Published on: 7 Nov, 2018

No other large stockmarket is as overwhelmingly macro driven as India’s. Arguably, this is because of the high cost of factors of production and the influence of the Indian state in every aspect of business life. To make money in India, investors need to understand the macro as much as company- specific fundamentals.

“In the late 1990s Rupert Murdoch visited India to explore launching satellite and cable joint-venture operations…After meeting all the government ministers in New Delhi, he flew to Mumbai…to meet Dhirubhai Ambani…Ambani asked Murdoch who he had met in Delhi. Murdoch said that he had met the PM, the Finance Minister and others. ‘Ah, you’ve met all the right people, said Ambani, ‘but if you want to get anywhere in India you must meet all the wrong people.’ By this he meant the corrupt politicians….” – Edward Luce in ‘In spite of the Gods: the Strange Rise of Modern India’ (2006)

Our rigorous data crunch singles out India

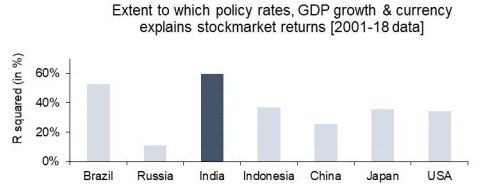

Using quarterly data for the last 18 years, we used regression analysis to understand the impact of three macro variable (exchange rates (YoY change), GDP growth and interest rates) on stock prices. Our crunch shows that 60% of the variability in stock prices in India is driven by these macro factors. In contrast, in the two biggest stockmarkets in the world – USA and Japan – the corresponding figures are 34% and 35% respectively, implying that in these markets company-specific factors are responsible for two-thirds of shareholder returns.

In the largest Emerging Market, China, macro factors explain only 25% of the variability in share prices. The only Emerging Market which is comparable to India is Brazil where 53% of the variability in share prices is driven by macro factors. But this is to be expected for Brazil is primarily a commodity dependent economy.

So why does the Indian stockmarket stand out in its dependence on macro?

We can think of three good reasons why stock prices in India are primarily dependant on macro factors:

- India is still fundamentally a feudal society with our politicians being the kings. As a result, most sectors are still heavily regulated by the Centre, the State and by local government eg. to start a hotel in Mumbai one needs almost 60 clearances from various layers of Government. A case study currently playing out in front of us which demonstrates nicely why macro dominates in India is the NBFC crisis – when the NBFCs realised that they will struggle to refinance their Commercial Papers they, as a group, ran straight to New Delhi which responded with a majestic show of power. The UPA Government too was a masterly exponent of political patronage – read this story for an example:https://www.indiatoday.in/magazine/nation/story/20120123-vedanta-anil-agarwal-p-chidambaram-flip-flop-sesa-goa-756976-2012-01-14

. - Factors of production are much more expensive in India compared to other large economies. For almost the entire period under consideration (2001-18), the cost of borrowing for SMEs in India has been well in excess of 11%. In contrast, in economies like China, Japan and USA, SMEs borrow at rates well below 5%. Minimum wages in India are 3x that in Bangladesh (and this inspite of the fact that Bangladesh has healthier, more literate workers). Click here for an interesting post on this subject by an Indian businessmanhttps://www.forbes.com/sites/quora/2017/12/13/why-is-manufacturing-more-expensive-in-india-than-in-china/#7cbcf3ba6301

. - If we could segment the Indian stockmarket in South vs North, it is highly likely that in the South we would see company-specific factors being more important than the North. The North of India (specifically the area between the Pakistan and Bangladesh borders) is an economic disaster without parallel in the post-World War II era. Per capita income there is less than half that of the South. Female labour force participation there is lower than in Pakistan and Afghanistan. On human development indicators, North India is on par only with war torn African countries. If you exclude the megapolis around Delhi, in North India it does not make sense to even talk about company-specific factors.

Investment implications

If you are managing money in India, you have to be able to understand the macroeconomy. If you can’t understand where the cost of funding or the exchange rate will go in India, you will have a tough time managing an Indian equities portfolio no matter how good your stock selection skills are.

Secondly, because the macro is tough in India, very few companies are able to outperform over extended periods of time. If, for example, you ran a data crunch on the 1990s and look for companies who over that decade grew revenues each year by at least double digits alongside at least 12% post-tax ROCE, you find only 5 companies – NIIT, Cipla, Hero Moto, Swaraj Engines and HDFC. The good news is that if you purchased these stocks in 2000, by 2010 your portfolio would be up almost 10x. A similar data crunch in 2018 would give you 12 companies. Companies who survive the vicissitudes of India’s macro are world class and you profit from backing these stocks.

Thirdly, if life does get incrementally easier for SMEs going forward (India’s upward movement in World Bank’s ‘Ease of Doing Business’ is encouraging on this front) and if cost of funding does fall for SMEs going forward (again, the past decade has been encouraging on this front) then the investment paradigm will change in India. One could then look to buy top quality smallcap companies and stay invested with them over extended periods (much like the young Warren Buffett did in post-World War II America)

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services.

Saurabh Mukherjea is the author of “The Unusual Billionaires” and “Coffee Can Investing: the Low Risk Route to Stupendous Wealth”. He’s also the Founder of Marcellus Investment Managers

Copyright © 2018 Marcellus Investment Managers Pvt Ltd, All rights reserved

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.