With most investors spending majority of their time reading and thinking about Coronavirus, it would be fair to say that their minds are now firmly “anchored” by the crisis. As Kahneman & Tversky showed 40 years ago, anchoring impacts our ability to think rationally. 300 years ago, Thomas Bayes created a pathbreaking theorem which can be used to rationally think about the risks around Covid-19. Applying Bayes’ Theorem shows that the risk of us dying from road accidents or from air pollution in an Indian city is at least FOUR TIMES HIGHER than the risk of us dying from Covid. Hence a rational investor like us cannot help being massively bullish on high quality Indian stocks.

“When the facts change, I change my opinion. What do you do, Sir?” – John Maynard Keynes

Wall to wall Covid coverage anchors us

Over the last month, the global media has gone into overdrive to give all of us nonstop coverage of the Covid–19 crisis. In addition, on social media, millions of self-proclaimed Corona gurus have emerged to spell out their visions of impending doom. In such circumstances, it is but natural that most people have got “anchored” to the belief that it is the end of the world as we know it.

The first psychologists to show us how anchoring works were the fathers of behavioural science, Daniel Kahneman and Amos Tversky. 40 years ago, they showed us how anchoring results in people taking a decision based on an initial view.

In one of their experiments they asked a group of high school students to give the product of the following equation within 5 seconds: 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1. And to another group of high school students, they gave the following equation: 1 x 2 x 3 x 4 x 5 x 6 x 7 x 8. People tend to extrapolate the answers using only the first piece of information that they have and hence the median answer of the first group was 2,250 and for the second group it was 512. However, the correct answer to the equation is 40,320. (Link – pg, 1128, “Adjustment and Anchoring”)

Taking this simple example of anchoring and applying it to the current scenario, it appears to us that most people are overestimating the risk posed to them (and to their livelihoods and to their portfolios) by Covid-19. This overestimation is being fuelled further by tendency of people to resort to “confirmation bias” where people will give undue weightage to information that confirms their initial view.

Bayes’ Theorem to the rescue

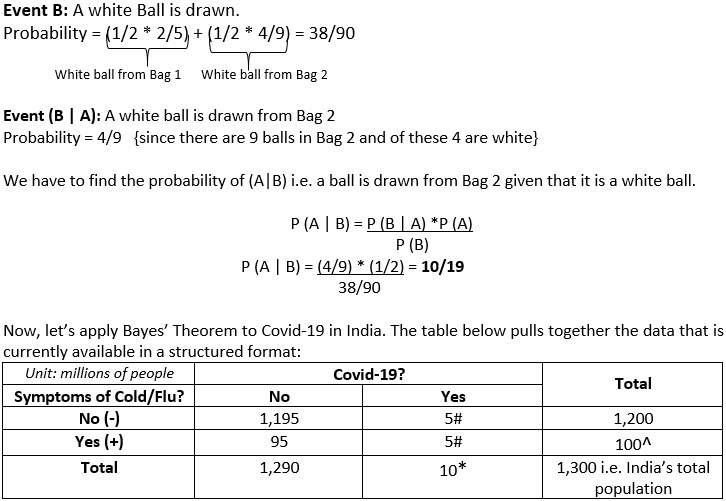

Given the paucity of data available on Covid-19, how does one reach a realistic assessment of risk? We at Marcellus have taken a shot at it with the help of Bayes’ Theorem, which describes the probability of an event, based on prior knowledge of conditions that might be related to the event.

In simple terms, Bayes’ Theorem helps in calculating the probability of certain event (say, Event A) given that another event (say, Event B) has already happened. The formula is:

Assumptions:

*Globally, the number of confirmed cases has reached 2 million and it is now showing signs of peaking (scroll down the page on this link and you will see the number of new Covid cases flat lining). However, it could well be that the number of new cases is levelling out because large parts of the world are under a lockdown and hence in our model, we have assumed 5x that number 10 million positive cases in India alone. We hope you will agree that this is an extremely conservative assumption.

#While it is still unclear about the distribution between symptomatic and asymptomatic cases, we have assumed that the number of asymptomatic cases is equal to symptomatic cases. We hope you will agree that this too is an extremely conservative assumption.

^The total number of tests done so far in India is around 200,000 and the number of people tested positive for Covid in India is around 10,000. Hence the ratio of cases/tests is around 5% i.e. India seems to have one of the lowest Covid infection rates in the world (Link). Erring on the side of caution, we have assumed the infection rate to be 5% in our model. Hence the number of people having symptoms, given that the number of symptomatic cases is assumed to be 5m, is around 100m. [This number is likely to be an extremely conservative estimate because it feeds off the the two preceding assumptions which are extremely conservative.]

Note: Numbers are updated as of 14th April, 2020.

What the table above is saying is:

- Even if one has symptoms of cough & cold, the chances of having Covid-19 in India is only 5% [first row of the table shown above].

- Without symptoms (of cough & cold) the chances of being infected by Covid-19 in India falls to 0.42% [second row of the table].

- Even if you do have symptoms of cough & cold, the chances of NOT having Covid-19 are 95% [third row of the table shown above; this is why you have to marvel at the power of Bayes’ Theorem].

- The chances of you not having Covid-19 and not having symptoms are very high at 99.58% [fourth row of the table shown above].

- Finally, the probability of an Indian citizen having Covid-19 is 0.77% [final row of the table shown above].

Even if one tests positive for Covid-19, the probability of a fatality is around 6% worldwide, while for India, fatality rate appears to be around 3% [Death rate = No. of deaths/no. of total cases, Link). This implies that under these extremely conservative (some will say cynical) assumptions made by us, India could see 300,000 Covid fatalities (10 million from the table above * 3%). To put this number of fatalities into perspective:

- So far, globally, 120,000 people have lost their lives to Covid (Link). So India alone suffering 300,000 fatalities sounds extreme.

- In 2018, there were around 150,000 deaths in India due to road accidents. Furthermore, the number of deaths due to air pollution in India is around 1,200,000 a year. Useful sources of getting these numbers are given – deaths due to road accidents, deaths due to air pollution

Investment implications

For those of us who live in Indian cities, you and I are at far greater risk of dying from a road accident or from air pollution in India than we are from Covid-19. In fact, the risk of us dying from road accidents or from air pollution in an Indian city is at LEAST FOUR TIMES HIGHER than the risk of us dying from Covid (and we are almost certainly overestimating the Covid related risks we face in India in the maths shown above). Of course, that shouldn’t stop us from scaring ourselves silly about Covid-19. However, the stock market rewards those who think about risks & rewards rationally, people like John Maynard Keynes, who other than being a pathbreaking economist was also a very good investor.

The data that is emerging from India is telling us that even amongst the 200,000 Indians who have been tested so far, the Covid-19 infection risks are amongst the lowest in the world. The data is also showing that the number of new Covid cases is already levelling out in India. We, as rational investors, believe therefore that to extrapolate the current lockdown in India and forecast a doom-laden future would be imprudent. In three separate notes recently, we have explained our view on how we are investing through the crisis:

- In our 22nd March blog we said that “Four times in the last 40 years, a US recession alongside falling US bond yields and falling oil prices has been followed by a strong economic recovery in India. In fact, India has NEVER witnessed an economic recovery without a US recession preceding it! Now, all three conditions for an Indian economic recovery – a US recession, smashed crude prices and falling US Government bond yields are – in place. Our portfolios – CCP and LCP – are ideally designed to capitalise on such an economic recovery.”

- In our 6th April Consistent Compounders newsletter we said that “In FY20, Marcellus’ CCP PMS has delivered healthy absolute returns (+7.6% vs -25.0% for Nifty50 Total Return Index) alongside resilience during the recent stock market correction (since 1st Jan 2020: -12.9% for Marcellus CCP vs -29.1% for Nifty50 TRI). Beyond the period of business disruption from the ongoing lockdown, fundamentals of Marcellus’ CCP companies are likely to remain exceptionally strong due to: a) insignificant exposure to global demand and global supply chains; b) high exposure to small ticket daily essential products and services; and c) the opportunity to accelerate market share gains given the challenges faced by weaker/smaller competitors. Hence, the share price recovery after every such crisis happens sooner and sharper for CCP companies (vs the broader market) and timing entry / exits in such a portfolio tends to be a futile exercise.”

- In our 7th April Little Champs newsletter we said that “We see limited impact of COVID-19 on Little Champs’ fundamentals beyond the short-term business disruptions given: (i) their strong balance sheets will help them navigate the near-term stress much better than leveraged peers; and (ii) export oriented portfolio companies’ exposure is mostly in essential products (pharma, agro, food) or replacement markets rendering immunity from a potential global recession. In fact, Little Champs are likely to emerge relatively stronger out of the situation as they can afford to invest in business growth (product/process innovation, market expansion) through the crisis but most of their peers cannot. Hence, we expect the Little Champs portfolio to demonstrate resilience in the market downturn (portfolio down 15% since January 2020 vs BSE Smallcap’s 30%) as well as to recover faster as the uncertainty fades.”

Harsh Shah and Saurabh Mukherjea are Analyst and CIO respectively at Marcellus Investment Managers.

If you want to read our other published material, please visit https://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.