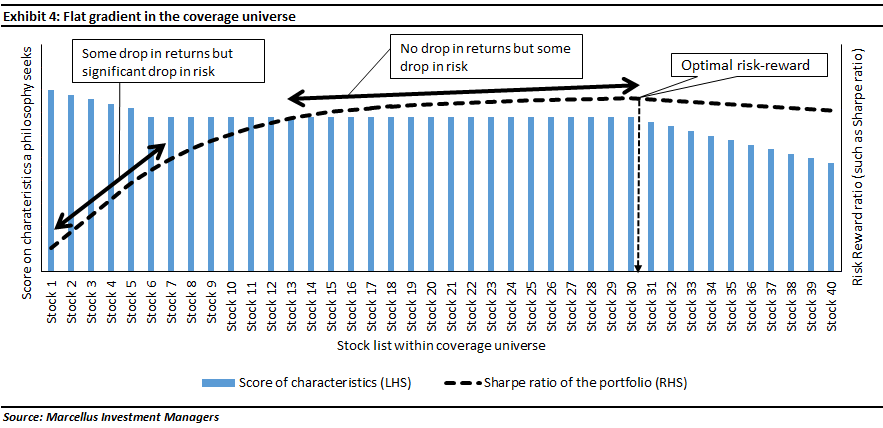

The flatter this gradient, the greater should be the number of stocks in an optimal portfolio. This is because a flat gradient implies that every incremental stock added to the portfolio

does not reduce the quality of the overall portfolio. Hence, as shown in Exhibit 4 above, after the first 10-20 stocks have meaningfully improved the risk-reward, there is no deterioration in the risk-reward of the portfolio due the increase in stock list to beyond 20 stocks. This is because there is no reduction in expected portfolio returns as the number of stocks increases, whilst there is a continued marginal reduction in risk due to portfolio diversification. For instance, the concentration risk of a 30-stock portfolio is slightly lower than that of a 20-stock portfolio, despite the expected performance of a 30-stock portfolio being the same as that of a 20-stock portfolio. For such a coverage universe, it is prudent to increase the number of stocks in the portfolio to the extent that the gradient of stock characteristics remains flat in the coverage universe.

Two non-fundamental reasons for over-diversification, which jeopardise the risk-reward balance of a portfolio

Theoretically, it makes sense to play around with the “gradient” highlighted above and achieve the optimal concentration / diversification of a portfolio. However, there are two factors which have got nothing to do with either the investment philosophy or the stock fundamentals, that can drive a fund manager’s decision on number of stocks in the portfolio.

- Depth of research: Shallow research around understanding the characteristics of stocks in a fund’s coverage universe leads to lack of clarity around the slope of gradient (steep or flat) highlighted above. In such a scenario, the difficulty in optimising portfolio concentration usually leads to the portfolio being over-diversified.

- Desired size of assets under management (AUM): The maximum size of AUM that a philosophy can manage depends, amongst other factors, on how illiquid are the underlying stocks and what thresholds of illiquidity risk is the fund manager willing to take. In a philosophy where liquidity is a constraint, one of the ways to increase the size of AUM is to increase the number of stocks in the portfolio, regardless of the impact this move has on the overall risk-reward of the portfolio.

If a portfolio is over-diversified due to these two non-fundamental factors highlighted above, it is likely to deliver a poor risk-reward outcome – possibly high risk and low returns!

Investment implications – Portfolio concentration methodology of Marcellus’ CCP

Marcellus’ CCP invests in a portfolio of companies where our research team is convinced about their: a) ability to generate strong free cash flows (hence high ROCEs) through deep-rooted competitive advantages; and b) ability to consistently reinvest the free cash flows back into the business to generate growth without any dilution in ROCEs over long periods of time.

There are not too many firms in India which fit this characteristic and hence our CCP philosophy’s coverage universe is very small. In fact this characteristic is so rare in India that our 26th February 2021 analysis (click here for more details) shows that “the top 20 profit generators in India (“the Leviathans”) now account for 90% of the country’s corporate profits. Beyond dominating the country’s profit pool, the Leviathans also reinvest these profits far more efficiently back into their businesses. By doing this over the last 25 years, the Leviathans have also widened the RoE gap between them and India Inc.”

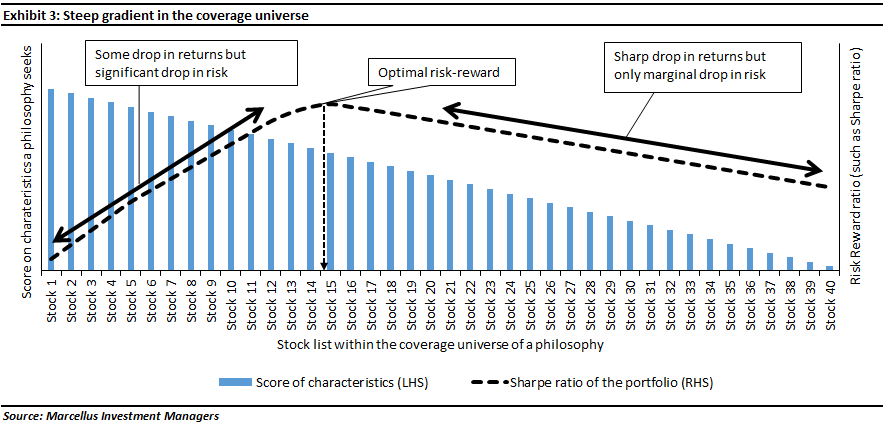

Since only a handful of companies in India possess the characteristics that we seek in Marcellus’ CCP portfolio, the coverage universe of Marcellus’ CCP portfolio has a steep gradient, similar to what is highlighted in exhibit 3 above.

Our depth of research helps us identify and quantify the gradient of characteristics discussed above in order to optimize our portfolio concentration / diversification and hence aim to deliver healthy rate of compounding without much volatility, consistently over the longer term. We currently have a portfolio of only 14 stocks, which we believe is both diversified enough to minimize the risk, and is concentrated enough to focus on healthy rate of compounding – i.e. aimed to achieve an arbitrage of low risk, healthy return over long periods of time.

Changes made to Marcellus CCP Portfolio – addition of Titan as a new stock

Last month, we added Titan Company as a new stock to Marcellus’ CCP Portfolio. Titan’s biggest strengths lie in its ability to: a) execute retail expansion whilst maintaining high store level and corporate level ROCE; and b) leverage on quality-oriented trust built around the Tata brand. In addition to this, the firm has successfully strengthened its jewellery merchandise by expanding successfully into wedding jewellery, by expanding gold exchange (as a substitute for gold-on-lease) for a large part of their raw material procurement, and by acquiring a majority stake in Caratlane, an online jewellery franchise which is expanding rapidly, successfully and profitably across ecommerce, omni-channel and brick and mortar formats. Titan Eyeplus has also been turned around through in-house manufacturing of the merchandise, closure of unviable store locations and tech investments to improve customer service. The ongoing shift of market share from unorganised to organised jewellers is a significant positive for Titan. Covid-19 related disruptions faced by both mom & pop jewellers as well as smaller organised chains provides a significant tailwind to Titan in the form of market share gains over the next few years. The firm has delivered a revenue CAGR of 16% over FY10-20 and 17% over FY17-20. Earnings CAGR over the same time periods has been 20% and 53% respectively. Titan’s average ROCE has been 34% over FY17-20 and 42% over FY10-20. We expect the firm to deliver healthy and consistent earnings growth with ROCEs substantially higher than cost of capital over the long term in future.