The Efficient Market Hypothesis (EMH) posits that all stocks always reflect all available information in their prices, making it impossible to find or buy undervalued stocks. With stock selection being redundant, the one way to increase portfolio returns is to increase systemic risk – i.e. buying high beta stocks. Many distinguished investors, including Warren Buffett have torn apart the very foundations of EMH. Called ‘Superinvestors’ by Buffett, these all have been successful proponents of the value investing strategy – the assumption that markets are not efficient and there are opportunities in finding and buying stocks that are undervalued.

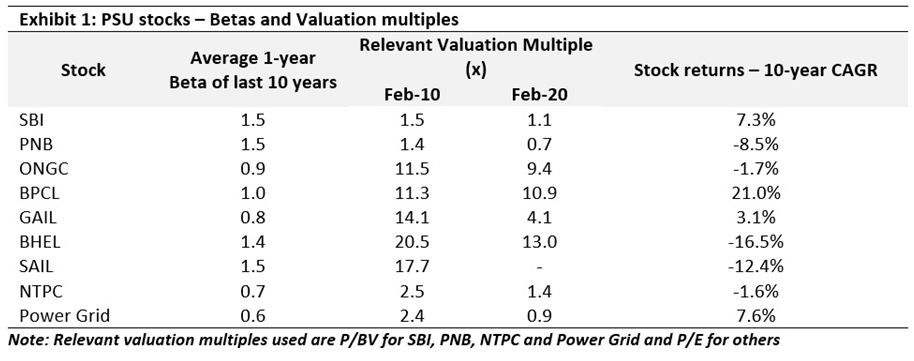

In the Indian context, there is a group of stocks that that has consistently flummoxed followers of the EMH as well as of value investing. These are stocks of Indian public sector units (PSUs). Say, for example, you bought State Bank of India, a stock with a relatively high beta of 1.3 in 2010. What would be your 10-year return? A CAGR of just 7.3%. If on the other hand, you tried applying value investing principles and picked a ‘low’ P/E multiple stock like ONGC (11.5x P/E), you would have lost money in absolute terms over a 10-year period.

For many practitioners of value investing, the quest for finding undervalued bargains often leads to stocks that look optically inexpensive – that is stocks with ‘low’ price-to-earnings ratio (PE), price-to-book value (P/BV) or enterprise value to EBIDTA (EV/EBITDA) multiples. Relying on such multiples however, has two hazards – first is extent to which one can trust reported accounting earnings (the ‘E’ in the ratio) and second is the inability of these multiples to appropriately factor in the longevity of the underlying earnings. However, a ‘low’ multiple stock is a temptation that’s hard to resist for someone in the hunt of an undervalued stock that will deliver superior long-term returns. A common refrain you’ll hear is “What’s to lose in a 6x PE stock”?

In some cases, the answer to the above question is – “A LOT”. The P/E erosion of PSU stocks shows up starkly in their share price performance. As of 31 Jan 2020, 7.6% of the Nifty comprised of PSU stocks. A decade ago, the corresponding ratio was 13.4%. If a decade ago, you had invested Rs 100 in the nine PSU stocks in the Nifty (assume 100 is spread equally across the 9 stocks), on 31 Jan 2020, you would have Rs 163 in your hand (including reinvested dividends). That equates to an annual rate of return of 5%. Over the same period, the Nifty returned a CAGR of 10.7%.

So why are PSU stocks serial underperformers? The usual answers to relatively weaker financial fundamentals of PSUs include ‘public sector inefficiency’ or ‘constraints of working under the 3 Cs – CAG, CVC and Courts’. A key reason, however, is that as minority shareholders, investors play on an uneven field with the government on the other side as a dominant shareholder as also as a customer of these PSUs. This duality of the government’s role puts at risk the efficient use of capital by PSUs, as well as the longevity of their earnings, which then reflect in the low multiples.

Government as dominant shareholder

In the last few years, the government has hit upon a novel way of disinvestment. Instead of offering its stake in PSUs to external financial or strategic investors, the government has forced a merger of two PSUs or the acquisition of one by another. This transfers to gives the cash reserves of the buying PSU to the government, without diluting its effective control over the selling PSU. The poor minority shareholders end up indirectly owning businesses they may have no interest in. For example, NTPC is set to acquire the government’s stake in two hydropower entities for approximately Rs100bn. These acquisitions will see NTPC’s hydropower generating capacity increasing materially from the current ~1.5%. This significantly transforms the risk profile of the business, but minority shareholders hardly have any say in it.

A similar case played out in ONGC’s acquisition of the government’s stake in HPCL in January 2018. While this made the government richer by Rs369bn, minority shareholders in ONGC saw their stock price slide steadily and is now 50% lower since the acquisition. There of course are other reasons also for ONGC’s poor stock price performance. However, the PE ‘de-rating’ is permanent because the risk of minority shareholders getting short-changed in the future will always remain. And that is why the stock trades at a ‘cheap’ valuation of just 5x PE. NTPC also appears ‘attractively valued’ at about 1x P/BV, but it is so because of the risk of the dominant shareholder continuing to influence poor capital allocation decisions on the management and/or compromising the company’s longer-term earnings sustainability.

Government as a customer

In many industries, the government is a major or in some cases, the only buyer of a PSU’s products. Let’s take the example of defence PSUs (DPSUs) such as Hindustan Aeronautics, Bharat Dynamics etc., where the Ministry of Defence (MoD) is the only domestic customer. As a customer, the MoD wants to procure defence equipment at the best or lowest possible cost and as the dominant shareholder, it would desire to sell at the highest possible price. The conflict is not serious where a DPSU is 100% owned by the Ministry but becomes a cause of concern where there are minority shareholders. In such cases, the ministry, as a customer, can reduce pricing/profitability for the PSUs, but as a shareholder, it would escape bearing the entire brunt of the reduced profitability. This is what happened in September 2018, when the MoD reduced the margins on equipment procured from DPSUs on nomination basis. While the government gained from lower procurement costs on all future purchases, investors in a leading DPSU lost 33% of their wealth in a 3-week period from the reduced margin norms becoming known.

These issues beg the question: should PSUs where such conflicts are likely to arise be listed at all? The government believes, and rightly so, that listing increases market scrutiny and makes PSUs more accountable and hence, more efficient. But experience with many listed PSUs shows that is not always the case.

The alternative is to sell 100% of the government stake and permanently separate the unified customer/supplier set up. However, privatisation in India has multiple political angles rather than just plain economic ones and one can’t be sure how aggressively any government in power will take this path.

A possible way then to resolve the conflict of interest is to separate the ownership and procurement functions within the government. The government can create a separate Ministry of PSUs to act on behalf of the shareholders, that has a mandate to maximise profitability for all PSUs it is responsible for. Such a mandate would mean that procurement rules favour the supplier with the best possible price/quality/delivery balance, irrespective of whether it’s a PSU or a private sector company. This will also mean that shareholders have a representative to resist any attempts at corporate actions that impact earnings or put balance sheets at risk.

While rules already exist for competitive procurement across government departments, the separation of responsibilities would mean these rules are effectively implemented. An added advantage of such a separation is that it helps level the playing field for the private sector to compete in government contracts, especially in case of ministries where a separate policymaking or regulatory body does not exist. So, if the urban development ministry wants to redevelop government properties, it need not be done by a PSU under the ministry’s control, but by any agency with the most competitive project delivery capabilities.

What is the likelihood this measure helps achieve resolution of the conflict of interest, considering that ownership and procurement continue to remain with the government, even if under separate operational ministries? The answer to this lies in the history of disinvestment in the country. The disinvestment program saw success only after the decision and execution of the same was vested in a separate Ministry of Disinvestment and not with the ministry in charge of the PSU. Today, a separate department under the Ministry of Finance decides what, when and how to divest. A separation of ownership from the functional ministry has the potential to improve efficiencies in PSUs and benefit all shareholders – the government as well as minorities.

However, there is a practical problem with the remedy mooted above – if you separate the ownership of the PSU from the functional ministry, you effectively reduce the scope for rent-seeking and patronage available to the said ministry. This obviously is likely to be resisted by the powers that be in that ministry. And hence it is hard to see how government owned entities will ever break free of the bind laid out above. That in turn makes it all but certain that PSU stocks will continue to be serial underperformers. In effect, they are caught between two masters – the sovereign on the one hand and the demanding minority shareholder on the other. Arguably, that conflict of interest undermines their ability to serve either master fully. The cheap multiples mask this crucial aspect of investing in PSU stocks. On a broader note, the inability to capture such dynamics is what results in the traditional format of value investing also serially underperforming in India.

Salil Desai and Saurabh Mukherjea are Portfolio Counsellor and CIO respectively at Marcellus Investment Managers (www.marcellus.in).

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.