Marcellus’ CCP Portfolio delivered earnings growth of 29% YoY in 3QFY21 backed by revenue growth of 19% YoY. Almost all stocks in the CCP portfolio gained significant market share over the past six months from both organized as well as unorganized competitors. The non-Financials part of the portfolio reported 45% YoY growth in earnings during 3QFY21. Whilst the earnings growth of the lenders in our portfolio has reflected the drag from their conservative provisioning, they are extremely well placed to accelerate market share gains and earnings growth in FY22 with capital adequacy ratios well above 20%. In this newsletter we also highlight some of the disruptive and innovative initiatives undertaken by our portfolio companies over the past 12 months which are likely to help strengthen the longevity of their competitive advantages in future.

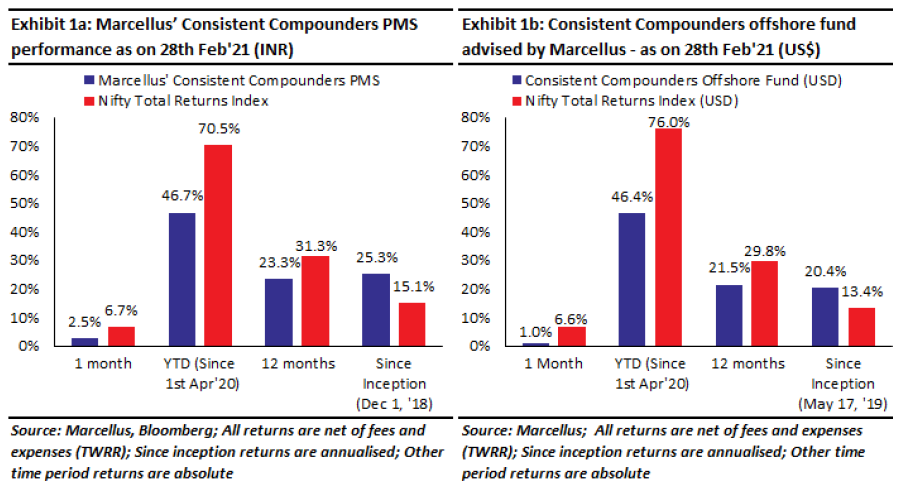

Performance update – as on 28th February 2021

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of eleven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

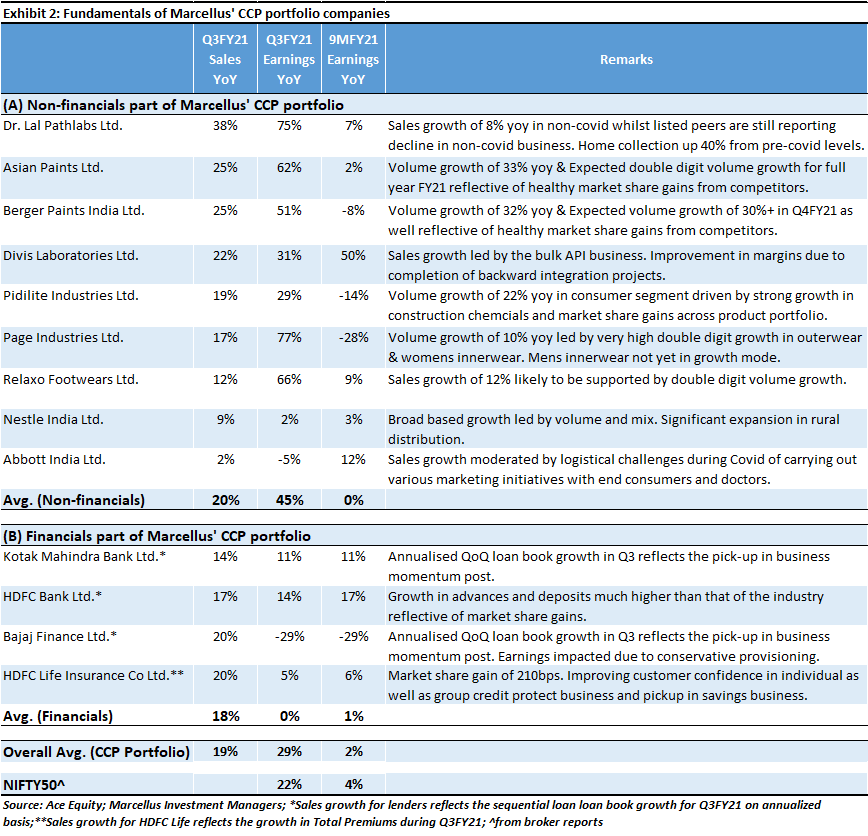

In 3QFY21, CCP companies have delivered 29% YoY growth in profits, backed by 19% YoY growth in revenues

Despite significant uncertainty in the economic environment over the past 12 months due to the ongoing Covid-19 crisis, the fundamentals of Marcellus’ CCP companies have remained highly resilient and healthy. As highlighted in Exhibit 2 below, in 3QFY21 Marcellus’ CCP portfolio delivered an earnings growth of 29% YoY, backed by revenue growth of 19% YoY.

There are several themes that have emerged from the recent fundamental performance of our portfolio companies.

Significant market share gains witnessed across the portfolio

The Non-Financials part of our portfolio has delivered 45% YoY growth in earnings in 3QFY21, backed by healthy 20% YoY growth in revenues. To begin-with, only a small part of this revenue growth can be associated with ‘pent-up’ demand since 2QFY21 for these companies also saw a 6% YoY growth in revenues and hence business momentum has been picking up gradually and consistently over the past 6-8 months for these companies.

Moreover, a large part of revenue growth for these companies has been driven by market share gains amidst a weak external environment. These market share gains have been of two types: a) gains from competitors who found it difficult to get their operations back to normalcy due to lack of institutionalized processes – such competitors were largely unorganized in nature; and b) gains related to superior value additions offered to customers, channel partners, employees and raw material vendors which helped our portfolio companies overcome various challenges that emerged during the crisis.

For instance, Asian Paints and Berger Paints have delivered around 25% YoY revenue growth in 3QFY21, backed by 30%-33% YoY volume growth when over the same period, peers like Akzo Nobel and Kansai Nerolac have reported only 7% and 18% YoY revenue growth. Recent media interviews by management personnel from these firms suggest that the healthy revenue growth momentum reported 3QFY21 has continued in January and February 2021.

Similarly, Dr. Lal Pathlabs’ non-Covid testing revenue growth of 8% YoY compares favorably against all their listed peers who have continued to report YoY decline in non-Covid testing related revenues (2%, 1% and 6.5% YoY decline for Metropolis, Thyrocare and SRL respectively in 3QFY21).

HDFC Bank’s total advances as on 31st Dec 2020 grew by 15.6% YoY vs. industry credit growth of 6.7% YoY leading to market share gains for the bank. Total deposits of HDFC Bank grew 19.1% YoY as on 31st Dec, 20 vs. 11.4% YoY growth for the industry leading to market share gains in total deposits as well.

HDFC Life reported 20% YoY growth in total premiums. Based on HDFC Life’s Individual WRP market share expanded by 214 bps from 14.3% to 16.4%. Value of New Business (VNB) grew 27% YoY in 3QFY21. Tax reason for life Insurance is reducing in customers’ decision-making, and tax benefits – which was at one point of time the top reason for buying life insurance – is now at lower priority as customer awareness improves. HDFC Life is emerging as the best placed life insurer to benefit from these structural changes.

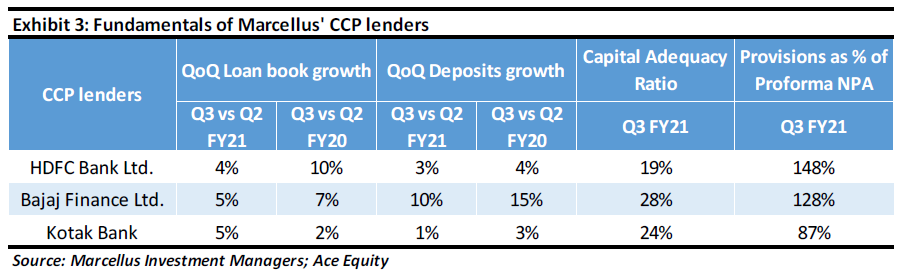

Lenders in CCP: well placed to substantially accelerate earnings growth over the next few years

Reported earnings growth of the three lenders in our portfolio (HDFC Bank, Kotak Mahindra Bank and Bajaj Finance) has so far reflected a drag from accelerated provisioning on their loan book, which has adversely affected their profitability over the last two quarters. As highlighted in Exhibit 3 below, sequential loan book growth (QoQ) for these lenders has been around 18% on an annualized basis for 3QFY21. Going forward, we expect both loan book growth as well as earnings growth to substantially accelerate due to a combination of two factors.

Firstly, as highlighted in one of our recent KCP newsletters (click here), capital adequacy ratios of lenders in Marcellus’ CCP are twice that of their largest competitors, despite provisioning for lenders in our portfolio being 6x that of their competitors. Hence, just like high quality lenders benefitted substantially from benign competitive intensity in the wake of the late 1990s NBFC crisis and the 2008 Global Financial Crisis (see our 1st November 2019 CCP newsletter on this subject), we expect HDFC Bank, Bajaj Finance and Kotak to gain market shares substantially over the next few years.

Secondly, conservative provisioning has had a significant drag on the profitability of firms like Bajaj Finance and HDFC Bank during 2QFY21 and 3QFY21. As a result, HDFC Bank’s and Bajaj Finance’s provisioning coverage ratio (PCR) as a % of proforma NPA is as high as 148% and 128% respective as on 31st Dec 2020. Going forward, normalization of provisioning will have a positive impact on earnings growth of these lenders.

Disruptive and innovative steps taken to benefit from the crisis

“Cash combined with courage in a crisis is priceless” – Warren Buffett, 2008

As highlighted in our recent newsletter (click here), dominance cannot be sustained without disruptions and innovations. CCP companies have always benefitted from black-swan events and economic stress to consistently find opportunities to disrupt and innovate during such times. There have been several such examples of new initiatives being implemented by our portfolio companies over the past 12 months.

Asian Paints, Berger and Pidilite have launched a wide range of products and services over the past 12 months in home building materials and home décor categories. Leveraging on the rise in ecommerce penetration in the past year, all three firms launched their new DIY brands – ezyCR8 from Asian Paints, iPaint DIY from Berger and further expansion of Fevicreate from Pidilite. Asian Paints has rapidly expanded its service-oriented offerings such as Beautiful Homes (architect services), sanitisation (San Assure and Safe Painting Service), etc, and has also introduced products across furnishings, furniture, and lightings in addition to its existing range of Bath fittings (Ess Ess) and Modular Kitchen (Sleek). Pidilite’s acquisition of Araldite from Huntsman gives it a leadership position in epoxy adhesives, one of the areas where it had struggled to gain market share historically. Pidilite has also made recent forays in the marble, granite, stone adhesives & coatings by acquiring majority stake in Indian operations of Tenax Italy and Tile & Stone solutions market through its Roff branded tile adhesives. Pidilite and Asian Paints have further expanded their retail store networks. “Pidilite Ki Duniya” stores, a network of merchandised stores in villages sub-12K population, are a one-stop shop for selling, training, and connecting with end users to drive penetration of home improvement products in rural areas. These stores have grown by 130% YoY in Q3FY21 to as many as 5,000 such stores now.

Dr. Lal Pathlabs has significantly scaled up its home collections infrastructure over the past year with an attempt to significantly reduce its turnaround times for processing these samples. This has led to a 40% increase in the volume of samples collected through home collection compared to pre-Covid-19 levels. Another initiative implemented by the firm is the acceleration of its organic expansion in West & South India. Our channel checks suggest that the firm has made significant progress in the expansion of its network of laboratories and collection centers in cities like Mumbai over the past 12 months, with plans to support this geographical expansion by opening reference labs in the cities of Mumbai & Bangalore in future.

Page Industries has made significant investments in technology (Sales Force Automation, Auto Replenishment System, Distributor Management System, Supply Chain Automation, etc.) and strengthening of its mid/senior management over the last 2 years. Leveraging on its expanded bandwidth due these investments, the firm has, over the past six months, setup a separate team and to increase distribution of Jockey in rural areas for economy products. This is in addition to continued expansion in urban with an addition of ~120 EBOs (exclusive brand outlets) and ~6000 MBOs (multi brand outlets) over the last 9 months.

Bajaj Finance has taken several business transformation initiatives like omni-channel model to enable the customer to move between online to offline and vice versa in a frictionless manner, developing productivity apps, launching ‘Bajaj Pay’ for consumers and merchants, building proprietary marketplaces – EMI store, Insurance marketplace, Investment marketplace, BF health, and a broking app. The firm plans to roll out the first phase of its business transformation by mid-July 2021. Once implemented fully, it is likely to will lead to further reduction in operating costs and significant improvement in customer experience.

Not all initiatives highlighted above for various CCP portfolio companies will prove successful in future. However, some of them are likely to further increase the dominance of these firms in their respective industries at a time the Covid-19 crisis has led to rapid evolution in consumption patterns and weakening of some competitors. Such initiatives implemented during times of crisis, highlight the lack of complacency / lethargy / fatigue in these firms, which helps strengthen our conviction on the expected longevity of their cash flows in future.

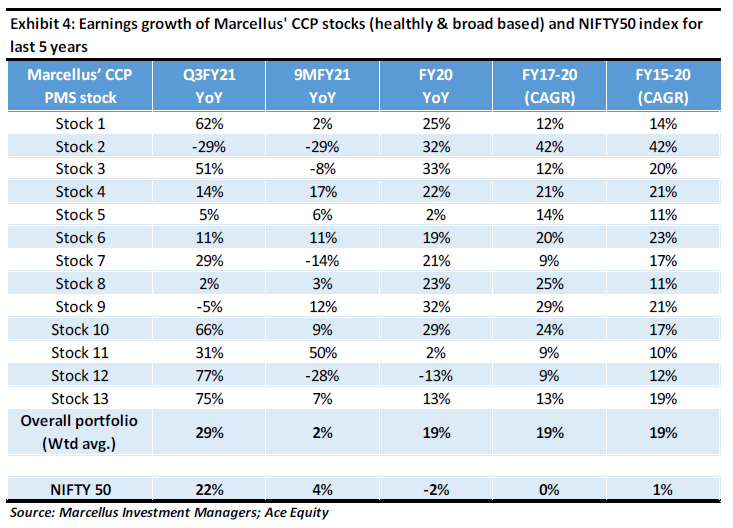

Consistency of earnings growth through disruptions and evolutions

The last five years have been characterized by a tough operating climate for B2C companies in India due to the impact of events such as demonetization in FY17, GST in FY18, Covid-19 in FY21 and working capital challenges from the lending sector’s crisis during FY19-FY20. In such a difficult external environment, consistency of healthy fundamentals can be delivered only by businesses which benefit more from the weaknesses of their competitors during periods of economic stress, whilst also participating in industry-wide growth during periods of economic upswings.

As highlighted in the Exhibit 4 below, Marcellus’ CCP companies have delivered such resilience throughout the last 5 years with 19% weighted average earnings CAGR over FY15-20. After a moderation in this earnings growth momentum during the early part of FY21, our portfolio companies have started benefitting from market share gains in the wake of the Covid crisis, due to the initiatives previously discussed in this newsletter.

Going forward, we expect the rate of market share gains to accelerate further especially for lenders in our portfolio, and also for non-financial companies in our portfolio.

If you want to read our other published material, please visit https://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this Publication in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor. The performance related information provided herein is not verified by SEBI.

Copyright © 2020 Marcellus Investment Managers Pvt Ltd, All rights reserved

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.