Published on: 22 Feb, 2019

The more we get plugged into social & mass media, the harder it becomes to escape the echo chamber of consensus thought. In stark contrast, original thinkers – in Investing and beyond – have wide ranging interests beyond their profession, have a yearning to alter the status quo and a high rate of idea generation.

Marcellus is offering a six month internship to a youngster who wants to learn investment analysis under our senior analysts: http://marcellus.in/jobs/

““Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.” – John Maynard Keynes

“…In the study, we had 163 participants complete a classic test of “divergent thinking” called the alternate uses task, which asks people to think of new and unusual uses for objects. As they completed the test, they underwent fMRI scans, which measures blood flow to parts of the brain.

The task assesses people’s ability to diverge from the common uses of an object. For example, in the study, we showed participants different objects on a screen, such as a gum wrapper or a sock, and asked to come up with creative ways to use them. Some ideas were more creative than others. For the sock, one participant suggested using it to warm your feet – the common use for a sock – while another participant suggested using it as a water filtration system.

Importantly, we found that people who did better on this task also tended to report having more creative hobbies and achievements, which is consistent with previous studies showing that the task measures general creative thinking ability…” – Roger Beaty, New Study Reveals Why Some People Are More Creative Than Others, 2018, (Source: http://theconversation.com/new-study-reveals-why-some-people-are-more-creative-than-others-90065)

Trapped in the echo chamber

The irony of contemporary urban life is that the more connected we are to each other through social media, the greater the likelihood that all of us will be locked in the same echo chamber and thus mouth the same messages. To the extent that the job of a professional investor is to think originally, to think independently, that job has arguably been made harder by the rise of both social and popular media. Therefore, are there methods which we can use to swing the odds in our favour? Given the costs – social and financial – of deviating from consensus, can we make it easier for ourselves to think independently? My friend, Anupam Gupta, and I recently wrote a column on this subject for The Ken. Click here to access the full column: https://the-ken.com/story/the-power-of-thinking-differently/?utm_source=tkow_story_v2&utm_medium=email&utm_campaign=daily_newsletter

What follows below are some excerpts from that column.

Underlying motivations matter

When we look around at the high achievers around us, we see two broad personality types. Type 1 people are striving to achieve new heights within an existing system whereas Type 2 people are challenging the existing system and being a force for change. Both are perfectly sound motivations and most people that we know fall in one of these two buckets. For example, the cricket superstar, Virat Kohli, the son of a criminal lawyer from west Delhi, is clearly driven by the need to becoming the best cricketer on the planet. He has worked very hard to achieve his goals and his weight training, diet and fitness regime in particular has set new standards of physical fitness in Indian cricket.

The celebrated author, Arundhati Roy, on the other hand is driven by the need to speak out against the establishment and in favour of the underdog. Roy, the daughter of renowned social rights activist Aruna Roy, is fundamentally driven by the need to challenge the status quo because of her belief that the status quo gives a raw deal to many groups in Indian society. Roy’s books have brought her fame and fortune but those outcomes are not what drive her to write. Writing is her chosen medium with which to change the world. Roy’s views on the Indian state, the unrestrained descriptions of sexuality in her books have made her the target of abuse by Indian nationalists and conservatives but that doesn’t frazzle her probably because she did not set out in the first place to seek popularity.

Virat Kohli strives for excellence within a pre-existing system (for elite cricketers). Roy strives to bring about change in the system. Both of them, arguably, make our lives richer. However, a Type 1 personality like Kohli does not have to deal with shaking up the status quo and taking on the establishment. Whereas, the Type 2 personality has already broken away from conformity and therefore is already thinking differently. Creative thinking comes more easily to those who want to change the status quo and have a visceral desire to shake up the establishment.

Interests beyond Finance and Investing matter

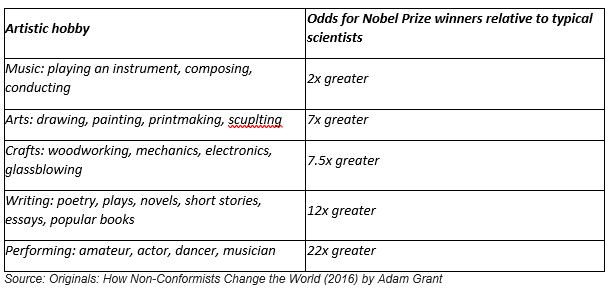

In his superb study of original thought, “Originals: How Non-Conformists Change the World” (2016), American academic, Adam Grant, notes that the most original thinkers in science – Nobel Prize winning scientists – tend to have the most diverse interests well beyond their scientific pursuits:

“In a recent study comparing every Nobel Prize-winning scientist from 1901 to 2015 with typical scientists of the same era, both groups attained deep expertise in their respective fields of study. But the Nobel Prize winners were dramatically more likely to be involved in the arts than less accomplished scientists. Here’s what 15 researchers at Michigan State University found about engagement in the arts among Nobel Prize winners relative to ordinary scientists….” [see table below]

We believe that this point can also be applied in the context of the investing profession. Investors who are open to cultural and/or professional influences beyond their comfort zone are much more likely to be original thinkers. If you have grown up in financial centres like Mumbai, Singapore or London and these cities – and the lifestyles of the people in it – is all that you see, not only is it harder for you to think originally, it also tougher for you to break away from the conventional markers of success in corporate life. Ultimately, the markers of success which we yearn for end up anchoring our thinking. To have alternative aspirations, one needs to cultivate alternative passions and alternative markers of achievement beyond Finance and Investing.

Working hard and producing lots of ideas helps

The Stanford professor Robert Sutton says that “Originals will come up with many ideas that are strange mutations, dead ends and utter failures. The cost is worthwhile because they also generate a larger pool of ideas – especially novel ideas.” (Source: Weird ideas that worked – 11.5 practices for promoting, managing & sustaining innovation (2001) by Robert Sutton)

The film director Satyajit Ray directed 36 movies in a 35 year career stretching from the mid-1950s to the early 1990s. In addition he published over two dozen books in Bengali (short stories, novels and poetry) and three books analyzing cinema (in India and around the world). From this phenomenal body of work emerged a few masterworks which have defined filmmaking in the twentieth century. The Apu Trilogy of movies made in the 1950s are regarded as a landmark in global cinema – its portrayal of a rural upbringing in Bengal followed by migration to Kolkata and the highs and lows of married life and parenthood are without equal in Indian cinema. Charulata (1964) is regarded as Ray’s best movie and like the Apu Trilogy garnered awards at home and abroad. More than the awards, Satyajit Ray’s creativity and intense work ethic laid down a template for excellence which paved the way for subsequent generations of film makers like Shyam Benegal and Vishal Bhardwaj. They understood that they did not have to confirm to the norms of Bollywood to build a career in filmmaking.

Don’t worry about being late

If you seek speedy completion of the task at hand, you will almost always produce something which is a rehash of pre-existing ideas. You have to let your mind meander for the original idea to hit you. Some of the most creative equity analysts we have worked with used to routinely produced research notes late regardless of what carrots and sticks were waved at them. Like Arundhati Roy, these creatives are not driven to seek the approval of others and the reward which comes from that. For them creative work is its own reward.

Leonardo da Vinci started painting the Monalisa in 1503 and then left it incomplete. He completed the masterpiece just before his death in 1519. By procrastinating for 16 years, da Vinci significantly increased his chances of producing a masterwork. As art historian William Pannapacker explains: “Leonardo’s studies of how light strikes a sphere, for example, enable the continuous modeling of the “Mona lisa” and “St.John the Baptist”. His work in optics might have delayed a project but his final achievements in painting depended on the experiments…Far from being a distraction like many of his contemporaries thought – they represent a lifetime of productive brainstorming, a private working out of the ideas on which his more public work depended…If creative procrastination, selectively applied, prevented Leonardo from finishing a few commissions – of minor importance when one is struggling with the inner workings of the cosmos – then only someone who is a complete captive of the modern cult of productive mediocrity…could fault him for it…But genius is uncontrolled and uncontrollable. You cannot produce a work of genius according to a schedule or an outline.” (Source: “How to procrastinate like Leonardo da Vinci” by William A.Pannapacker, 2009, The Chronicle of Higher Education)

Investment implications

The most successful investors are often those who are least plugged into social media. The most successful investors are often geographically located a million miles away from the big financial centres. The most successful investors are often very passionate about things which have nothing to do with Finance and Investing. At the peak of his investing career in the 1970s, Warren Buffett helped create a Pullitzer Prize winning newspaper in Omaha. George Soros has spent serious time and money championing democracy and free markets in Eastern Europe for the past 30 years. Some of India’s most successful investors are also amongst the best Bridge players in the country. Original thinkers – in investing and beyond – neither care for consensus opinions in their specific area of expertise nor confine themselves to mastering only one discipline.

If you want to read our other published material, please visit http://marcellus.in/resources/

Saurabh Mukherjea is the author of “The Unusual Billionaires” and “Coffee Can Investing: the Low Risk Route to Stupendous Wealth”.

Note: the above material is neither investment research, nor investment advice. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

Copyright © 2018 Marcellus Investment Managers Pvt Ltd, All rights reserved.

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.