In this newsletter we discuss the evolution of the Financial Services sector in the US and UK and in that context, highlight the implications for Indian investors. Between 1990-2020, the weight of Financial Services stocks in the S&P500 index has increased from 7% to 11%. However, a closer look at the composition of Financial Services stocks shows that the weight of diversified Financial Services (payment companies, asset managers, investment bankers, brokers, etc.) in the S&P500 increased from 1.5% in 1990 to 5% in 2020 while the weight of insurers and banks has largely remained unchanged. A similar trend of diversified financials gaining importance has also played out in the UK. If we were to compare this to India – Financial Services stocks constituted 10% of the BSE500 index in 2001 vs. 25% in 2019. Unlike the Western economies, who have witnessed a gradual decline in the weight of banks in the bellwether indices post the Global Financial Crisis, India has seen a steady increase in the weight of not only the Financial Services sector but also banks in the BSE500. This has been due to the remarkable rise of private banks and diversified financials which now cumulatively account for 22% of the PAT of the BSE500 index vs. only 4% in 2001.

Performance update of the live fund

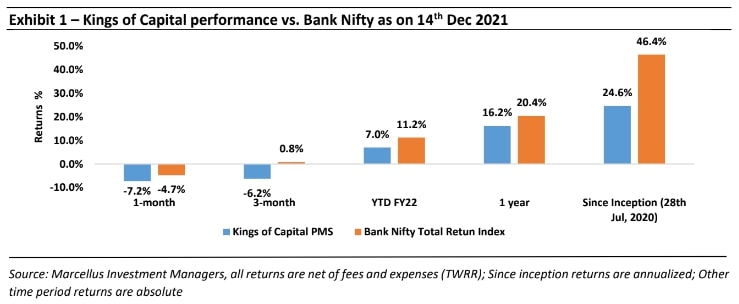

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Evolution of Financial Services in the United States – a tale of two eras

The evolution of the modern American Financial Services industry can be split in two phases:

(i) The pre-Global Financial Crisis era: Banks were able to earn high fee income and high investment banking income and suffered low loan losses prior to the Global Financial Crisis. During the 1990s and the early 2000s banking remained a highly profitable business with a few players earning super normal returns on equity as illustrated in the table below.

(ii) The post-Global Financial Crisis era: In the aftermath of the Global Financial Crisis, the Government and regulators saw the need for banking systems to be more transparent, more liquid and less leveraged. Apart from heavy fines and increased regulations for American banks, there was also an increase in the Tier-1 capital requirements. As illustrated in the table below, the combination of tighter regulations and lower leverage resulted in lower profitability and diminished return on equity for American banks in the post-GFC era. The downfall of American banks also coincided with the rise of diversified financial services players including payment companies, asset managers and, more recently, fintech players. While traditional powerhouses such as American Express, Visa and Mastercard have continued to grow profitably, there have also been other diversified Financial Services players such as Blackrock and Charles Schwab who have done well over the past decade.

Source: Marcellus Investment Managers, Reuters

Evolution of Financial Services in the UK – non-life insurers stand out in a tough market

• Story of UK banks in the post GFC era is similar to the US: Similar to the US, British banks saw a decline in the post GFC era. However, the weight of diversified Financial Services in the FTSE350 increased from 1.5% in 2002 to 5% in 2020.

• Other Financial Services business did better than the index: As seen in the Exhibit below, all UK financial services indices except the banking index have outperformed the FTSE350 with non-life insurers doing significantly better than the rest.

Evolution of Financial Services in India

• The Financial Services sector in India continues to grow post the Global Financial Crisis: Unlike the UK and the US, the contribution of the Financial Services sector has continued to grow post the Global Financial crisis. In the Indian context. As these companies raise equity every few years, the market cap contribution to the index can look artificially higher. Therefore, we also looked at earnings growth of these Financial Services companies as a growing Financial Services business is a capital consumptive business.

• Increase in weight of Financial Services is due to robust earnings growth of private banks and diversified financials: We note that the consistent increase in the weight of Financial Services stocks in the BSE500 Index over the past two decades is supported by robust fundamentals. During 2001-2019, the total PAT of the BSE500 Financial Services companies has grown at a CAGR of 15% which is similar to the 15% PAT CAGR delivered by all BSE500 companies. However, the PAT of private banks has grown at a CAGR of 27% and the PAT of Diversified Financials has grown at a CAGR of 26% during this period.

• Transfer of wealth from shareholders of PSU banks to private banks and NBFCs: The earnings as well as market cap of PSU banks has seen a gradual decline over the past two decades – this is similar to the global banks over the past two decades. Private banks and NBFCs have been benefitted significantly at the cost of PSU banks – their cumulative weight in the BSE500 Index has increased to 20% in 2020 from 6% in 2001. On the other hand, the weight of PSU banks has reduced from 3.5% in 2001 to 2.5% in 2020.

Understanding the implications for investors in the Indian Financial Services sector:

(i) Presence of state-owned players in India: Unlike the US and the UK, in India government owned banks, life insurers and general insurers have significant market share. Unless the Government of India is able to consistently fund these public sector players, private players are likely to see market share gains in these sectors for a long period of time.

(ii) India’s demographics and economy’s stage of evolution: India’s demographics ensure that for a long period of time the demand for credit will be much higher than the supply of credit. We have also seen a significant cleansing of the banking system over the past few years which has resulted in the consolidation of the banking sector. The large Indian banks now have adequate capital and are well poised to grow at a rapid pace – similar to the US banking industry during the 1990s and early 2000s.

(iii) Different regulatory regime: The Indian regulatory regime for Financial Services businesses differs from the Western Countries. For instance, the democratization of payments through the introduction of UPI has made India one of the leaders in digital payments but it has also meant that payments cannot be a standalone business. As illustrated above, banks in the UK and US have delivered poor returns post the Global Financial crisis due to changes in capital requirements and regulations. However, Indian banks have continued to do well as the Indian banking system was relatively better regulated and was able to insulate itself better from the global financial problems.

(iv) Large Indian banks own other dominant Financial Services businesses: Unlike the US and the UK, the dominant Indian life insurers, general insurers and asset managers are owned by the large Indian banks. This was a result of the availability of a physical distribution network, capital and recognizable brands with these large banks at the turn of the century. This has led to concentration of profits in the hands of a few large Financial Services conglomerates. This will lead to these companies cornering a disproportionately higher share of the sector’s profitability and generate high RoEs which can be further reinvested in technology, distribution, etc. leading to a virtuous cycle. This has allowed few companies like HDFC Bank, Bajaj Finance, Kotak Bank to deliver superior and consistent shareholder returns.

(v) Data on Indian borrowers and savers is getting concentrated in the hands of few private sector Financial Services conglomerates: The data on Indian borrowers and savers is getting concentrated in the hands of 3-4 Indian Financial Services conglomerates whose business interests span across lending, asset management, general insurance and life insurance. Given the rising importance of data and technology, the dominance of these Financial Services conglomerates will only rise with each passing year as they sweat their existing data to gain further market share. This data will help these Financial Services conglomerates to dominate not only lending but also life insurance, general insurance and asset management.

(vi) Concentrated portfolios of well-run Indian private banks, insurers and diversified Financial Services players are likely to generate wealth. The Kings of Capital portfolio is therefore invested ~40% in banks and ~60% in diversified financials and insurers: The combination of: (i) large market share of state-owned players; and (ii) the ongoing formalization of the Indian economy provides private Indian banks a long runway for growth. However, as seen in the UK and the US, over a longer time horizon, a large part of the wealth will be also created by non-banking players in the Financial Services ecosystem. This makes it essential for investors to invest in a portfolio which consists of not only banks but also other Financial Services businesses.

Regards,

Team Marcellus

If you want to read our other published material, please visit http://marcellus.in/resources/

Copyright © 2021 Marcellus Investment Managers Pvt Ltd, All rights reserved

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.