It has become fashionable to say that we are in the age of de-globalization driven by hyper-nationalist politicians. Thankfully, the data simply does not support such an alarmist narrative. Instead the data on trade and on capital flows shows that globalization continues to progress apace.

The creation of a false narrative

2016 was the year in which it became fashionable to propagate the idea that local producers and manufacturers need to be saved from foreign competition. This in turn led to angst-ridden commentary in the mainstream media regarding the rise of deglobalization i.e. restricting trade (especially imports) to raise demand for domestically produced goods and services. The new gloomy mood was captured aptly by The Economist in its March 2017th issue which noted that, “The new nationalists are on the march in Europe and America. They argue that globalization has benefited the elites and penalized the ordinary workers and that governments should put America/Britain/France first. That means favoring domestic producers and restricting global flows of people, goods and (this gets mentioned less often) capital….A previous column suggested that the world may have entered a third phase of the post-1945 economy, after the Bretton Woods phase (fixed exchange rates and recovery) from 1945-early 1970s and the globalization phase from 1982-2007. Each phase ended in a crisis (stagflation in the 1970s, a credit crunch after 2008). The next era could see globalization in retreat for the first time since 1945.” (read more here). Such commentary gathered credence and momentum as the US-China tariff war clicked through the gears. And by the time Covid-19 arrived, most people were utterly convinced that we are living through deglobalization. However, is there any data to support this narrative?

Credible data versus a less-than-credible narrative

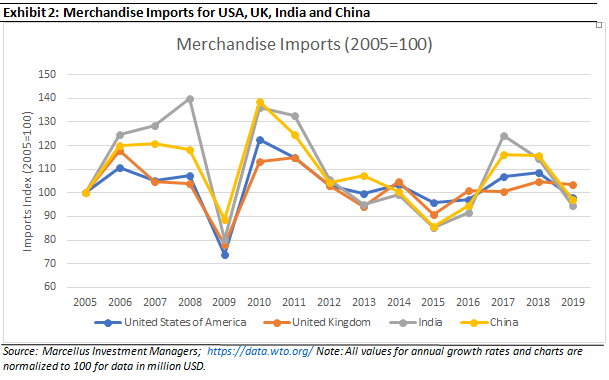

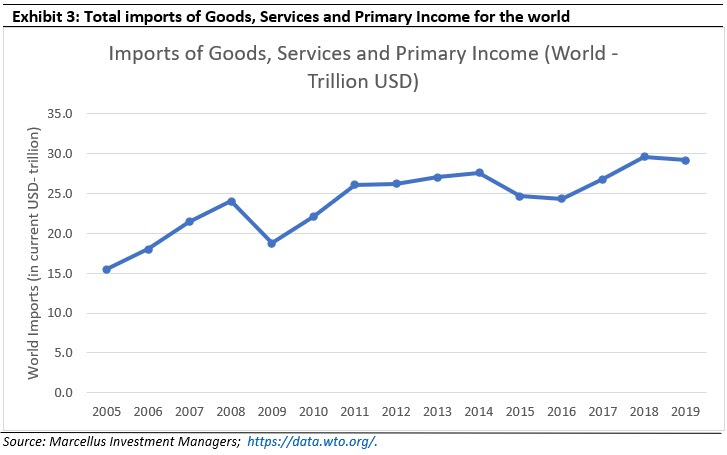

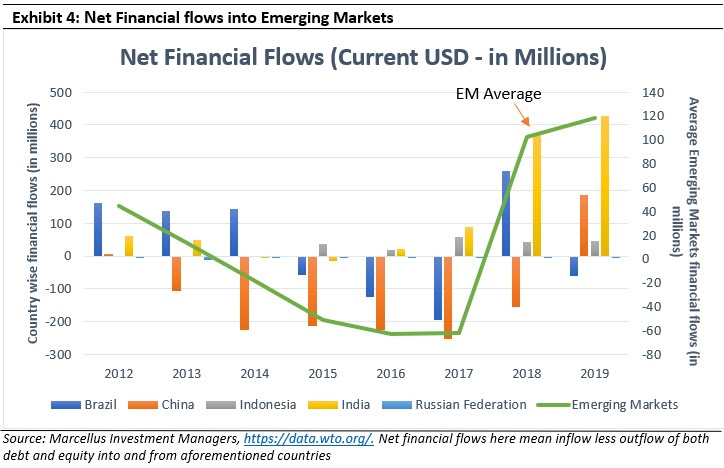

Data for trade (both import and export of merchandise & services) for the US, the UK, India, and China show that trade volumes have been stable between 2016 to 2019 – see Exhibits 1 & 2. Whilst the rate of growth in the imports and exports of services has been slower than what was seen in the first decade of this century, merchandise imports and exports have both risen for the US, the UK, India, and China (compounded annual growth for each of them approximating around 1-2% from 2016-2019).

|

||

|

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.