“Everyone holds his fortune in his own hands, like a sculptor the raw materials he will fashion into a figure. But it’s the same with that type of artistic activity as with all others: We are merely born with the capability to do it. The skill to mould the material into what we want must be learned and attentively cultivated. “ – Johann Wolfgang von Goethe

A super idea from a podcast host

I was recently recording a podcast about my latest book “The Victory Project: Six Steps to Peak Potential” with my co-author Anupam Gupta when Anupam came up with a great question. He asked me “what is the main difference between the Simplicity Paradigm which we have laid out in the book versus what most people do in their day-to-day lives?” Anupam’s question got me thinking about the world which I know best, the world in which I try to earn my daily bread – asset management. In this note, I have tried to address – using the Simplicity Paradigm – how the truly great investors are different from the rest of us.

Great vs Good in the context of the Simplicity Paradigm

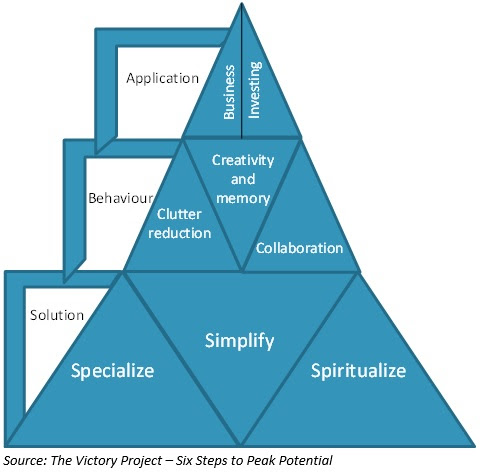

The Simplicity Paradigm – shown in the diagram above – has two layers of skills. The first layer focuses on building positive behavioural habits (specialisation, simplicity and spirituality) which become the foundations of a high performing professional’s career. The second layer focuses on building more advanced skills (clutter reduction, creativity and collaboration). Millions of people are hardworking & ambitious but, as we have explained in the book, only a select few have the discipline to adopt the Simplicity Paradigm in a disciplined manner.

In my 20 year career as a broker and a fund manager, first in the UK and then in India, I have found that there are three specific facets of the Simplicity Paradigm on which great fund managers work very hard to pull away from the herd:

Deep focus alongside clutter reduction: one of the most interesting things I have found in my meetings with great investors over the years is how fiercely they can concentrate on a subject for an extended period of time. We have spoken to Mark Mobius several times over the last couple of years. In some instances our discussions have extended beyond 90 minutes. Not once has Dr Mobius interrupted the meetings to take phone calls or read his Whatsapp messages. In fact, the longer the meeting goes on, the greater the powers of concentration of this 83 year old investment legend who did much to build the asset class that is today called Emerging Market equities.

When we met Prof Sanjay Bakshi, the managing partner at Value Quest Capital, in Delhi at the Lodhi Hotel to interview him for the book, the meeting lasted for over two hours. Prof Bakshi is a big believer in the idea of intense focus and cutting off all distractions to spend quality time on a single idea. He showed his phone has a blank home screen and no notifications. Throughout our meeting, his phone did not beep or light up or ring even once. In those two hours he gave us some of the deepest insights into fierce focus that I have received in my career. Chapter 3 of The Victory Project contains these insights.

Similarly when we interviewed Sanjiv Bikhchandani of Infoedge – arguably amongst the most successful VC investors in contemporary India – for the Victory Project, the meeting lasted for over 90 minutes. During that time, he did not once look at his mobile phone or entertain other visitors.

Clearly these investors have numerous calls on their time but their ability to declutter their minds and their diaries and concentrate for extended periods of time marks them out from a typical fund manager whose life revolves around monitoring newsflow and share prices all day long even as emails and Whatsapp messages keep pinging away on his mobile phone.

Creativity alongside extensive reading: The tendency of investment analysts is to believe that their success, or lack thereof, is down to how hard they work on reading annual reports or on building their financial models. The reality is that if you want outsized success as an analyst or investor you have to necessarily see the world from angles that others cannot even imagine. You have to discover perspectives which are undiscovered. You have to take your mind to places that no else has been to. So how do you do that?

Mark Mobius and Prof Sanjay Bakshi are not just successful investors, they are also voracious readers. Not only do they read plenty of finance literature but also material pertaining to the arts and spirituality. As Dr Mobius says in Chapter 9 of the book, “Learn the fundamental skills like reading and writing. Go to museums because art gives you a hint about how the future can look. Develop your creativity – so learn to play an instrument, learn to draw, learn creative writing. Machines and robotics will take away a lot of the normal work that we do and we will be relegated more and more to the creative aspects like creating new concepts.”

We also saw during our research for the book, how the Marico Chairman, Harsh Mariwala’s, library is well stocked with books on management and on psychology. In fact, every single expert we interviewed for the book turned out to be a voracious reader. By the time we finished writing the book, we fully understood why Charlie Munger says, “In my whole life, I have known no wise people….who didn’t read all the time – none, zero.”

Collaborative skills: The modern cult of achievement is very much built around the individual. It is a bit like Ayn Rand’s philosophy from her book “The Fountainhead” on steroids. People have been taught to believe that they can succeed in highly competitive professions by riding roughshod over people. The exam oriented education system in India further encourages this type of thinking. However, back in the real world, whether you want to build a great company, a great product, launch a successful fund or compose great music – all successful endeavour is necessarily collaborative. Great investors understand this. Jason Voss, a successful American investor, who we interviewed for the book told us that the idea that capitalism is the pre-eminent institution of competition is a faulty one. In his view, capitalism is as much about co-operation as it is about competition. “All of this is hardcoded in us like a program. I would say that it is a software programme that is in need of an upgrade,” he told us.

This collaborative spirit pervades the great investment partnerships of our era whether it is Warren Buffett & Charlie Munger or Motilal Oswal & Raamdeo Agrawal or George Soros & Stanley Druckenmiller. Such partnerships are especially effective if the partners bring different skillsets and diverse perspectives to the table. As psychologist Matthew Liberman says in his book “Social”, ‘The greatest ideas always require teamwork to bring them to fruition; social reasoning is what allows us to build and maintain the social relationship and infrastructure needed for teams to thrive.’

Saurabh Mukherjea is the CIO at Marcellus Investment Managers (www.marcellus.in). Saurabh and Anupam Gupta’s book ‘The Victory Project: Six Steps to Peak Potential’, will be published on 17th August by Penguin.