| Portfolio construction based on grandmothers’ stories and advice from snake oil salesmen means that the vast majority of affluent Indians have invested most of their wealth in assets which do not and,cannot deliver returns in excess of the rate of inflation. This skewed portfolio allocation means that millions of Indian families are heading into retirement with portfolios which are being swiftly depleted. How did this happen? And what can be done to retrieve the situation?

An RBI report acts as a warning bell

In August 2017, the RBI published its ‘Indian Household Finance Survey’ (click here). The report highlighted that, amongst other things, “The average Indian household holds 84% of its wealth in real estate and other physical goods, 11% in gold and the residual 5% in financial assets. Retirement accounts play a very limited role in household balance sheets, even at the top of the wealth distribution…Households in advanced economies hold substantially more financial assets than their Indian counterparts, are much more likely to finance home purchasing with a mortgage, and allocate a sizeable fraction of their wealth to retirement savings over the course of their lifetime…The model also cannot explain the observed prominence of physical assets in middle-age, exactly when the potential for the accumulation of financial wealth would be largest…”

Despite the extraordinary nature of the above findings, back in 2017 no one paid too much attention to this report. However, over the last couple of years, having met over 10,000 HNWs, the enormity of the RBI’s 2017 report has hit us – most Indians – including affluent Indians – have allocated the vast majority of their wealth (over 95% according to the RBI report) – to assets which do not and cannot generate a real rate of return. This includes gold, real estate, low-quality debt mutual funds and low-quality stocks. The stage is therefore set for a whole generation of Indians who began working in the early 1980s, and who will retire in the next ten years, to struggle mightily through retirement. How did this disaster take place? And what can be done to mitigate the problems that millions of seemingly affluent Indian families will face as they head into retirement?

The perils of being an Indian HNW

The challenge for affluent Indians who are trying to get their financial planning on track arises from two different sources. Firstly, manufacturers of financial savings products and intermediaries of such products are marketing proactively, and sometimes aggressively, to get a slice of Indian HNWs’ savings pot. Often, these marketing/advertising campaigns have little to do with the facts on the ground. The second challenge facing well-intentioned Indian HNWs is themselves – most affluent investors live in an environment where myths around the pros & cons of various investments proliferate. These myths are often the biggest driver of the investment activities of affluent Indians. We now highlight the four myths that we encounter most often in our discussions with HNWs.

Myth 1: Gold will help me protect my wealth

Over the last 30 years, the price of gold (in rupee terms) has compounded at 9% annualised, marginally higher than the rate of consumer price inflation prevalent in India, thus indicating that gold can act as a reliable store of value in India. However, does holding gold increase your wealth in the Indian context? Over the past three decades, gold has given returns below the rate of inflation in the decade between March 1990 to March 2000 where gold prices rose by 3.5% per annum, and gold has given returns marginally higher than inflation in the decade between March 2010 to March 2020 where gold prices rose by 9.8% per annum. (Source for gold prices: RBI’s database on Indian economy)

Whilst gold does not appear to have the ability to materially augment your wealth – after accounting for the impact inflation – can it improve the risk vs reward trade-off in Indian HNWs’ portfolio i.e. can gold help Indian investors diversify their exposure?

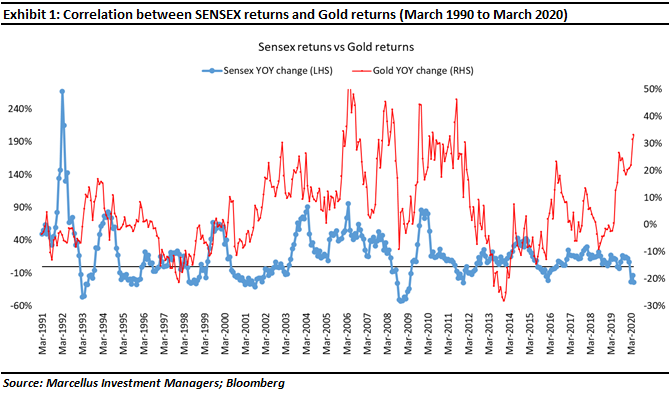

For gold to be an asset that is a meaningful diversifier it should have zero or negative correlation to the Sensex. If we look at the annual change in prices every month – for gold and for the Sensex – from March 1990 to March 2020, we find the two assets to have a positive correlation of 12%. Whilst this might sound counterintuitive to those who see gold to be a ‘safe haven asset’, especially when equities are under pressure (e.g. during the Lehman Brothers collapse and during the Covid panic in Feb-Apr 2020), a look at the price movements of the two assets validates the positive correlation – see the chart (Exhibit 1) shown above

Myth 2: Real Estate will help me grow my wealth

Over the last five years, if one were to look at metropolitan cities in India such as Mumbai, Delhi and Bangalore, one would see that returns on real estate have been around 3-4% per annum i.e. house prices have at best kept pace with consumer inflation, and in major markets like the National Capital Region not even done that (see NHB website: click here)

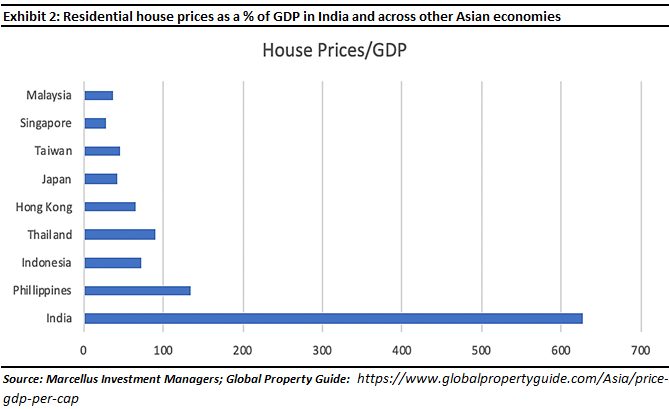

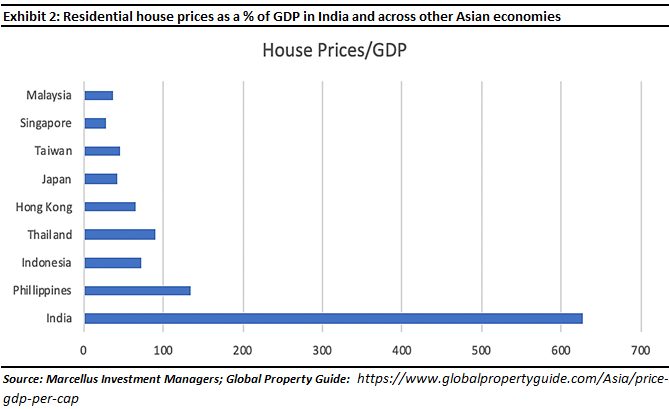

However, there is a school of thought In India which says that because residential real estate returns have been weak over the last 5 years, they will be better going forward. This point of view cannot be sustained when one compares Indian house prices with the prices prevalent in markets outside the country. The first problem is affordability. As shown in the chart below (Exhibit 2), Indian residential house prices, expressed as a proportion of GDP, are 6-10x higher than prices prevalent in other Asian economies.

Secondly, Indian residential rental yields are around 2-3% in most Indian cities. In contrast, the cost of a home loan for prime residential real estate customers is in the vicinity of 7.5%. The disparity between these numbers suggests that Indian residential real estate still has room to correct before It becomes an attractive asset class.

Thirdly, comparing Indian residential rental yields with yields in other countries suggests that the Indian residential property market is significantly overvalued. Other markets where rental yields are comparable to India – say, Singapore and USA – have cost of borrowing in the vicinity of 2-3%. In contrast, as mentioned above, in India, the cost of a home loan even for a prime customer Is around 7.5%. In fact, the cost of a home loan In India Is actually significantly higher than it is in Indonesia (7.5% vs 5%) even though rental yields in Indonesia are much higher than in India (see Global Property Guide website: click here)

Myth 3: Debt mutual funds offer decent returns with low volatility

Salespeople who earn a living by selling mutual funds have popularised the idea that HNWs should invest in debt funds which give industry-beating returns. In spite of the repeated high-profile reverses suffered by prominent mutual fund houses who have high risk, low-quality paper in their debt funds, the intermediary community continues to sell such products. So, why are debt funds far riskier to invest than many investors perceive them to be (and many intermediaries let on)? Monika Halan, the personal finance guru, has provided an excellent explanation on the subject on Value Research (click here)

In our book ‘Coffee Can Investing: the Low Risk Route to Stupendous Wealth’ (2018), we explained the issue in the following manner: A debt mutual fund’s return is a function of: 1) Yield to Maturity or YTM, 2) Mark to Market or MTM, and 3) Expense Ratio. Let’s delve into each of these three items.

MTM and the expense ratio should not differ markedly between debt mutual funds. That brings us to the YTM of a debt fund which is the weighted average yield of all its investments. The yield of a debt fund depends on the credit quality of its portfolio. All corporate debt is ‘rated’ basis the probability of the corporate defaulting on its debt obligations. These ratings are provided by credit rating agencies who, the world over, are conflicted because the issuer of the debt pays the credit rating agency its fees. The debt issuers with the strongest balance sheets get a rating of ‘AAA’ implying that the probability of default is like a government bond. In contrast, the companies with poor debt management may get a rating of ‘B’.

There tends to be an inverse correlation between the rating enjoyed by the debt issuer and the YTM on the issuer’s bonds i.e. companies with strongest ratings enjoy the lowest YTMs. That in turn means that a fund manager who stuffs his debt portfolio full of highly rated bonds, will have a fund with a low YTM and hence it will give low returns. However, that will make the fund unpopular with the army of salespeople who sell such products. So, fund managers who want to earn big bonuses tend to stuff their debt funds full of bonds with low credit ratings. For a few years such funds deliver high returns and then one day when the whole thing blows up, millions of investors find that their savings in debt funds are worth much less than they thought they would be. For a few years after, HNWs steer clear of debt funds, but as the memory of the previous debt fiasco fades, the intermediaries get to work again and the cycle of wealth destruction repeats itself.

Myth 4: GDP growth drives the stock market. So, if I can time the economic cycle, I (or my wealth manager) can time the stock market

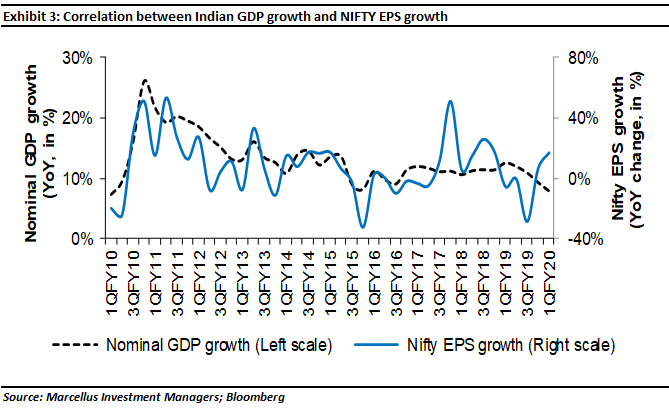

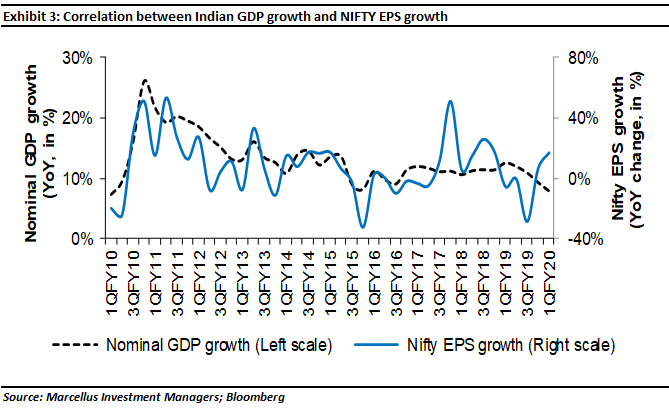

As pointed out in our 26th November 2019 blog, the relationship between Nifty EPS growth and GDP growth seems to have completely broken down in the last five years (click here). Note:

- The growing gap between the two lines in the chart above; and

- The fact that the lines often go in opposite directions.

Hence, the Nifty no longer appears to be a play on the Indian economy.

To understand why the Nifty no longer captures the dynamism of the Indian economy a good place to start is the index as it stood ten years ago. The ten-year share price return from investing in the Nifty is 9% (on a total return basis) i.e. significantly lower than India’s nominal GDP growth which over the preceding decade has been around 12% per annum.

More generally, across the world there tends to be low or no correlation between the stock market and GDP growth, implying that timing the stock market is not possible on a systematic basis. Ben Inker of the fund management house, GMO, published an article in 2012 where he concluded that “Stock market returns do not require a particular level of GDP growth, nor does a particular level of GDP growth imply anything about stock market returns.”

The valuation guru Aswath Damodaran says that the causal relationship instead of running from GDP growth to the stock market instead runs the other way round i.e. stock markets are predictors of GDP growth (rather than being “reflectors of GDP growth”). He highlights a 30% correlation between stock market returns in the US in period t and GDP growth four quarters hence – see slide 8 of this presentation.

Reality: The only reliable way to compound with relatively low risk is CCP

No one that we have met can time the stock market. Neither can we, and we make no attempt to do so. We know of only one way to generate significant real returns in a consistent manner – buy clean, well-managed Indian companies selling essential products behind very high barriers to entry. We call this approach to investing Consistent Compounding and have seen, both in theory and in practice, that it works.

To build the portfolio without using any human judgement each year on 30th June we invest in stocks which in each of the preceding ten years have grown revenues at double digits AND delivered pretax-ROCE of at least 15% per annum (throughout the ten year period). We then hold these stocks for the next ten years. If we had invested Rs 100 using this method on 30th June 2000 then in mid-May 2020 our wealth would have compounded to Rs 1463, a compounded return of 14.4% per annum. In contrast, the same exercise with the Sensex would have yielded Rs 673 implying a return of 10.1% per annum. (Note: both returns are expressed on a total return basis.) In short, in the space of twenty years, using the most rudimentary of financial filters, the Consistent Compounding method of investing would give you almost 15x compounding on your wealth as opposed to a mere 7x compounding from the Sensex. For more details, please refer to our book ‘Coffee Can Investing: the Low Risk Route to Stupendous Returns’ (2018).

Saurabh Mukherjea, Deven Kulkarni and Amaya Chinai are CIO, Analyst and Intern respectively at Marcellus Investment Managers (www.marcellus.in)

|

|

|

|

|

|

|

|