The moats created by dominant franchises in India differ from their counterparts in the West due to differences in the underlying structure of the respective markets. We use Asian Paints and Sherwin Williams as examples of how two equally dominant companies in the same industry have followed completely different paths to dominance. The case study also brings home the folly of taking Western business models and blindly applying them in India.

In the United States, the decorative paints industry is roughly USD 13bn in size (i.e., ~Rs 90,000crs). Over the last 60 years, the US decorative paints market has consolidated into the hands of just four players (viz. Sherwin Williams, PPG, Masco & Benjamin Moore). To put this into perspective, in the 1960s around 50 companies had ~55% market share, then by 2006 around 20 companies had ~55% market share, whereas today, the 4 players mentioned above control around 80-85% of the US decorative paints market. India has witnessed a similar evolution of the Indian decorative paints market where the market share of Top 5 players (viz. Asian Paints, Berger Paints, Nerolac, Akzo & Indigo) has increased to ~70% today compared to ~50% in 2000.

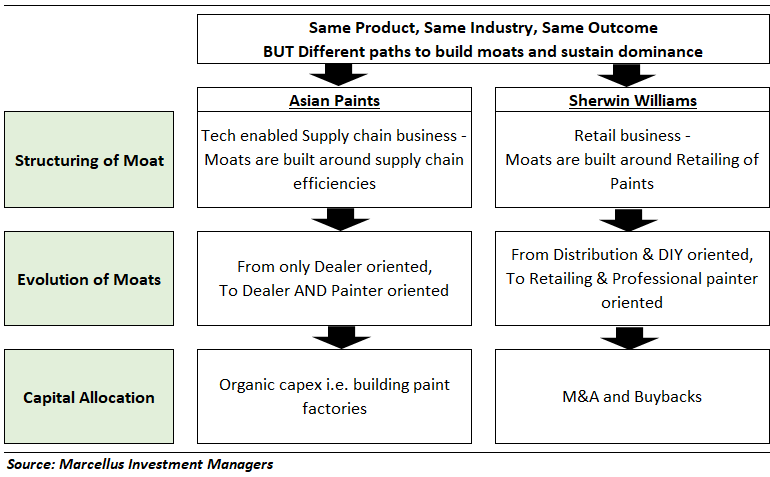

A more interesting similarity is between the market leaders in both countries. Sherwin Williams and Asian Paints have the achieved the same outcome in terms of market share dominance in the decorative paints industries with 40-45% market share as well as in terms of ROCEs with average ROCE of ~35% over the last five years. However, the two companies have followed completely different paths to build moats and sustain their dominance.

Structuring the moat

The evolution of Sherwin Williams

Named after its founders Henry Sherwin and Edward Williams, Sherwin Williams began life as a company in 1870 in Cleveland, Ohio. The company began life by selling ready-mixed paint in an era when paints were hand made from raw pigments and other materials. Sherwin Williams’ growth in its initial 100 years is attributed to: (a) focus on the chemistry side of paints to launch innovative products, (b) emphasis on manufacturing of high-quality paints, and (c) investments in brand building to effectively distribute paints through the independent paint dealer channel. Between 1960s and the 1980s, with the rise of discount stores like Home Depot in USA, Sherwin Williams lost the ability to control retail prices and trade terms of its products as discount stores started under-cutting independent paint dealers.

In 1979, Sherwin Williams hired its first lateral CEO, John Breen, who led the firm’s turnaround by radically changing the way the firm sold paints i.e., from selling paints through independent paint shops to selling paints from company owned & operated ‘Sherwin Williams Paints’ shops. Today, around 60% of sales and 75% of profits of Sherwin Williams come from their ~4,200 exclusive paint shops in the US – a number which is more than ~5x that of the number 2 player in the market, PPG.

To understand why running ~4,200 exclusive paint shops give Sherwin Williams a competitive advantage, one must understand the evolution and market dynamics of the US decorative paints industry. Around 80% of demand for decorative paints in USA is led by repainting of homes (just like the Indian decorative paints industry) which comes from two types of consumers viz. DIY consumers and Professional Painters. In 1980, ~60% demand came from DIY consumers and ~40% from Professional Painters. Today, the mix has reversed to ~60% demand coming from Professional Painters and ~40% from DIY consumers. This shift towards ‘Professional Painter’ has been led by the increasing willingness of homeowners to hire a Professional Painter due to the rise in home prices (which has made homeowners keener to tart up their houses and flip it for a higher valuation) and an increase in the aged population demographic in the US (who opt for Professional Painters due to the laborious work involved in repainting).

For a Professional Painter, 85-90% of his cost is labour; hence what really matters to him is getting the right paint in the right quantity at the right time at a paint site to complete the paint job in an efficient & timely. The cost of paint is not the primary factor driving the purchase decision since it forms only 10-15% of his total cost. Through its network of ~4,200 shops across USA, what Sherwin Williams’s offers to a professional painter is: (a) Availability of a wide variety of paint SKUs in sufficient quantities v/s a large retail chain store which offers a limited range and stocks small quantities of paint, (b) Better customer service as Sherwin Williams store managers are experts in paints as opposed to store staff of large DIY chains who only have basic knowledge, (c) Value added services to contractors such as contractors’ discounts, on-site delivery of paints – e.g., Sherwin Williams owns a fleet of ~3000+ trucks which does ~5000+ deliveries in a day, and (d) Time saving value-added paints like 2 in 1 & primer, faster drying paints, etc which despite being expensive, help professional painters to optimize labour cost and thus get a better ROI. Hence, a professional painter prefers buying from a Specialty Paint shop (Professional Painters account for 85-90% footfalls for Sherwin Williams) rather than large DIY retail chains like Home Depot which mainly cater to DIY consumers.

The evolution of Asian Paints

In India, the nature of market dynamics is completely different relative to the USA, particularly the channel through which paint is sold in India. In USA, there are an estimated ~12,000 shops through which paint is sold while in India, Asian Paints alone reaches 120,000 mom-n-pop shops and thus services the vast & widely dispersed population spread across small town and large cities.

The challenge in terms of retailing paint in India is two-fold: (a) Paint is a highly voluminous commodity with low realisations which is sold from space constrained paint shops, and (b) Although on paper paint dealers get a healthy margin of ~15-20%, there is perfect competition amongst the paint dealers in a locality resulting in price undercutting to win over or retain the painter’s business, leaving the dealers with wafer-thin margins of ~5-7% on the MRP. Hence, the only way for a paint dealer to generate a healthy ROI is through rapid inventory turns and that is exactly what Asian Paints offers i.e., the ability to maintain low inventory level at any point of time and order inventory from depots to get it delivered within 3-4 hours. To deliver within 3-4 hours, Asian Paints must maintain the right type and right quantity of inventory for 2000+ SKUs at its 150+ depots across India. This has been enabled by proactive investments in technology to forecast demand with high accuracy for every SKU to deliver within 3-4 hours and optimize inventory & production at its depots and plants.

While supply chain efficiencies primarily define the leaders in the Indian decorative paints industry, over the last 15 years, Asian Paints has evolved from being only a dealer centric firm to being a dealer AND painter centric firm.

In a paint project, it is the painter or the contractor who influences the end customer’s choice of which paint brand to use. Primarily, a painter’s choice of paint is driven by the brand which is readily available at the nearest paint shop. Over the last 15 years, Asian Paints has focussed on winning the loyalty of painters through various initiatives like incentivizing painters through loyalty points/ coupons, ‘Colour Academies’ to train painters in modern painting techniques or upskilling painters to execute waterproofing jobs, and more recently supporting painters through Covid with direct cash transfers. After capturing the dealer and the painter, the next phase of evolution which is underway at Asian Paints is experimenting with service offerings like SAFE Painting services, Colour Consultancies, Home Décor services, etc. and retailing through the ‘Colourideas’ stores or the ‘Beautiful Homes’ stores.

Capital Allocation

Strong moats mean that the two firms generate healthy free cash flows. However, the two firms have completely different approaches towards capital allocation. One of the main factors which influence reinvestment decision is the growth potential of the decorative paints industry. The Indian decorative paint industry grows at ~13% in value terms while US decorative paint industry grows at ~3-4%. Hence, Asian Paints reinvests around ~40% of its cash inflows (i.e., Operating Cash Flows +/- Debt) in building new plants. On the other hand, Sherwin Williams’ reinvestment is mainly in two areas: (a) Buybacks: until 2016, ~50% of inflows were used for Buybacks which meant that EPS grew by 11-12% (v/s 8-9% PAT growth), and (b) M&A: In 2017, Sherwin Williams acquired Valspar – a performance coatings company for USD 9.3bn which has helped the firm accelerate EPS growth rate to 17-18%.

Paints is not the only sector in India where dominance is built differently to the US

A similar comparison can be made between the diagnostic chains in the US and India. In the US, diagnostics is more of a B2B model, where reimbursements from Heath Plans or Insurance companies accounts for more than 90% of business. Thus, the Health Plans or Insurance companies negotiate the prices with diagnostic chains and influence the decision of which lab the patient walks into. In India, diagnostic charges are borne by the patient; so, the industry has evolved to a service industry competing on consumer convenience (rather than being focussed on the clinical or medical side). The most important factor for a patient in India is TAT (Turn Around Time) i.e., the time from submission of sample to delivery of report. Historically, a patient, especially in small town India where lab density is low, spent a significant amount of time & money to travel to the nearest lab first to give a sample, then wait for a day to visit the lab to collect the report and finally visit the doctor along with the report.

Diagnostic chains like Dr. Lal Pathlabs solved this challenge by: (a) Going closer to the customer through gradual expansion of Collection Centres & Labs, and (b) Optimization of sample logistics and lab automation to reduce report generation time. Hence, rather than the Clinical side (i.e., test menu or accuracy of reports) where the scope to differentiate is low, it is the Retail and Logistics which defines the leaders in the diagnostics industry in India. To put in perspective the scale at which Dr. Lal operates and should be treated at as a retail business, LabCorp and Quest Diagnostics – the two largest diagnostic chains in the US, do a business of around USD 7,000-7,500mn each (i.e., Rs 50-55,000crs) and have only ~2,000-2,200 collection centres each across the entire nation. In contrast Dr. Lal’s has revenues of ~USD 200mn (i.e., Rs 1,400crs) through ~3,700+ Collection Centres which are predominantly located in the North & Eastern parts of the country.

Investment Implications

While the dominant franchises established in the western world are impressive stories to learn from, no one in their right mind should take a business model from the West and replicate it in India. Understanding of dynamics of how the business environment works in in India must be a “first principles” approach rather than about mindless benchmarking with the western world. This is due to three key reasons:

- In India, moats are defined in a completely different manner because of the different challenges & market dynamics. Hence, replicating business models of successful businesses in the US does not always work in India. There are many examples of many supermarket chains in India who have failed by replicating the store formats & merchandise of Western retailers.

- The ways moats evolve in the same industry across different countries can differ i.e., the path of evolution of moats can be different in the same industry. An outstanding company is able to successfully navigate this evolution rather than being stuck to a single way of doing business. Sherwin Williams radically changed the way it sold paints from a Distribution oriented model to a Retailing model and continues to be dominant even after 150 years of existence. Asian Paints has evolved from being dealer centric to painter centric and is now experimenting with service offerings & retailing thereby increasing its dominance consistently for more than 40 years.

- Great companies use capital allocation as a tool to enhance shareholder returns and longevity. Asian Paints capital allocation approach is straightforward i.e., completely organic in building factories due to the massive reinvestment opportunity in the Indian decorative paints market. While Sherwin Williams’ capital allocation approach is two-fold: (a) Buyback of shares to enhance per share value, and (b) Inorganic expansion through M&A to accelerate growth & market share gains

Deven Kulkarni is part of the Investments team at Marcellus Investment Managers (www.marcellus.in)

Disclaimer

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided "as is;" no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.