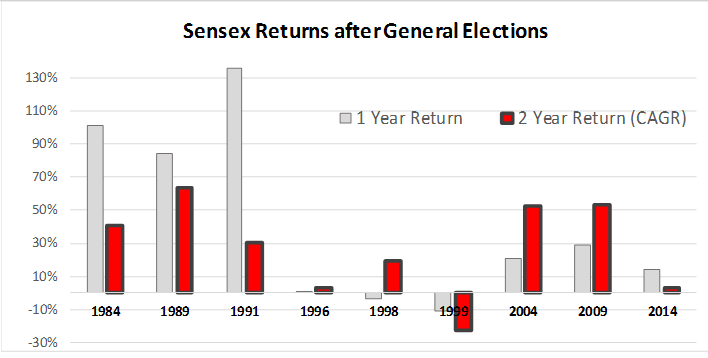

Ever since India started liberalising its economy in the early 1980s, the two-year period following General Elections has always generated positive returns with one exception (1999). In fact, the two years following General Elections have accounted for 80% of the returns generated by the Indian stockmarket. Furthermore, Consistent Compounder stocks have more than adequately participated in these post-Election rallies.

“In Italy, for 30 years under the Borgias, they had warfare, terror, murder and bloodshed, but they produced Michelangelo, Leonardo da Vinci, and the Renaissance.

In Switzerland, they had brotherly love, they had 500 years of democracy and peace – and what did they produce? The cuckoo clock.” – Orson Welles as Harry Lime in ‘The Third Man’ (1949)

The link between General Elections and Sensex returns

As the quote above suggests, the impact of good/bad political governance on the stockmarket is less obvious than most imagine it to be. Whatever you or I might think of the quality of successive Indian administrations, of the nine elections that India has seen since 1984 (that being the period when India began liberalising its economy), eight have produced positive stockmarket returns in the two year period following elections (1999 being the only aberration and one that can be blamed on the dotcom bust rather than on domestic factors). Even more remarkably, the average one year and two year post-election returns for the Sensex are 41% and 27% respectively (the two year return is a CAGR figure).

Since the Sensex’s 35-year CAGR (1984-2019) has been 15% and since the two-year post-election CAGR is 27%, simple arithmetic suggests that the two years following General Elections have driven 80% of the Sensex’s returns in the last 35 years. If you believe in the takeaways from historical data, the message is that if you don’t invest in the Indian stockmarket in the two year period following General Elections, you are missing out…bigtime. So why does this link exist and will history repeat itself in the grim economic aftermath of the 2019 General Elections?

Why does this link exist?

In economic theory, the correlation between election cycles and the economic cycle has been discussed for nearly a century now. As Lisa Chauvet of DIAL (a Paris-based think tank) and Paul Collier of Oxford University pointed out in 2008: “Economic policy is critical for prosperity and so how it is shaped is of enormous importance for developing societies. It is now widely accepted that the struggle for good economic policies and governance is predominantly an internal process within these societies rather than something that can be imposed from outside…Potentially, elections are the key institutional technology of democracy than enables citizens to hold governments to account. While the potential may seem self-evident, quantitative political science research has become rather sceptical of the efficacy of democracy in improving economic performance…We have investigated whether elections have forced governments into policy improvement…Elections in developing countries have cyclical effects on policy.” [Emphasis in bold is ours]

India’s history, since the early 1980s, points to a close link between political and economic cycles. Specifically, the combination of a decisive electoral mandate and decisive economic reform has typically acted as a major spur for the Sensex even without economic growth being an immediate beneficiary of economic reform. For example, after the 1991 General Election, the economic reforms initiated by the then Congress government presaged a two year drop in GDP growth even as the stockmarket roared away.

A more recent example is the corporate tax reforms enacted last month wherein not only did the Finance Minister cut the corporate tax rate by nearly 10% points, she also said that manufacturers who set up new plants post 1st October 2019 can avail of a 15% corporate tax rate on the profits generated from the new plants. As explained in our recent newsletter (see http://marcellus.in/

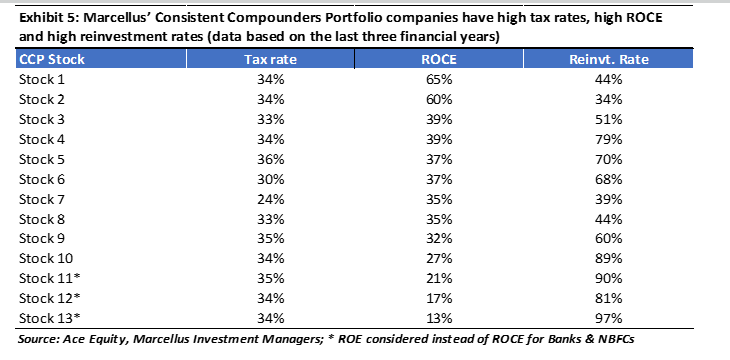

“…the biggest beneficiaries of the cut in corporate tax rates are companies with a combination of high ROCE + high reinvestment rate + high tax rate. Firms which will NOT benefit much from the tax rate cut are those which either do not have avenues for capital reinvestment, or which have low pricing power (and hence will have to sacrifice the gains from the tax cut), or which have low ROCE, or those that are not cash generative. In short, the vast majority of the Indian stockmarket will not benefit from the recent cut in corporate tax rates! Those gains shall, rightfully, go to their consumers…

Consistent Compounders benefit disproportionately from the cut in corporate tax rates

As highlighted in exhibit 5 below, the 13 stocks in our Consistent Compounders Portfolio (CCP) will not only benefit from high existing tax rates (an effect which has been factored into their share price in September already), but also from accelerated earnings growth given their high ROCEs and capital reinvestment rates (a snowball effect which has not yet been factored into their share price).”

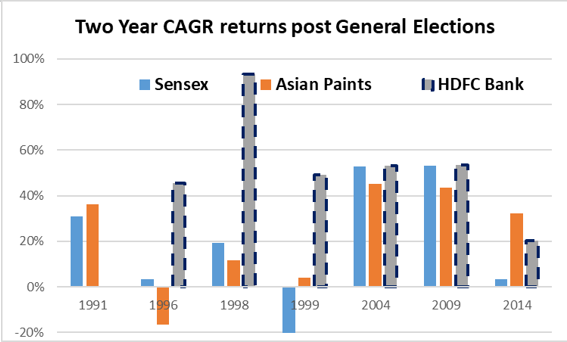

In fact, moving beyond the specifics of the recent corporate tax rate cut, we find that more generally our Consistent Compounder stocks participate more than adequately in the post-Election rallies. As shown in the chart above, in the two year period following General Elections:

(a) the lowest return HDFC Bank has given is 20% CAGR;

(b) the lowest return Asian Paints has given is -17% CAGR [post the 1996 elections];

(c) HDFC Bank has never given negative returns; and

(d) Asian Paints has once given negative returns.

To conclude, the more general points we are driving at are that:

- Economic reforms often seem to benefit specific types of companies rather than benefiting the economy as a whole or benefiting the entire corporate community.

- We have seen repeatedly in India that economic reforms often come in the wake of decisive General Election results.

- In the wake of reforms, even as GDP growth slows, the stockmarket rallies as it anticipates higher future profits for a subset of companies.

To read our other published material, please visit http://marcellus.in/resources/

Saurabh Mukherjea is the author of “The Unusual Billionaires” and “Coffee Can Investing: the Low Risk Route to Stupendous Wealth”.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.