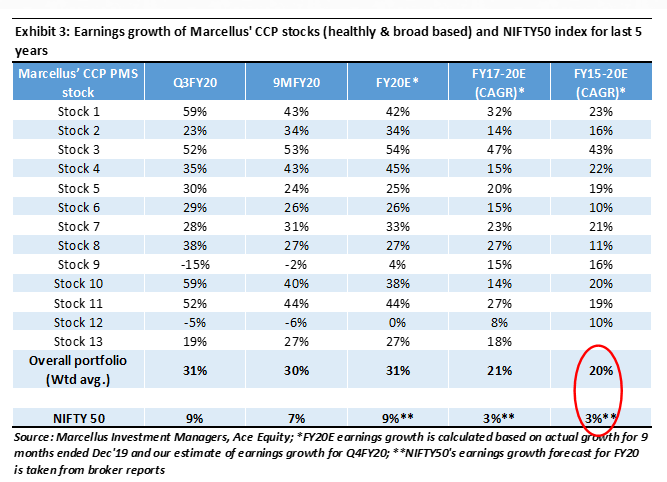

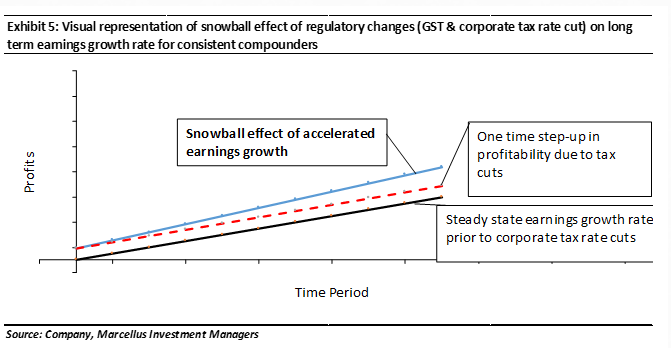

The performance of Marcellus’ CCP portfolio over the past 12 months has been fully supported by fundamentals. The CCP stocks have seen more than 30% YoY growth in profits during 3QFY20 and 9MFY20 vs 28% portfolio performance since 1st April 2019. In fact, CCP stocks have seen more than 20% annualized growth in profits over FY17-20 and over FY15-20. This is predominantly due to accelerated market share gains in a difficult economic environment over the past five years. Moreover, recent regulatory changes like corporate tax rate cut and GST, are creating a ‘snowball effect’ for the earnings growth of our portfolio companies, which has not yet been adequately factored into their valuations.

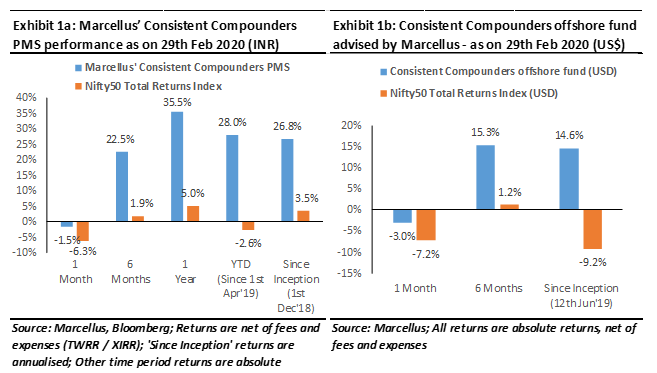

Performance update – as on 29th February 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of seven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

CCP Portfolio’s profits grew by more than 30% in FY20 and more than 20% CAGR over FY15-20, fully supporting the portfolio performance

As highlighted in our 6th Nov’19 blog (click here), the share price growth for any stock broadly mirrors its earnings (or cash flows) growth over the longer term. Another way to make the same statement is that in the equation of P = P/E * E, the compounding of the share price of a firm over the long run is solely dependent on compounding of its earnings, because the P/E multiple does not compound in the long run.

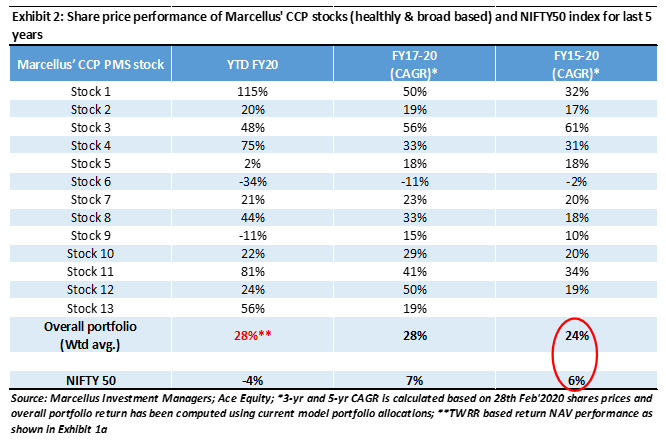

Over the past five years, due to a tough macro-economic environment in India, earnings growth for the broader market has been subdued – the Nifty50 index has delivered only 3% earnings CAGR over FY15-20, 3% earnings CAGR over FY17-20, and only 7% YoY earnings growth in the first nine months of FY20 (i.e. 9MFY20). Hence, it is not surprising that Nifty50 Index has increased by only 6% CAGR over the past five years and delivered a -4% return since 1st April 2019.

Despite such a weak external environment for the economy as well as for the stock market, the performance of our CCP Portfolio has been +28% since 1st April 2019 and our current model portfolio has delivered +24% share price CAGR over the past five years – see exhibit 2 below.

This portfolio performance over the past 1 year (approx. 30%) and over the past five years (over 20% CAGR) in a tough environment could optically cause concerns amongst investors around overvaluation. However, this portfolio performance (both in absolute terms and relative to the index) has been fully supported by equally robust fundamentals (in fact the P/E multiple of our portfolio has dropped by ~5% vs what it was one year ago). As shown in Exhibit 3 below, our portfolio has delivered earnings growth of over 30% YoY during FY20 and over 20% CAGR during the last five years.

This resilience in our portfolio’s earnings amidst a weak macro-economic environment is not unusual. As highlighted in our 1st Sept 2019 newsletter (click here), over the past 25 years, Consistent Compounders have delivered resilient share price performance during periods of market stress mainly because of their robust fundamentals and resilient earnings growth, even during periods of weak economic growth. This is mainly due to accelerated pace of market share gains by Consistent Compounders when the macro-economic environment weakens. Some of the reasons for such acceleration in market share gains include: a) the ability of CCP companies to help their distribution channel access bank financing during the ongoing liquidity crisis; b) the higher ROCE of an influencer (or channel partner) in the business carried out with CCP companies compared to their peers, which makes the influencer pass on the drop in consumer demand to firms offering lower ROCE to them, whilst keeping the business of CCP companies unaffected; and c) higher ROCEs of CCP companies provides them with better access to capital relative to peers, which can help fund expansion plans during a period of financial crisis.

Recent regulatory changes are likely to create a ‘snowball effect’ on future earnings growth of our portfolio companies

Regulatory changes like GST implementation and the corporate tax rate cuts have resulted in disproportionate benefits for our portfolio companies. These benefits are not limited to one or two years. Instead, they are likely to create a massive snowball effect in the following manner:

- Snowball effect of corporate tax rate cut: We had explained this in Exhibit 4 of our 1st Oct 2019 newsletter (click here). CCP companies have the rare ability to deliver healthy returns on capital employed (ROCE) whilst also maintaining a high rate (60-70%) of reinvestment of operating cash flows. Hence, such companies will plough back on to the balance sheet, the incremental profits generated from reduced tax rates, thereby creating a strong ‘snowball effect’ as time progresses. This ‘snowball effect’ accelerates the earnings growth rate of such a company into the long-term future. In addition to the ‘snowball effect’ of reinvesting incremental profits back onto the balance sheet, some CCP companies have also announced utilisation of incremental profits via: a) incremental product price cuts to suffocate competitors who did NOT receive tax cut benefits due to weaker profitability; b) increase in employee incentives to help reduce talent attrition; and c) increase in advertisement spends. Such actions are also likely to benefit a CCP company more than their peers because of two reasons: (a) the quantum of incremental profits of a CCP company are higher than those of their peers, giving it the extra firepower to spend in these areas; (b) some of the moats of a CCP company might have been built around R&D / IT / HR / brand-recall, etc – which might not be true for their peers.

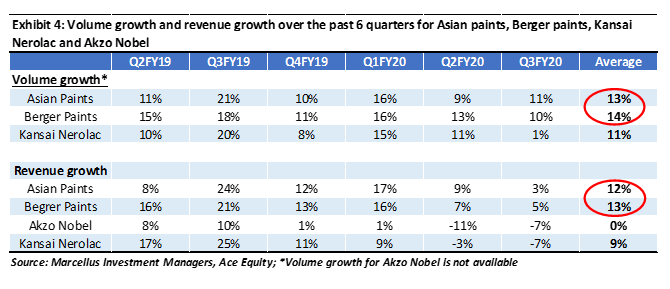

- Snowball effect of GST: Over the past 12-18 months, the economic growth moderation in India has materially affected consumption growth to the level that even staples products with the lowest ticket size and highest utility have had flat or declining volumes on a YoY basis (see this press article for instance). Despite this, firms like Asian Paints and Berger have reported consistent and healthy volume growth rates throughout the last 12-18 months (see Exhibit 4 below). One of the biggest reasons for these healthy growth rates has been the shift of market share from unorganized to organized players in the industry, thanks to the implementation of GST. Even in the context of this shift, the CCP companies have benefited more than their other (organized sector) competitors. For example, Asian Paints and Berger have grown faster than Kansai Nerolac and Akzo Nobel due to substantially stronger moats for Asian Paints and Berger Paints around supply chain efficiencies. This is not just a short term step up in volumes, revenues and earnings for a couple of years for Asian Paints and Berger Paints. Instead, it is a snowball effect which is likely to accelerate their earnings growth in future years because of: a) their ability to redeploy the incremental earnings generated from this market share gain back into the business as explained in bullet 1 above; b) premiumisation of the newly acquired market share from economy products currently, to premium products and services in the future; and c) incremental operating efficiencies of supply chain into smaller towns and cities from where such market share gain would have been achieved after GST.

Investment implications

The low risk route to compounding wealth via equities at a healthy run-rate is to buy a portfolio of great companies whose fundamentals are resilient and healthy even during periods of stress in the external environment. Such companies accelerate the rate of market share gains from their weaker competitors during periods of economic stress. More importantly in India, regulatory changes over the past 3 years, like GST and corporate tax rate cuts, have only helped accelerate future earnings growth potential of such great companies by creating a ‘snowball effect’. Hence, as we have seen in the last five years, in the equation of P = P/E * E, healthy and consistent compounding of earnings of such great companies is likely to be the biggest driver of their share prices in future – regardless of how quickly (or slowly) the economy recovers.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this Newsletter does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this newsletter are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this Newsletter are hereby expressly disclaimed. The content on this Newsletter is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this Newsletter should act or refrain from acting on the basis of information on this Newsletter without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.