Published on: 8th October, 2019

Simon Sinek’s latest book ‘The Infinite Game’ should be celebrated as a breath of fresh air in the futile discourse around the rightful purpose of capitalism. In that context, one of India’s greatest sons – the late Verghese Kurien, the man who made Amul a powerhouse – deserves to be lauded as the greatest player of the ‘Infinite Game’. We can learn from Sinek & Kurien about how ‘just cause’ lie at the heart of great enterprises.

“…he was the man who revolutionised milk production in India, transforming the country from a milk-deficient place to the world’s largest producer (with 17% of the global total), and along the way drawing millions of rural farmers out of poverty…Few others had his tenacity, his drive, his sheer bloody-mindedness, to get government ministers and foot-dragging babus to yield to his ideas. No village panchayat, no landowner, no grasping corporatist, stood for long in his way. One minister of agriculture tried to remove him from the National Dairy Development Board, of which he was founder-chairman for 33 years; instead, the minister lost his own job. The saying in Delhi was, “Don’t touch Kurien.” Once engaged in a knuckle-banging argument, he never gave in; and he never gave in, of course, because he was right.” – The Economist’s obituary on Verghese Kurien, 22 September 2012 (source: https://www.economist.com/obituary/2012/09/22/verghese-kurien)

The Greatest Exponent of the Infinite Game….

Nine years ago Simon Sinek shot to fame with his incredibly popular Ted Talk. His books Start With Whyand Leaders Eat Last have been an inspiration for those looking to build businesses with purpose. In his latest book, The Infinite Game, he extends those principles for those who want to build businesses that outlast them. In an interview with Greg Thomas of Workday (see https://blogs.workday.com/simon-sinek-to-succeed-in–business-you-must-understand-the-game/ Sinek cites the example of the Vietnamese war which the Americans lost despite winning all the battles. Sinek says ‘It’s not so much that America lost the war, it’s that America was fighting to win and the North Vietnamese were fighting for their lives. America didn’t lose, they ran out of the will or the resources to stay in the game and dropped out of it.’ For anyone seeking to build a lasting business, it is important to distinguish the battles from the war and thus play Sinek’s infinite game.

In fact, quoting further from Sinek’s interview with Workday illustrates this point more clearly:

- “There is no such thing as winning business—it doesn’t exist. We can have wins inside a business like you can have battles, but there’s no such thing as “winning” business. The problem is too many business owners, too many leaders don’t know the game they’re playing. They talk about being number one, being the best, beating their competition. Based upon what agreed-upon metrics? Based upon what agreed upon timeframes? There’s no such thing.

When we play with a finite mindset in the infinite game, there are a few very consistent and predictable things that happen. Over the course of time, you will see a decline in trust, cooperation, and innovation. Eventually, your organization will run out of the will or the resources to stay in the game. We call it bankruptcy; we call it a merger and acquisition.” - In order to build an infinite business, you need to have several things in place. “First, you have to have a just cause. A cause so just that you would willingly sacrifice your interest to advance that cause. Second, you have to have trusting teams. It means that we work with and for people such that we can raise our hands and say, “I made a mistake or I’m scared or I have troubles at home and they’re affecting my work,” without any fear of humiliation and retribution.

Third, you have to have a worthy rival. They reveal to us our weaknesses; that’s what makes us so uncomfortable in their presence or when their names come up. Instead of getting angry about them, try to learn what it is about them that people admire and love so much, and maybe focus that energy into working on ourselves. Self-improvement. Every day. Constantly.

Fourth, you have to have the capacity for existential flexibility. This is much bigger than the daily flexibility that we need to have in our jobs. An existential flex is the capacity to make a dramatically huge strategic shift in an entirely new direction to advance our cause.

And finally, you have to have the courage to lead. That means the courage to say, “That’s bad for business, and I’m going to do it differently.” People may call you naïve and say you don’t understand the business. You may say they don’t understand the game they’re playing. That takes tremendous courage.

…I’m talking about the ability to massively shift an entire business model because it’s the right thing to do to advance the movement. Why is it that the technology industry invented the electronic book, and not the publishing industry? Because publishing thought they were in the book business, not the reading business. Why is it that the movie industry and the television industry didn’t invent Netflix? It’s because companies can be so preoccupied with protecting the status quo they don’t make these existential flexes until they’re forced to, and then they’re playing defense the entire time.”

…Lived & worked in Anand, Gujarat

Sinek’s new book isn’t available in India as yet but reading the Workday blog reminded us of Amul and the man who engineered this remarkable enterprise’s rise to glory – Verghese Kurien.

Born into an affluent Syrian Anglican family in Kerala in 1921, Kurien excelled in academics & sport first in Loyola College in Chennai, then in the College of Engineering (Guindy) and, finally, in Michigan State University (where he was sent on an elite scholarship sponsored by the Government of India). Upon his return to India, in 1949 the Government sent him to work at a run-down creamery in Anand in what was then part of Bombay state and is now Gujarat.

Kurien hated his Government job in Anand and when he quit a few months later, Tribhuvandas Patel, a prominent political leader of local farmers, persuaded Kurien to stay and help run the Kaira District Cooperative Milk Producers’ Union Limited which came to be known popularly as Amul dairy). 25 years later this co-operative was merged into other co-operatives to create the now legendary Gujarat Cooperative Milk Marketing Federation Ltd (GCMMF).

Arguably, the most striking example of sustained co-operation on an epic scale in India, GCMMF generated revenues in FY19 of Rs 330 billion (nearly US$5 billion). That is 3x as much as its closest competitor Nestle India’s revenues and that is only 20% shy of Hindustan Unilever’s revenues. On this measure, GCMMF is India’s second largest FMCG company.

Not only is GCMMF big, it grows much faster than its rivals. Over the past decade, GCMMF has grown revenues at 17% CAGR compared to Nestle’s 10% and HUL’s 9%. Over the last five years, the growth gap between GCMMF and its two largest rivals is even bigger! In key FMCG product categories such as butter, cheese and packaged milk, Amul has been the longstanding market leader in the face of sustained efforts by MNCs to break its dominance. GCMMF is also India’s biggest exporter of dairy products.

Growth aside, the scale on which GCMMF operates is astonishing. GCMMF’s daily procurement of milk is 23 million litres from over 18,700 village milk co-operative societies (which include 3.6 million milk producer members). The way GCMMF aggregates the milk produced by over 3 million families into the village co-operative dairy and then further aggregates that into the district co-operative which in turn feeds into the mother dairy has been studied by numerous management experts.

So how does GCMMF give a fair deal to its farmers, its management team, its 10,000 dealers, its one million retailers and its hundreds of millions of customers? At the core of this pioneering co-operative’s success appear to be four factors:

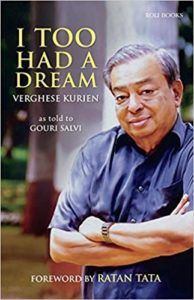

- Careful cultivation of brand: Its 60 year old brand with the its distinctive imagery of the little girl in the polka red dotted dress has been central to Amul’s success. Cultivated with great effort and patience, numerous surveys has shown ‘Amul’ to be one of the most trusted brands in the country. As Kurien says in his autobiography ‘I Too Had a Dream’ (2005), “…we had to make the products as attractive as possible to the market.. We sought help from advertising professionals…In 1966…the Amul account was given to the Advertising and Sales Promotion Company (ASP) with the brief that they should dislodge Polson from its ‘premier brand’ position in Bombay. That was when Eustace Fernandes of ASP created the Amul mascot – the mischievous, endearing girl. The image of the Amul girl went down so well with consumers that very soon it became synonymous with Amul….Together, the team at ASP gave Amul butter its memorable and catchy campaign tagline ‘Utterly, butterly, delicious’ – which broke all records to become the longest-running campaigns in Indian advertising history.”

- Sustained alignment with stakeholders’ interests: The practical concept – implemented daily in millions of homes – of a fair deal for the farmer and the linked idea of the disintermediation of the middleman. As Harish Damodaran explains in ‘India’s New Capitalists’ (2008), “A farmer pouring buffalo milk with 6% fat content to a Gujarat co-operative 2004-05 would receive Rs 13-14 per litre, which is 25-30% more than the corresponding farmgate prices paid by dairies elsewhere in the country…If the electronic tester displayed in front were to show the fat content for a particular lot of milk at 8%, the milkman would be entitled to a proportionately higher prices of Rs 17-18 per litre. Taking an average rate of Rs 13, the GCMMF dairies would in 2004-05 have pumped in around Rs 2,800 core to their farm members, constituting 70% of their aggregate turnover of Rs 4,000 crore. By contrast, milk purchase costs are less than half of the value of product sales for a company like Nestle India, marking the essential difference between a farmer controlled co-operative and an investor owned concern.”

- Political and regulatory capture: GCMMF and Kurien were able to co-opt almost every single politician of note in independent India to help them promote the cause of Gujarati farmers. As Kurien’s autobiography shows, Sardar Patel, Tribhuvandas Patel, JL Nehru, Lal Bahadur Shastri, Morarji Desai, TT Krishnamachari, YB Chavan, Indira Gandhi – basically anybody who mattered in New Delhi or Western Indian politics was brought to Anand, wowed by the scale of the miracle in Anand and converted to the cause of promoting Amul. Kurien explains in his autobiography how he repeatedly used his political clout to hurt his competitors by getting bans, embargoes, tariffs, etc imposed on them. Eg. in 1962, upon the Indian Army’s request, Kurien stopped supplying butter to the open market and instead diverted all his output to the Army. When a rival company, Polson, took advantage of this by increasing the prices of its butter, Kurien simply went to the Government and had Polson’s butter output frozen. When Polson’s aggrieved promoter complained to the relevant Minister in Ahmedabad, Kurien told him in front of the Minister “You bloody bastard. You come here and speak lies to the Minister. I will castrate you.”

- Calculated risk taking a consistent basis: With a clear goal of helping farmer’s earn more from their produce, Kurien repeatedly took major risks to open up new opportunities for Amul. For example, in the 1950s, in the flush season Amul’s farmers were producing twice as much as milk as was required by the Bombay market (Amul’s main market at that point). The logical thing to do was to convert this surplus into skimmed milk powder and condensed milk. However, at that point of time the received wisdom the world over was that buffalo milk – which was Amul’s main output – could not be used to make skimmed milk powder and condensed milk. In a ‘world first’ demonstration of its kind, using a machine made by L&T, Kurien’s colleague and college friend, HM Dalaya, demonstrated to the Bombay Government that buffalo milk could be used to make skimmed milk powder. (Incidentally, the demo took place a couple of kilometres from Marcellus’ office in Andheri East.) A few years later, Amul made cheese from buffalo milk, another world first. Kurien’s autobiography ‘I Too Had a Dream’ contains several examples of audacious risk taking on a pan-India including the launch of ‘Operation Flood’ in 1970 – the scheme which took the Amul model pan-India and catapulted India from a milk powder importing beggarly nation into a surplus milk exporter. (If you grew up in the India of the 1970s and 1980s, you owe your physical development to Operation Flood milk and hence to Kurien!)

Investment implications

In Sinek’s world it does not matter whether an enterprise is for-profit or not-for-profit, private sector or public sector. What matters more is over what horizon the enterprise thinks, plans and acts. If these enterprises don’t think, plan and act over very long time frames, it is ‘game over’ for them regardless of how good their staff are, how strong their competitive advantages are, how strong their balance sheet is. Furthermore, to sustain any purposeful endeavour over long periods of time, the enterprise needs to be centred around a ‘just cause’ [whether it is for-profit or otherwise is a secondary distinction because customers are not bothered about the enterprise’s profits].

In India, we find a very small number of listed enterprises have the mindset to play the infinite game. Not only are most promoters short termist, they have no cause to pursue (the two issues are obviously linked). As a result they flit from one opportunity to other whilst constant being buffeted by free market forces and being preyed upon by bankers, brokers and corporate financiers.

To quote from my 2016 bestseller ‘The Unusual Billionaires’: “’Most Indian companies tend to focus on short-term results and hence that makes them frequently do things that deviate away from their articulated strategy…these deviations take them away from the path they have to travel to achieve their long term goals…the willingness to resist the temptation of short-term ‘off strategy’ profits for long-term sustainable gain is not there in most leading companies,’ writes Rama Bijapurkar, a leading market strategy consultant…The typical promoter profiled in [“The Unusual Billionaires’] is patient and persevering, even bordering of the boring. He ignores short-term thrills based on flavour-of-the-month ideas. He consciously rejects aggressive forays into unrelated businesses…Such behaviour requires tremendous patience and a willingness to ignore the stock market’s proclamations regarding prevailing fads and fashions.”

Asian Paints, Berger Paints, Marico and HDFC Bank are amongst the companies covered in detail in “The Unusual Billionaires.” All four companies are a part of our Consistent Compounders Portfolio. You can see here how our portfolio is doing:

Verghese Kurien was ousted from his leadership role in GCMMF in 2006 by politically vested interests. (If you are interested in what transpired.The great man passed away six years later. Verghese Kurien’s legacy will outlast the vested interests who found it fit to stab this modern day Caesar in his Rome.

To read our other published material, please visit http://marcellus.in/resources/

Saurabh Mukherjea is the author of “The Unusual Billionaires” and “Coffee Can Investing: the Low Risk Route to Stupendous Wealth”.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Copyright © 2019 Marcellus Investment Managers Pvt Ltd, All rights reserved.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.