjusted profitability is less volatile for HDFC Life.

We believe that HDFC Life’s profitability adjusted for the above two factors is twice its reported profitability. As a result, HDFC Life’s adjusted P/E multiple is also half of the P/E multiple calculated on reported PAT.

In addition to being a high-quality life insurer, life insurance as a business is likely to have a relatively low correlation with the lenders in the Kings of Capital Portfolio

During FY21, the Indian lending industry has struggled with asset quality issues and balance sheet stress due to Covid-19 induced lockdowns. However, during this time the awareness for life insurance has increased and HDFC Life has grown premiums at 16% YoY during the first nine months of FY21. While life insurers do not have a long history of being listed in India, the past year has shown that even though insurance and lending are a part of the larger financial services universe, the balance sheet structures, and business models of insurers and lenders are quite different and uncorrelated to each other. This low correlation between the savings plays and lenders in the Kings of Capital portfolio act as a natural hedge and reduce the portfolio’s volatility.

Note: HDFC Life is a part of many of Marcellus Investment Managers’ portfolios.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.