In the BSE100 universe we find no significant correlation between starting period valuations (i.e. at the beginning of the concerned period) and subsequent long-term returns, no matter which phase of the stock market one looks at – phases of rapid P/E multiple expansion, significant P/E multiple compression, strong earnings growth, or weak earnings growth. Instead, in each of the historical phases, there has been a strong correlation between earnings growth rates and share price returns. Provided an investor can build a portfolio of consistent compounders, such a portfolio outperforms the broader market, and delivers healthy absolute returns in all types of external market environments.

“Cognitive psychology tells us that the unaided human mind is vulnerable to many fallacies and illusions because of its reliance on its memory for vivid anecdotes rather than systematic statistics.” – Steven Pinker, a Johnstone Family Professor in the Department of Psychology at Harvard University.

Two of the most common fallacies of investing in the stock market are:

- P/E multiple of 10x is cheap and P/E multiple of 50x is expensive

- During time periods when P/E multiples of great companies compress, share prices of poor quality companies will outperform those of great companies.

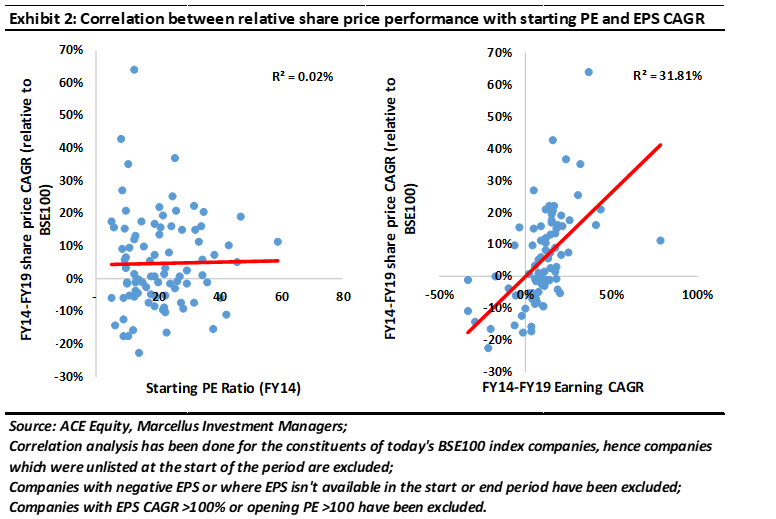

Let’s do a quick statistical analysis to test these two points. As shown in the exhibits that follow, the BSE100 universe in India has had no significant correlation between starting period valuations (as at the beginning of the concerned period) and subsequent long-term returns, no matter which phase of the stock market one looks at.

Scenario 1 – FY14-19 – High-quality stocks were in vogue!

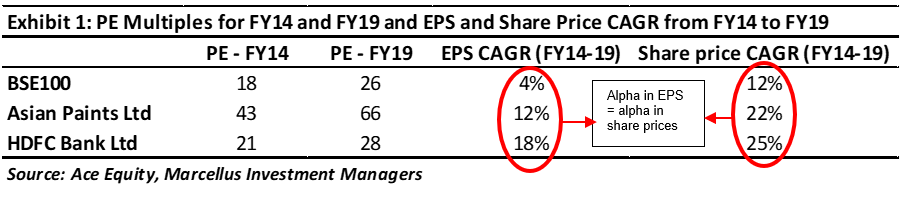

The first scenario considers the five-year period of FY14-19 during which ‘high quality stocks’ were in vogue (although many not-so-great-quality stocks were also perceived to be ‘high quality’ during this phase). During this period, BSE100 index delivered a weak earnings CAGR of 4%, but underwent a 50% expansion in its P/E multiple from 18x to 26x (see exhibit 1).

As can be seen clearly from Exhibit 2 on the left below, there is no significant correlation (0.02%) between the returns profile and the starting price multiples of the index constituents. Instead, there is a strong correlation (R-square = 32%) between the returns profile and earnings compounding during this period. Hence, despite this being a phase of significant P/E multiple expansion for the entire index, it has been earnings (rather than starting period P/E multiples) which have determined outperformance of a stock relative to the index.

Scenario 2 – FY04-08 – Capex and infra boom!

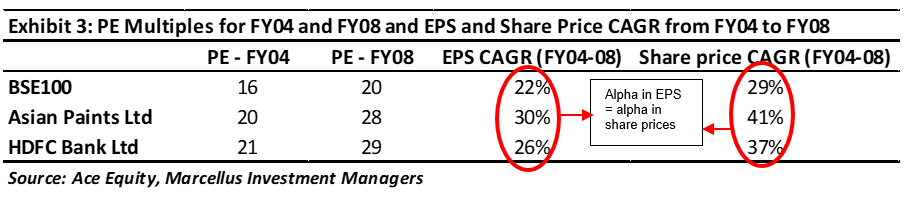

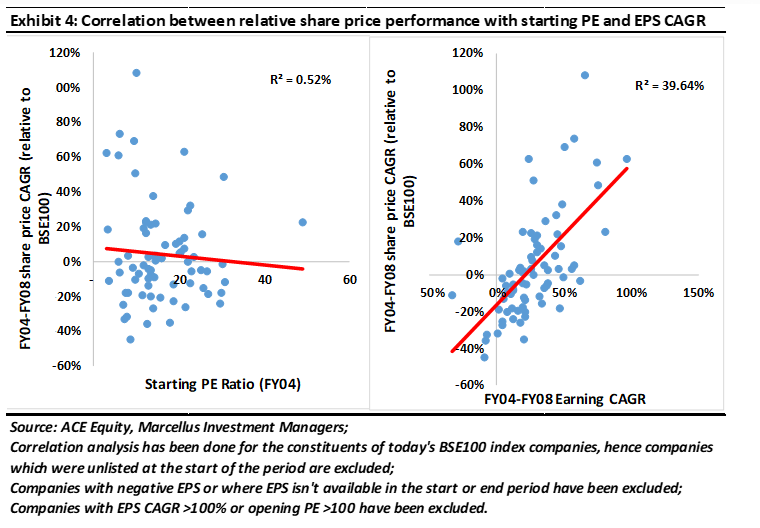

This scenario considers the four-year period of FY04-08 during which BSE100 delivered earnings CAGR of 22% – twice the long-term average earnings growth rate. In this phase, earnings growth rates were broad based with only a narrow gap between earnings CAGR of high quality stock and the not-so-high-quality stocks in the index. P/E multiple expanded at a modest pace (see exhibit 3).

As can be seen clearly from Exhibit 4 on the left below, there is no significant correlation (R-squared = 0.52%) between the returns profile and the starting price multiples of the index constituents. Instead, there is a strong correlation (R-squared = 40%) between the returns profile and earnings compounding during this period. Hence, despite this being a phase of broad-based healthy earnings CAGR with only a modest P/E multiple expansion for the entire index, it has been earnings (rather than starting period P/E multiples) which have determined outperformance of a stock relative to the index.

Scenario 3 – FY94-04 – P/E multiples HALVED!

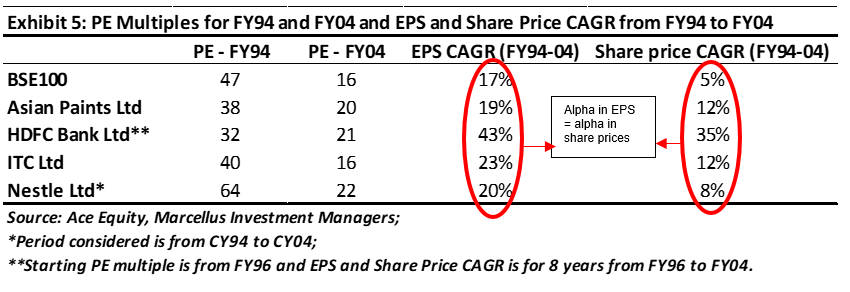

This scenario considers the 10 year period of FY94-04 during which BSE100 underwent a massive compression in its P/E multiple from 47x in FY94 to 16x in FY04. The P/E compression was broad-based with stocks like Asian Paints, Nestle, ITC undergoing more than 50% reduction in their P/E multiples over the decade (see exhibit 5).

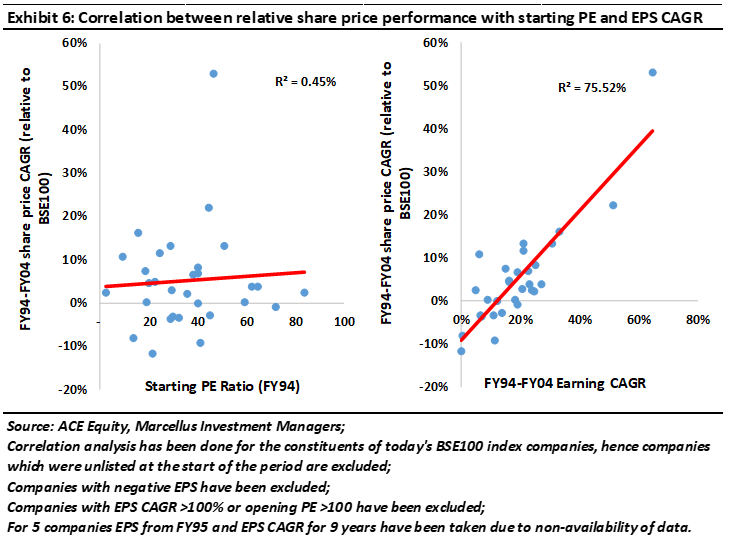

As can be seen clearly from Exhibit 6 on the left below, there is no significant correlation (R-squared = 0.45%) between the returns profile and the starting price multiples of the index constituents. Instead, there is a strong correlation (R-squared = 75%) between the returns profile and earnings compounding during this period – see Exhibit 6 on the right below. Hence, despite this being a phase of deflation in P/E for quality stocks, it has been earnings (rather than starting period P/E multiples) which have determined outperformance of a stock relative to the index.

What is also quite interesting is that the absolute share price return of high-quality stocks was in mid-teens CAGR, a run-rate which should be quite comfortable for most investors if that is the worst-case scenario. Hence, sitting on cash / investing fixed deposits was less rewarding compared to investing in equities even in this scenario, provided an investor can orient their portfolio only towards great companies.

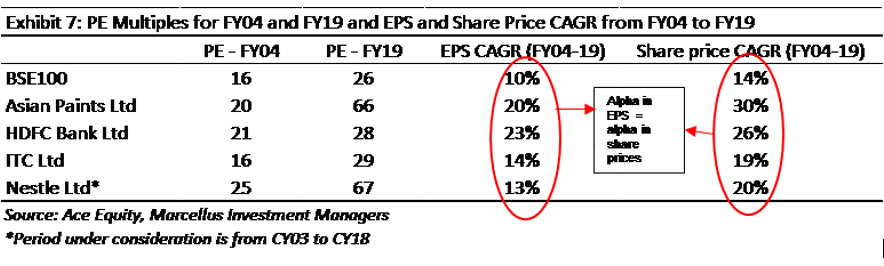

Scenario 4 – FY04-19 – The long term story

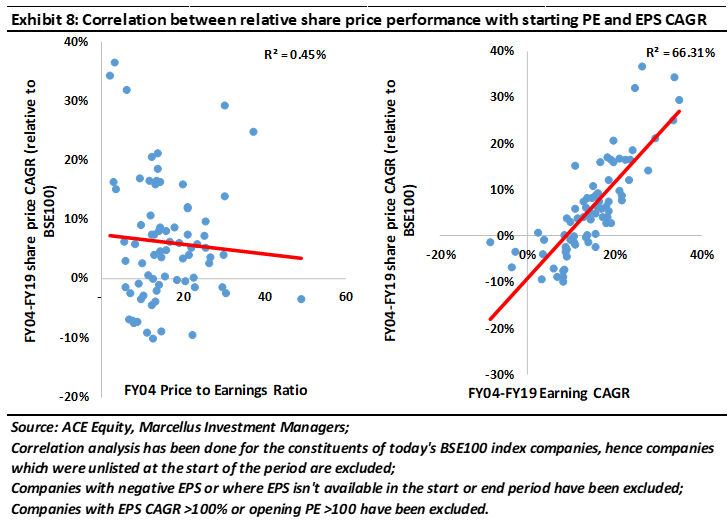

This scenario takes into account a 15-year period which has seen different phases of growth as well as contraction and expansion of PE. More than 70% of the returns in the index is explained by earnings and less than 30% is explained by PE expansion (see exhibit 7 and 8 below)

As can be seen clearly from Exhibit 8 on the left below, there is no significant correlation (0.45%) between the returns profile and the starting price multiples of the index constituents. Instead, there is a strong correlation (R-squared = 66%) between the returns profile and earnings compounding during this period – see Exhibit 8 on the right below.

Investment implications

In our 2nd July 2019 newsletter, we highlighted that Nestle India’s P/E multiple was 64x (trailing) in 1994 and it is 69x currently i.e. the stock appeared expensive 25 years ago, and it might appear expensive today as well. However, investment in Nestle in 1994 at 64x P/E multiple would have fetched 17% CAGR (1994-2019) compared to 10% CAGR delivered by Sensex over the same time period. To put it in another way, investment in Nestle India at 290x P/E multiple in 1994 and exit at today’s price, would have delivered shareholder returns in line with Sensex. Hence, in 1994 Nestle’s fair valuation P/E multiple was 290x!

Why do such conundrums exist? Let us start with an analogy. Let’s say you went to purchase a new car for yourself, and you were offered two cars by the car dealers – a Maruti Suzuki Swift Dzire for Rs 30 lakhs and a Bentley for Rs. 30 lakhs. Your instant reaction will be that the Swift Dzire is overvalued and that the Bentley is undervalued. Why? Because you are aware of the tangible utility and luxury offered by these cars which helps you to conclude that the fair value of Swift Dzire is substantially lower than Rs 30 lakhs and that of the Bentley is substantially higher than Rs 30 lakhs. But what if you were new to the car industry and this awareness was not there at all? What if the Swift Dzire marketing campaign talked about ride comfort in exactly the same manner as Bentley’s marketing campaign? Then you might not think that Bentley’s Rs 30 lakhs price tag is deeply undervalued and that Swift Dzire’s Rs 30 lakhs price tag is substantially overvalued.

Now, let’s get back to the stock market. If you go by first principles, the fair value of any firm is the present value of all expected future cash flows. However, it is difficult to predict the future because of the uncertain interplay between continuity and disruption. As a result, at the same price tag of 45x P/E multiple in 1999, both Nestle and Unilever appeared similar in quality to most investors. More importantly, at that price tag, both appeared ‘expensive’, when Nestle turned out to be significantly cheap at that price tag (and HUL turned out to be radically overvalued).

Almost 99% of the companies listed on the stock exchanges, have historically exhibited a very high degree of volatility in their revenues, earnings and ROCE. Due to such weak and unpredictable fundamentals, even at 10x / 20x / 30x P/E multiples, they have proved to be over-valued. There are less than 1% of firms which have delivered consistency of healthy fundamentals over several decades in a row. Such firms have been found to be undervalued even at P/E multiples of 30x / 40x / 50x, as quantified below.

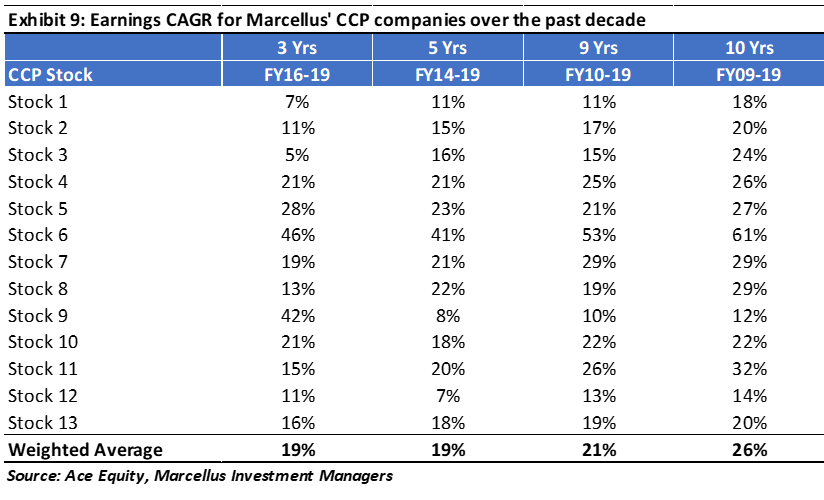

At a portfolio level for Marcellus’ Consistent Compounders PMS, earnings growth rates have been ~20% CAGR historically – see the Exhibit 9 below.

It is worth noticing that over the past five years (FY14-19), India has witnessed a significant moderation in economic activity (click here for our blog on this subject) with the nominal GDP growth in India being in single digits, significantly lower than its long term historical average. This has led to BSE100 Index delivering only 4% EPS CAGR (see exhibit 1 under Scenario 1 of this blog). During such a period of weak external environment, as shown in Exhibit 9 above, our portfolio companies have managed to deliver 19% earnings CAGR. This 15% gap against the benchmark index has fully supported the outperformance of the share prices of our portfolio companies relative to the index returns over this period.

There are a handful of companies which are consistent compounders of earnings due to their superior businesses and great management. These businesses are incredibly rare, not even 1% of the listed universe. Provided an investor can build a portfolio full of only consistent compounders, such a portfolio outperforms the broader market, and delivers healthy absolute returns in all types of external market environments.

Our research team of five analysts focuses only on understanding the reasons why companies in our coverage universe are likely to deliver consistent and healthy earnings growth in future as well.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.