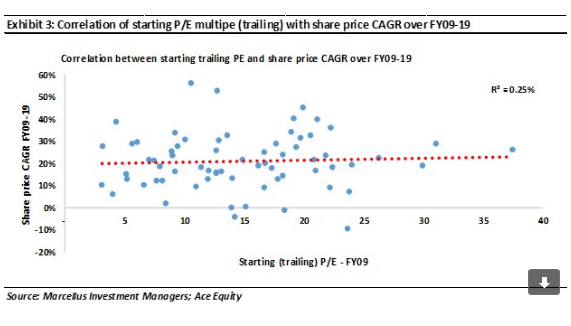

The P/E multiple of a stock has ZERO ability when it comes to explaining future share price movements in India. The same is applicable for P/B and EV/EBITDA multiples. In contrast, Free Cash Flow (FCF) growth explains nearly 60% of the movement in the share prices of BSE100 companies. Coming to terms with this counterintuitive fact is central to successful investing in the Indian stock market.

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return — even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.” – Charlie Munger in “The Art of Stock Picking” (2013) [Source: http://csinvesting.org/wp-content/uploads/2013/01/Charlie-Munger-Art-of-Stock-Picking.pdf]

The “fundamentalists” at Marcellus

Over the past couple of years, we have reiterated time and again the folly of using P/E multiples as a gauge of which stocks one should invest in. For example, in a recent newsletter for our small cap Little Champs Portfolio, we said that: “The last 10 years clearly indicate that the best performing small cap stocks have been those which have generated the highest earnings growth as well as the highest return on capital employed (ROCE). For instance, as shown in the charts below, for both the time periods FY09-14 and FY14-19, the companies which delivered the highest PBT growth also ended up delivering the highest share price returns.” (Source: https://marcellus.in/newsletter/little-champs/quality-trumps-cheap-valuations-comprehensively/)

More provocatively, in our July 2019 newsletter for a our Consistent Compounders Portfolio we explained that: “A weak franchise trading at 10x P/E multiple appears cheap, when its fair value P/E might actually be 5x. On the other hand, a consistent compounder trading at 50x appears expensive, when its fair value P/E could be higher than 100x. Conviction on the ability of a firm to deliver sustainable competitive advantage (represented by ROCE) as well as growth (which requires capital reinvestment) is often underappreciated in a P/E multiples based valuation methodology.” In fact, in that newsletter we demonstrated that, in 1994 Nestle’s fair valuation P/E multiple was 290x! (Source: https://marcellus.in/newsletter/consistent-compounders/valuing-longevity-of-healthy-fundamentals/)

The futility of P/E multiple based investing

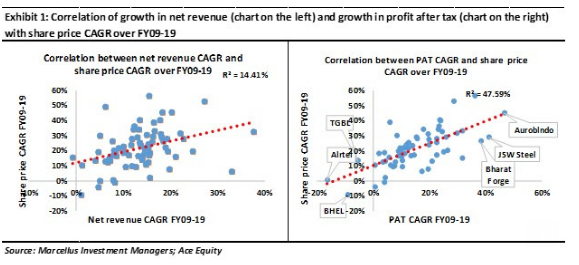

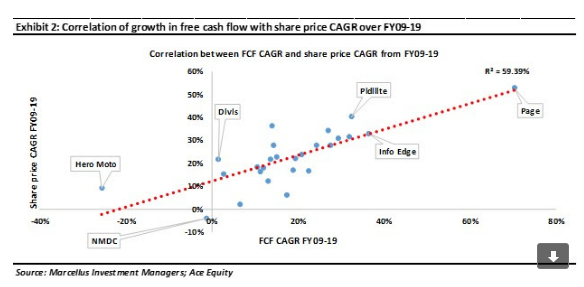

In this note, we assess the relative power of a variety of metrics which explain stock price movements. In the three charts shown below we have illustrated the ability of three different fundamental metrics – revenue growth, profit growth and Free Cash Flow (hereafter called FCF) growth – to explain stock prices of the BSE100 constituents over the last 10 years.

As you can see from the charts, whilst revenue growth can explain only 14% of the stock price movement seen over the past decade, profit growth can explain a healthy 48% of the stock price movement. But the star of the show is FCF growth – it can explain nearly 60% of the movement in BSE100 stock prices over the past decade. That is truly extraordinary and it suggests that amongst all fundamental metrics FCF growth is by far the biggest driver of shareholder value.

So what is FCF? Technically speaking it is the operating cashflow that a company generates less the monies that it spends on investing in property, plant, equipment and other assets that it acquires. The formula for FCF we have used is “Operating cash flow – (Capex+ Advances for capex) – Investment in subsidiaries & intercorporate deposits”. In plain English, FCF is a true measure of how much money a company makes after paying not just for its expenses but also paying for various assets & equipment that it needs to run the show.

In contrast to the potency of FCF growth in explaining stock price movements, it is worth seeing a visual illustration of how useless P/E multiples are when it comes to explaining stock price movement – P/E explains around 0% of the movement in stock prices. (No that is not a typo. It is 0%.) In plain English, whether BSE100 constituents’ share prices rose or fell over the past decade had NOTHING to do with the P/E multiples of these stocks. If you want to see how useless P/E, P/B and EV/EBITDA multiples are in India over horizons such as 1 year, 3, 5 and 10 years, please refer to Appendix 5 of our bestselling book “Coffee Can Investing: The Low Risk Route to Stupendous Wealth” (2018).

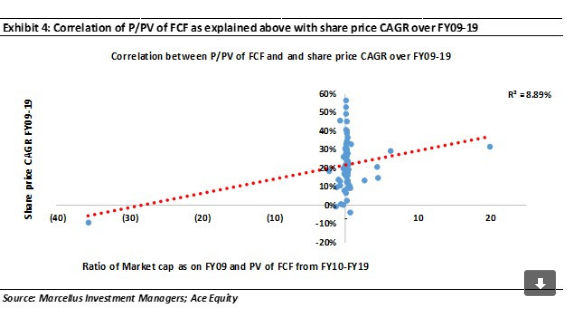

The God-like simulation

Since we know the FCF of the BSE100 constituents over the past 10 years, we can pretend that we are sitting in Mumbai in March 2008 and with God-like prescience forecast FCF over the next 10 years. Armed with these FCF forecasts, we then use a discount rate of 15% to calculate the Present Value (PV) of these free cashflows as in March 2008. That gives us PV of FCF. Using this metric, we calculate P/ PV of FCF for each of the BSE100 constituents. Now, we can test whether this new God-like metric is better than P/E multiples in explaining stock price movements.

As shown in the chart above, P/PV of FCF explains 9% of the movement in BSE100 stock prices over the past decade. Since 9% is > 0%, P/ PV of FCF appears to have greater potency than P/E multiples in explaining stock price movements. However, the relative impotence of P/ PV of FCF (compared to a metric like FCF growth) underscores the insignificance of stock prices in forecasting future stock price movements. This counterintuitive fact seems to confound many investors in the Indian stock market – they simply cannot understand why the stock price of a company today tells you next to nothing about how the company’s stock price will perform going forward.

Investment implications

As highlighted in the quote from Charlie Munger at the beginning of the note, how much money an investor will make from an investment depends fundamentally on one thing and one thing alone – what is the Return on Capital generated by the investee company. If the company’s pretax ROCE is below 15% (which is the case for just over a third of the BSE100 constituents in FY19), it will be very difficult for an investor to generate a healthy return from buying shares in such a company EVEN IF THE P/E OF THE COMPANY IS LOW. Conversely, as Mr Munger explains, if we buy shares in, say, Pidilite – a company with a pretax ROCE of 34% in FY19 – we are likely to make a very healthy return from the investment EVEN IF PIDILITE’s P/E IS OPTICALLY HIGH. [By the way, the point made here for Pidilite is equally applicable to a stock like ITC which hasn’t in recent years enjoyed as stellar a share price run as Pidilite.]

FCF growth captures this aspect of investment success far better than P/E does because FCF is nothing more than ROCE less the cost of capital. Therefore, healthy growth in FCF necessarily implies equally healthy growth in ROCE. That is why, as shown in Exhibit 2, FCF growth is able to explain nearly 60% of the change in the share prices of BSE100 constituents.

For those investors who prefer focusing on a stock’s share price or P/E multiples for long term investment returns, our submission would be that at the very least they should switch to P/ PV of FCF rather than focusing on P/E multiples.

(Disclosure: Please note that Pidilite and ITC are held in most of Marcellus’ portfolios)

Saurabh Mukherjea and Deven Kulkarni are Founder and Analyst respectively at Marcellus Investment Managers (www.marcellus.in).

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.